Here's how to plan your 2026 outbound team (the right way)

Optimize → validate → scale. Part 2.

👋 Welcome to a 🔒 paid edition 🔒 of my weekly newsletter: Outbound Kitchen. Each week I dive into reader questions about creating outbound systems for sustainable growth. For more: Podcast | Launching Outbound | Scaling Outbound | Deep Dives

Last week, I broke down the 3 mistakes that destroy outbound growth:

The Top-Down Trap: Hiring before you prove capacity math works

The Territory Trap: Ignoring TAM when planning SDR headcount

The Timeline Trap: Forgetting ramp, tenure, and turnover realities

Today: how to do it right.

I’ll walk you through the exact framework to plan 2026 headcount without lighting money on fire. We’ll run two scenarios side-by-side so you can see the difference between the 2022 playbook (hire your way out) and the modern outbound playbook (optimize first, then scale).

For paid members, you’ll get my new V3 Outbound Headcount Planning Spreadsheet at the end of this newsletter.

P.S. If you missed last week’s newsletter, you can read it here.

Outbound Headcount Planning 2026: How to Do It Right

The Three Constraints That Govern Outbound Headcount Planning

1. Capacity Constraint

Outbound capacity: How many SQOs/S2 can your SDRs produce?

Sales capacity: How many SQOs/S2 can your AEs actually work?

These must stay aligned. More SDRs without AE capacity = wasted pipeline. More AEs without pipeline = expensive bench warmers.

2. Market Constraint

Your TAM is finite. Each new SDR or AEs shrinks the territory per rep.

Contact frequency matters: accounts should only be touched every 3 months. That means each SDR needs 3x their monthly account volume in their territory.

Some markets hit limits faster than others.

3. Timeline Constraint

SDR ramp: 3 months average (Bridge Group, 2025)

AE ramp: 5.7 months average (Bridge Group, 2024)

Sales cycle: Add this on top of ramp before you see revenue

SDR tenure: 23 months average, with 49% annual turnover (Bridge Group, 2025)

AE tenure: 33 months average, with 30% annual turnover (Bridge Group, 2024)

Solution 1: Bottom-Up Capacity Planning

Counters Mistake #1: The Top-Down Trap

The Principle

Stop starting with revenue targets. Start with what your team can actually produce.

Top-down planning says: “We need $3M ARR, so let’s hire enough people to hit it.”

Bottom-up planning says: “What can our current team produce? What’s the gap? What’s the cheapest, fastest way to close it?”

The Dual-Capacity Framework

You need to track two numbers:

Outbound Capacity = SDRs × SQOs per SDR per month

Sales Capacity = AEs × SQOs each AE can work per month

For this article, we’ll simplify: Sales Capacity = Quota. In reality, capacity and quota aren’t always equal, but we’re keeping this focused on outbound math.

The Calculation

Let’s say your goal is $1.5M net new ARR from outbound (with another $1.5M coming from inbound, handled directly by AEs).

Here’s the math:

$1.5M ARR ÷ $11,400 ACV = ~132 deals needed

132 deals ÷ 12 months = ~11 deals/month

At 10% win rate = 110 SQOs/month needed

Now compare to your current output:

5 SDRs × 10 SQOs = 50 SQOs/month

Gap: Need 110, producing 50

Here’s where most teams make the mistake. They see a 60 SQO gap and immediately think: “We need more SDRs.”

But there’s a better question: Can we increase productivity before we increase headcount?

Productivity Before Headcount

Hiring 6 more SDRs at 10 SQOs each = 60 more SQOs

Cost: ~$558K/year in new salaries alone

Plus 3 months until they’re productive

Plus 49% of them will turn over within 2 years

Or:

Increase current SDRs from 10 → 20 SQOs each = 50 more SQOs

Cost: Outbound Ops (AKA GTM engineer) + new tools = $50k-$150K/year

Faster impact (no ramp time)

No turnover risk on new hires

Same output. 4x cost difference.

This is why the first question in any headcount conversation should be:

“Have we maxed out our current team’s productivity?”

Solution 2: TAM-Based Territory Validation

Counters Mistake #2: The Territory Trap

The Principle

Your market is not infinite. Before you decide how many SDRs to hire, you need to know how many accounts exist for them to work.

This is why Salesforce can have 1,500 BDRs while other companies cap out at 50.

It’s not about company size, it’s about total addressable market.

The Contact Frequency Math

Accounts should only be contacted every 3 months.

Touch them more often, and you’re spamming. Your reply rates tank. Your domain reputation suffers. Prospects block you.

This means:

If an SDR works 200 accounts/month

And accounts should only be contacted every 3 months

Then each SDR needs 600 accounts minimum in their territory

With 5 SDRs, you need 3,000+ qualified accounts

Before hiring your 6th SDR, ask: “Do we have 3,600 qualified accounts?”

The Chili Piper Example

At Chili Piper, we sold to companies with sales teams of 10+ reps. Sounds like a big market, right?

Here’s the reality when you run the numbers on Sales Navigator:

That’s 11,000 accounts globally. And that’s before filtering for CRM usage (Salesforce/HubSpot only), which shrinks the list further.

At 600 accounts per SDR (3-month contact cadence), that’s a maximum of ~18 SDRs worldwide before you’ve exhausted the market.

This is why you must map and score your market before you plan headcount.

The TAM Validation Checklist

Before adding SDRs, confirm:

Total ICP accounts identified: How many companies fit your criteria?

Accounts with verified data: How many have accurate contact info?

Accounts already worked: Subtract customers and active pipeline

Net addressable accounts: What’s left for outbound?

Accounts per SDR at 3-month cadence: Net addressable ÷ (SDR count × 3)

If accounts per SDR drops below 500, you’re over-hiring.

Market + Product Constraints

TAM isn’t just about geography. It’s about your product.

Companies like Salesforce can keep growing because they:

Sell multiple products to different teams

Serve SMB to Enterprise

Operate worldwide

Their market is essentially every company on earth.

But if you sell HR compliance software specific to California regulations? Your market is a fraction of that. A US-only company targeting enterprise accounts? Smaller still.

Know your constraints before you hire.

Solution 3: Time-Aware Hiring Plan

Counters Mistake #3: The Timeline Trap

The Reality of Ramp, Tenure, and Turnover

The Bridge Group 2025 + RepVue data::

SDRs:

Ramp time: 3 months

Average tenure: 23 months

Annual turnover: 49% (12% involuntary, 16% voluntary, 21% promotions)

Total cost: ~$93K/year (OTE + tools)

AEs:

Ramp time: 5.7 months

Average tenure: 33 months

Annual turnover: 30% (19% involuntary, 11% voluntary)

Total cost: ~$178K/year (OTE + tools)

Let’s do the math on what this actually means:

An SDR hired in January 2026:

Starts producing: April 2026 (after 3-month ramp)

First deal closes: August 2026 (after 4-month sales cycle)

Full revenue impact: 7 months after hire

And statistically:

1 in 4 will leave within 12 months (voluntary)

1 in 8 will be let go (involuntary)

1 in 5 will be promoted out of the role

You’re not just hiring an SDR. You’re buying a lottery ticket that takes 7 months to scratch off, and half the tickets expire within 2 years.

The Phased Hiring Approach

Instead of hiring all at once, gate your hiring decisions:

Phase 1: Optimize (Months 1-6)

No new SDR hires

Focus entirely on increasing productivity

Invest in GTM Engineer, better tools, improved processes

Target: 10 → 20 SQOs per SDR

Phase 2: Validate (Month 6)

Did productivity increase?

Is the improvement consistent (±15% month-over-month)?

If YES: Consider hiring

If NO: Keep optimizing

Phase 3: Controlled Scaling (Months 7-12)

Add SDRs only if productivity gains are proven

Hire in small batches (2 at a time)

Watch TAM per rep closely

Re-evaluate every quarter

Phase 4: Continuous Monitoring (Ongoing)

Track actual vs. expected ramp

Monitor turnover rates

Adjust hiring plan quarterly based on real data

Putting It All Together: The 18-Month Comparison

Let’s run two scenarios for a company planning 2026:

Starting Point:

B2B SaaS, $11,400 ACV, multi-geo

Current team: 5 SDRs, 5 AEs

Current SDR output: 10 SQOs per SDR per month

AE quota: $600K/year each ($3M total capacity)

Total AE Capacity: 220 SQOs/month (5 × 44)

AE Capacity for Outbound: 110 SQOs/month (50/50 split with inbound)

Goal: $1.5M net new ARR from outbound

Required: 110 SQOs/month (at 10% win rate)

Current output: 50 SQOs/month

Gap: 60 SQOs/month

Scenario A: Optimize First (2025/2026 Playbook)

Strategy: Increase SDR productivity from 10 → 20 SQOs before any hiring.

Investment:

Fractional Outbound Ops (AKA GTM Engineer): $60K/year

New tools (Data, signals, AI, enrichment): $30K/year

Total: $90K/year

Month-by-Month Plan:

First number = ramped SDRs, second = new hire ramping

⚠️ The Capacity Constraint Revealed: Notice months 13-18 show negative capacity gaps. This isn’t a bug. The model is telling you: “Outbound is producing more SQOs than your AEs can handle.”

At this point, you have three options:

Hire more AEs to handle increased pipeline

Slow SDR hiring to match AE capacity

Shift AE focus from inbound to outbound

Accept waste — some SQOs won’t get worked

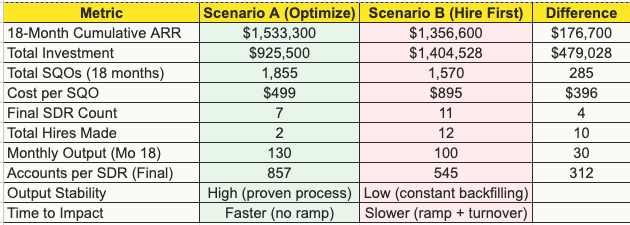

18-Month Totals (Scenario A):

Total SQOs Generated: 1,855

Total ARR Closed: $1,533,300

Final Team: 7 SDRs (net +2)

Total Outbound Investment: $925,500

Final Monthly SQO Output: 130

Accounts per SDR (6,000 TAM): 857 ✓ (healthy)

Cost per SQO: $499

Scenario B: Hire First (2022 Playbook)

Strategy: Hire more SDRs at current 10 SQOs output to close the gap.

Math: Need 110 SQOs. At 10/SDR, need 11 SDRs. Hire 6 more.

Investment:

6 new SDRs: $558K/year

Additional tool seats: $48K/year (6 × $8K)

Hiring Timeline:

Month 1: Hire 2 SDRs

Month 3: Hire 2 SDRs

Month 5: Hire 2 SDRs

Month-by-Month Plan:

Note: At 49% annual turnover, a team of 11 SDRs loses ~5 people per year. This model shows turnover eating into productivity gains.

The Turnover Tax: Scenario B spends months 9-18 in a constant backfill cycle. Every time someone leaves, you’re back to ramping.

18-Month Totals (Scenario B):

Total SQOs Generated: 1,725

Total ARR Closed: $1,476,300

Final Team: 10 SDRs (but constant churn)

Total SDR Hires Made: 7 (6 original + 1 backfill shown, more likely in reality)

Total Outbound Investment: $1,480,281

Final Monthly SQO Output: 100 (and unstable)

Accounts per SDR (6,000 TAM): 600 ⚠️ (getting tight)

Cost per SQO: $858

The Side-by-Side Comparison

Scenario A generates $57K more ARR, at 37% less cost, with a smaller team, and better TAM health. Cost per SQO is 42% lower.

The Bottom Line

The companies that win in 2026 won’t be the ones who hire the most SDRs.

They’ll be the ones who:

Optimize before they scale: Doubling productivity is cheaper and faster than doubling headcount

Respect their TAM: Every hire shrinks territory per rep

Plan for reality: Ramp time and turnover aren’t edge cases, they’re the default

Start with what you have. Make it work better. Then scale.

Elric

Head Chef, Outbound Kitchen

🔒 Paid Subscriber Bonus: The V3 Outbound Headcount Planning Spreadsheet

I’ve been refining this model, and V3 is ready.

What’s new in V3:

Fully Dynamic Model: Every input cascades through the entire 18-month projection. Change your ACV, sales cycle, team size, or targets, and watch both scenarios recalculate instantly. No more hardcoded cells.

AE Capacity Split: The model now accounts for inbound vs. outbound revenue split. Enter both targets, and it automatically calculates how much AE capacity is actually available for outbound. This is the constraint most planning models miss.

Capacity Constraint Alerts: Negative capacity gaps (when outbound SQOs exceed what AEs can handle) now highlight in red automatically. The model tells you when you’re about to create pipeline your team can’t work.

Instructions Tab: Step-by-step guide for customizing the model to your business. Explains what each input means, how the capacity gap works, and what to do when you see negative gaps.

What’s inside:

Inputs Tab — 25+ customizable inputs (blue = editable, black = calculated)

Scenario A — 18-month “Optimize First” projection with productivity ramp

Scenario B — 18-month “Hire First” projection with turnover modeling

Dashboard — Side-by-side comparison that auto-updates

Financials — Detailed cost breakdown and ROI analysis

Download it here:

Keep reading with a 7-day free trial

Subscribe to Outbound Kitchen to keep reading this post and get 7 days of free access to the full post archives.