3 Outbound Headcount Mistakes That Destroy 2026 Growth

Hiring an SDR in Jan? They won't produce until April. AEs until July. Plan now.

👋 Welcome to a 🔒 paid edition 🔒 of my weekly newsletter: Outbound Kitchen. Each week I dive into reader questions about creating outbound systems for sustainable growth. For more: Podcast | Launching Outbound | Scaling Outbound | Deep Dives

It’s Q4. Which means you might planning your 2026 headcount.

And most GTM leaders are about to make the same expensive mistakes they made last year.

Here’s the thing: hiring cycles mean the decisions you make in the next 30 days will determine whether Q2 and Q3 of 2026 are profitable or a disaster.

Why? Because an SDR hired in January won’t be fully productive until April. An AE hired in January won’t close their first deals until June or July. Your 2026 revenue is being decided right now.

Yet most founders and GTM leaders are building their 2026 headcount plans with broken math.

Here are 3 mistakes I’ve seen with my customers, and from working full-time for companies, that often end up causing layoffs:

The Top-Down Approach: Hiring Before You’re Ready

Top-Down SDR Hiring Without TAM Validation: Hiring for capacity you don’t have

The Timeline Trap: Not Planning for Ramp Time, Sales Cycles & Tenure

Let me show you what these look like in the wild, then on Wednesday I will send you the framework to plan 2026 the right way.

The 3 Headcount Planning Mistakes That Will Destroy Your 2026 Planning

Mistake #1: The Top-Down Approach (Hiring Before You’re Ready)

On the AE Side

The classic mistake looks like this:

“We need $5M in new ARR in 2026.”

“Our AE quota is $600K per year.”

“So we need 8.3 AEs. Let’s hire 8 AEs in Q1.”

Seems logical, right?

Here’s what actually happens:

Month 1-3: You hire 8 AEs. They’re ramping. Your existing 2 AEs are carrying the load.

Month 4-6: New AEs are starting to work opportunities, but your pipeline isn’t growing fast enough. You have 10 AEs but only enough pipeline for 5 spread into 10 reps.

Month 7: Your top performers (the ones who joined expecting a pipeline) start interviewing elsewhere. They didn’t sign up to prospect their own deals.

Month 8-9: Bottom performers who can’t hit quota get fired. Now you’re down to 6 AEs and you’re back in hiring mode.

I saw this at one company I worked at, and the same cycle happened a few more times there.

The problem isn’t the revenue goal. It’s that you worked backward from revenue instead of forward from capacity.

You forgot the other side of the equation: demand generation capacity (here we are going to talk about outbound capacity).

If it were as simple as “hire more AEs = more revenue,” every company would hire 100 AEs and print money. But you can’t close deals without pipeline.

On the SDR Side: Scaling Broken Processes

CEO: “We need to 2x revenue in 2026. Let’s hire 6 more SDRs.”

His current 2 SDRs? Still figuring out outbound.

My advice: “Don’t hire anyone until your team hits 12 SQOs per SDR per month, consistently, for 3 straight months.”

He’s still waiting. And saving $360K in wasted headcount.

The mistake:

Most GTM leaders plan headcount top-down (even for SDRs):

“We need $5M in new ARR”

“So: 12 SDRs × 12 SQOs (goal) × conversion rates = pipeline”

“Done. Post the JDs.”

But you’re planning with aspirational numbers, not actual performance.

If your current SDRs create 6 SQOs/month (not 12), and your meeting-to-opp conversion is 40% (not 60%), hiring 6 more SDRs doesn’t fix that.

You’re just scaling broken processes.

Bottom-up planning forces reality:

What are SDRs actually creating today?

What’s your actual meeting show rate?

What’s your actual meeting-to-opportunity conversion?

If those numbers aren’t hitting benchmarks consistently, adding headcount multiplies the problem.

The result:

10 SDRs producing what 4 should produce

Managers firefighting, not coaching

AEs without pipeline

Board asking why you’re burning cash

The fix:

Start with what SDRs actually produce today. If it’s 6 SQOs/month, don’t hire more until you fix why it’s not 10.

Fix conversion rates first. Get 3 months of consistency. Then scale.

Which brings us to...

Mistake #2: Top-Down SDR Hiring Without TAM Validation (The Territory Trap)

Even if your model is proven and metrics are consistent, you can still destroy your team by ignoring your Total Addressable Market.

Here’s how this plays out:

At Chili Piper in 2022, we were scaling aggressively. Metrics were good. Model was working. The math said we needed 80+ SDRs.

What we didn’t account for:

Our TAM wasn’t big enough to support 80 SDRs at full capacity.

Each SDR was assigned ~400 accounts. On paper, great. In reality:

Only ~100 of those 400 were actually ICP-fit

The other 300 were “maybe” accounts that dragged down productivity

As we scaled from 20 → 30 SDRs, productivity per SDR dropped significantly

We couldn’t give new SDRs enough high-quality accounts to succeed

The result: We fired 10 SDRs that year. Because we didn’t have enough ICP accounts to support them.

What went wrong:

We never properly mapped our market with accurate scoring. We used technology and firmographic data that wasn’t accurate enough to identify real ICP-fit accounts.

We should have asked:

Is this data accurate?

Do we have the right data to map our market and feed our scoring system?

How many target accounts does each SDR need to maintain full productivity?

What’s the maximum team size our TAM can support?

At what team size do territories become too thin?

We didn’t.

The contrast: How Snowflake does territory planning right

Snowflake maps their TAM with a predictive scoring with 120+ data points to:

Map their TAM accurately

Build territory plans

Create hiring models

Understand the true potential of each territory

That’s bottom-up planning.

The Math You Need

Total accurately scored ICP accounts ÷ Accounts per SDR = Maximum team size

Example:

6,000 accurately scored ICP accounts

200 accounts per SDR for full productivity

Maximum team size = 30 SDRs

Hire SDR #31 and you dilute everyone’s territory.

Mistake #3: Not Planning for Ramp Time, Sales Cycles & Tenure (The Timeline Trap)

Most headcount plans treat hiring like flipping a light switch. But sales has multiple time lags that compound in headcount planning.

The Three Time Lags Nobody Plans For

Time Lag #1: Ramp Time

According to The Bridge Group’s research:

SDRs take 3.0 months to reach full productivity

AEs take 5.7 months to reach full productivity

Hire an SDR in January? They’re not creating opportunities at full capacity until April.

Time Lag #2: Sales Cycle Length

Even when your SDR is ramped and creating opportunities, those opportunities don’t close immediately.

If your outbound sales cycle is 4 months:

Opportunity created in January closes in May

Time Lag #3: Tenure & Attrition

Here’s the reality (Bridge Group data):

SDR Attrition:

Involuntary (discharges, layoffs, or termination) : 13%

Voluntary (aka quits): 11%

Promotions: 16%

Total: 40% annually

AE Attrition:

Involuntary: 19%

Voluntary: 11%

Total: 30% annually

You lose 40% of your SDR team every year.

Average SDR tenure is 23 months (The Bridge Group - 2025):

3 months ramping

20 months at full productivity

Then they’re gone

Average AE tenure is 33.6 months (The Bridge Group - 2024):

6 months ramping

24 months at full productivity

Then they leave

What This Means for Your 2026 Plan

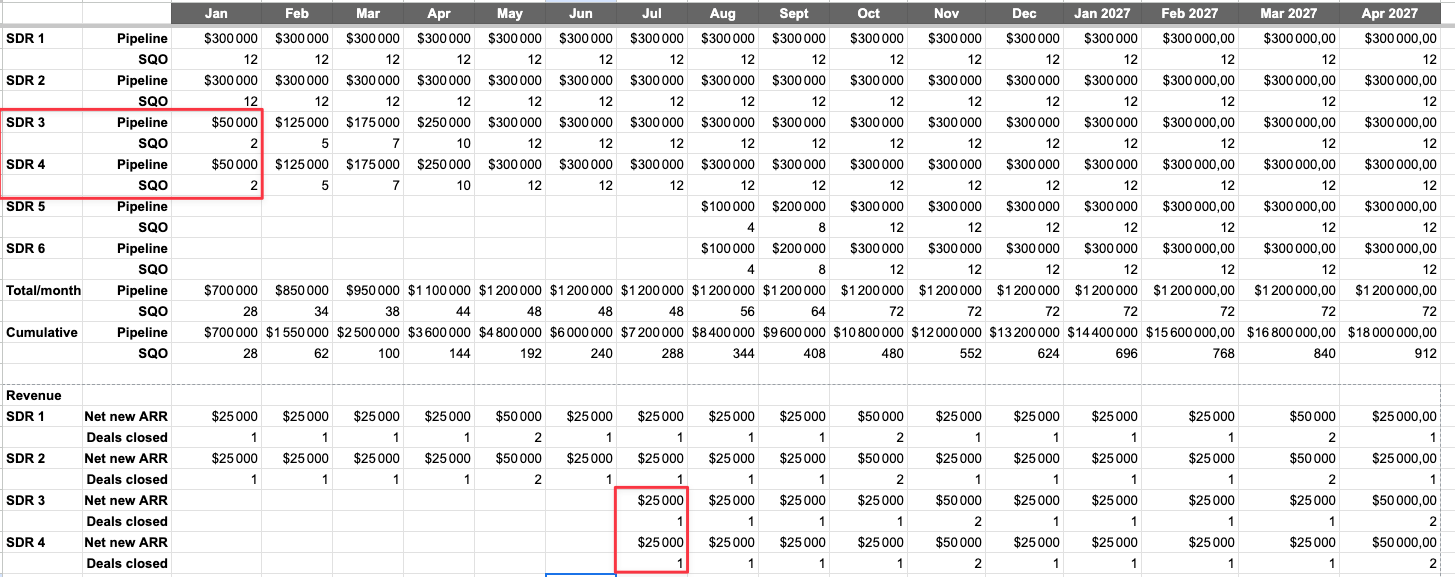

Hire an SDR in January 2026:

Jan-Mar: Ramping (0-8 opportunities per month)

May: First full month at capacity (12 opportunities created)

July: First deals close from Feb/March’s opportunities (4-month sales cycle)

Dec 2027: They leave (23-month tenure)

Total timeline: 7-8 months from hire date to first revenue.

What’s Next?

These three mistakes kill outbound growth. But the solution isn’t complicated.

It’s called bottom-up planning. And it starts with capacity and current performance, not revenue targets.

In next week’s newsletter, I’ll show you the exact framework to plan your 2026 headcount:

The Alignment Principle (how to size SDR and AE teams together)

The Capacity Formulas (based on TAM, bandwidth, and conversion rates)

The Planning Process (with phase gates to prevent overspending)

The Outbound Speedometer (weekly metrics to monitor scaling health)

Plus: The exact spreadsheet to model it all (Headcount & Capacity Planning V2)

What’s your biggest headcount planning challenge for 2026? Hit reply and let me know.

Elric

Chef, Outbound Kitchen

P.S. Want to get ahead?

Grab my Headcount & Capacity Planning Spreadsheet

Want to run these numbers for your own team?

I’ve built a spreadsheet that does all the capacity math for you: Headcount & Capacity Planning V2

Just plug in:

Your current team size and production rates

Your ACV and win rates

Your ramp curves

And it shows you:

Maximum supportable team size

Month-by-month capacity projections

Revenue impact with realistic timelines

SDR productivity KPIs and benchmarks

Cost per hire and CAC ratios

Keep reading with a 7-day free trial

Subscribe to Outbound Kitchen to keep reading this post and get 7 days of free access to the full post archives.