How to Build Outbound Strategy: 7-Step Framework (Real Company Example)

Complete 7-step outbound framework from company analysis to messaging. Real example: Salesmotion. Strategy before tactics. See how each step builds on the last.

👋 Welcome to a 🔒 paid edition 🔒 of my weekly newsletter: Outbound Kitchen. Each week I dive into reader questions about creating outbound systems for sustainable growth. For more: Podcast | Launching Outbound | Scaling Outbound | Deep Dives

I’m starting a new series where I break down how I’d build outbound strategy for real companies, from company analysis to the first message I’d send.

Why this format?

Most outbound content shows you tactics in isolation: subject line templates, email sequences, tools to use. But tactics fail without strategy.

You can’t write relevant messages if you don’t know who you’re targeting. You can’t define your ICP if you haven’t analyzed your business model first.

So I’m showing you the complete system - all 7 steps, in order, with a real company as the example.

Why Salesmotion?

I’m picking companies where:

I can use the product in outbound messages, that way, people can see what they’ll get before booking a demo.

I deeply understand the problem they solve (account intelligence for sales teams, I live in this world)

The product is strong enough that I’d actually work with them

Salesmotion is account intelligence for B2B sales teams. I know their CEO Semir, chatted with him a few times, and asked if he’d be cool with me using them as the example. He said yes.

This is a founder-led, bootstrapped, early-stage company, which means constraints drive the strategy. You’ll see how business stage shapes every decision from ICP to messaging.

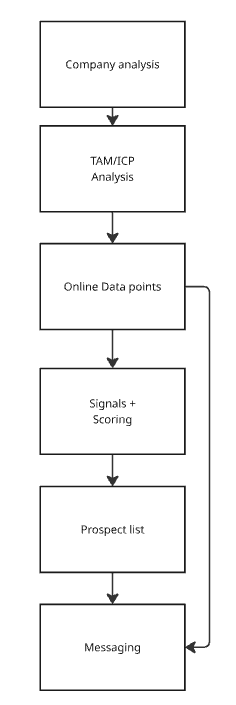

What you’ll learn: The exact 7-step framework I use with my clients:

Company analysis (drives everything else)

TAM and ICP definition (who could buy + who should buy first)

Research data points (for scoring/signals/messaging)

Scoring system (how to prioritize - Part 1)

Signals + Hit list (how to prioritize - Part 2)

Stakeholder mapping (who to target)

Messaging strategy (how to be relevant)

And how I use the Chef's Sample framework in my messaging.

By the end, you’ll see how each step builds on the last, and why you can’t skip steps without breaking the system.

P.S. Paid members: You’ll get all the prompts to build this quicker for your team.

Let’s get cooking!

How I’d Build Outbound for Salesmotion (Episode 1)

Step 1: Company Analysis

Before anything else, I need to understand what Salesmotion actually does and how they make money.

The Product

Salesmotion solves the manual account research problem. Instead of reps spending 6+ hours per week searching Google, reading annual reports, and piecing together context from 5+ different sources, Salesmotion automatically monitors accounts and delivers briefings.

Business Model:

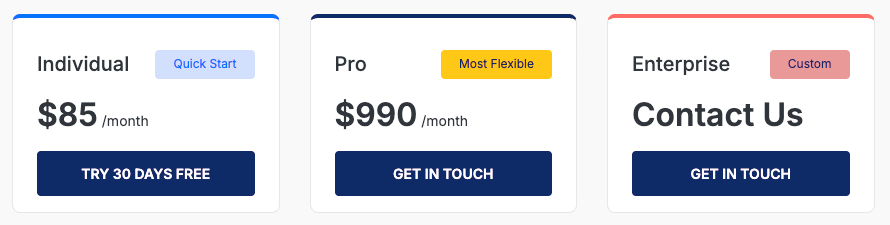

Pricing: Per-account tracked (more sales reps = more accounts = higher ACV)

Sales Motion: Hybrid (reps can adopt bottom-up, sales leaders buy top-down)

Go-to-market: Founder-led, bootstrapped, early-stage

Why this matters: Semir (CEO) is the only sales rep. This means we need fast buyers with clear pain, not enterprise deals with 6-month cycles and endless feature requests.

The Core Problem (in customer words):

Specific pain points from customers:

1. Time drain

“6 hours of account research per week”

“Hours of searching” through multiple sources

“Searching Google and reading annual reports”

“Lengthy manual account research”

2. Scattered information

“Consolidation of prospect company information” needed

Sales reps using “5 different sources” to piece together context

No single source of truth for account intelligence

3. Poor meeting preparation

Reps showing up without company context or POV

Unable to “arrive prepared with a POV on company objectives”

Missing “up to date account information” causing sales cycle obstacles

4. Timing blindness

Can’t identify “why now” moments for outreach

Missing “account and contact signals” for better timing

No visibility into hiring, funding, leadership changes

Customer Language (not our language):

“Way better informed” (not “more data”)

“Arrive prepared” (not “be ready”)

“Unblock obstacles within sales cycles” (not “close faster”)

“Cut research time” / “reducing prep time” (quantified efficiency)

“Always made a great impression” (relationship outcome, not just efficiency)

Results customers see:

Output:

50% increase in meetings booked

40% increase in qualified opps + $1M+ pipeline

Productivity:

60% reduction in prep time

50% cut in sales research time

Competitive positioning (matters for messaging):

Not competing with ZoomInfo/Apollo (contact data)

Competing with: Manual research + ChatGPT + scattered tools

Unique angle: Continuous automated monitoring, not one-time lookups

Step 2: TAM + ICP v1

Total Addressable Market (TAM)

Any B2B company with a sales team could theoretically buy Salesmotion. That’s ~100,000 companies in US/Canada alone.

Industry: Nearly universal

B2B SaaS

Professional services (consulting, agencies, legal)

Manufacturing (enterprise sales cycles)

Financial services (wealth management, insurance)

Healthcare (pharma, medtech)

Technology hardware/infrastructure

But TAM doesn’t matter for early-stage.

Here’s why: Semir can’t serve 100,000 companies. He needs customers who:

Close fast (no long enterprise cycles)

Have clear, immediate expensive pain

Validate product direction

Become referenceable logos

So the question isn’t “who could buy?”.

It’s about “Who should we sell to first?”, the accounts with the biggest pain right now.

ICP v1: Early-Stage Constraints

This is my first guess based on Salesmotion’s current stage, customers, and business model, something we would improve over time.

The framework:

Speed to close (founder’s time is the constraint)

Clear pain (product solves expensive problem)

Economic viability (deal size justifies effort)

Product fit (current features solve their needs)

Referenceable (logos/testimonials that attract more customers)

Applying this to Salesmotion:

Geography

Target: US/Canada only

Why:

Richest data sources = best product experience

Faster sales cycles (no cross-border complexity)

Case studies already US-heavy (social proof exists)

Avoid: International for now (expand later when they have sales team)

Might try the UK, Semir is based in London.

---

Company Size:

Target: 100-1,000 employees

Why this range:

Lower bound (100+):

Need 10+ sales reps to justify ROI

Upper bound (1,000):

Above this = enterprise procurement processes

Security reviews, legal, multi-stakeholder approvals

6-12 month sales cycles (too slow for founder-led and bootstrap)

Feature requests that derail product roadmap

Exception: If they have a PLG motion (rep buys, expands later)

Potential sweet spot: 250-750 employees

Large enough: 15-50 sales reps (strong ACV)

Small enough: Director/VP can make decision quickly

Growing companies: hiring, moving upmarket (pain is acute)

Sales Team Characteristics

Must-haves:

1. Sales team size: 10-50 reps

Minimum 10 for economic viability and sales maturity

Maximum 50 to avoid enterprise complexity

Potential sweet spot: 15-30 reps (growing but not bureaucratic)

2. Sales segmentation exists

SDR/AE split (shows process maturity + investment in logo acquisition)

Mid-Market or Enterprise AE titles:

sales team maturity vs non segmentation within the sale team

selling complexity matches product value)

Frontline sales managers (champion persona)

3. Outbound motion active

Not purely inbound (account research less critical)

Not purely transactional (context doesn’t matter)

Need account-based approach where research = competitive advantage

Growth Indicators

Target: Companies in growth mode

Why growth matters:

Growing pains = urgent need for efficiency

Hiring reps = scaling challenges

Moving upmarket = research complexity increases

Budget available (not in cost-cutting mode)

Signals to track:

1. Sales team growing (past 6 months)

20%+ headcount increase in Sales roles

Active job posts for AE/SDR positions

New sales leaders hired (VP Sales, CRO, Head of Sales)

2. Moving upmarket indicators

“Enterprise AE” or “Strategic AE” job postings

ABM/account-based language in job descriptions

Sales Engineer or Solutions Consultant hiring (complex sales)

Industry/Product Type

Best fit: Horizontal SaaS with large TAM

Why horizontal > vertical:

Horizontal SaaS (selling to HR, Finance, IT, data, Security, Sales, Marketing teams):

✅ Sell to any industry → more enterprise accounts to track

✅ Rich data available (public companies, tech news, funding)

✅ Account research is differentiator (competitive markets)

Avoid for now: Vertical SaaS

Vertical SaaS (selling to 1 industry: restaurants, healthcare providers, construction, retail):

❌ Limited account data available publicly

❌ Smaller enterprises

❌ Research needs are different (local market dynamics, not company news)

Exception: Vertical SaaS selling to ENTERPRISE within their vertical (e.g., Veeva selling to pharma enterprises). This could work because enterprise data exists.

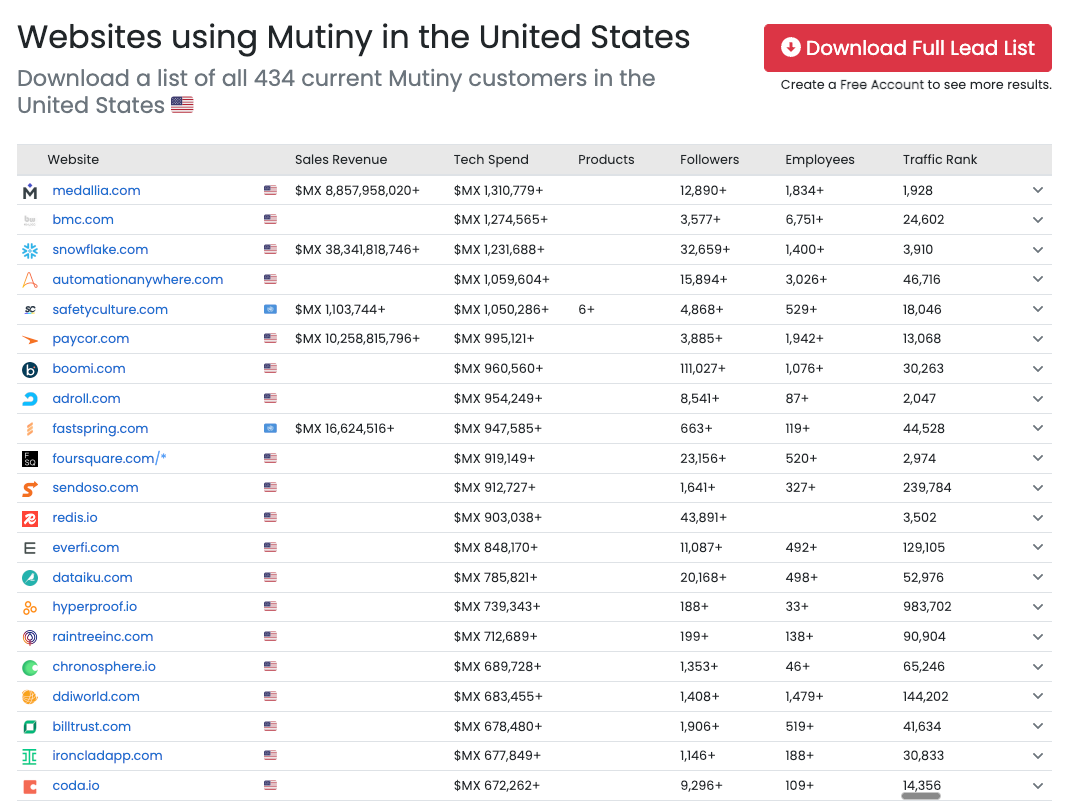

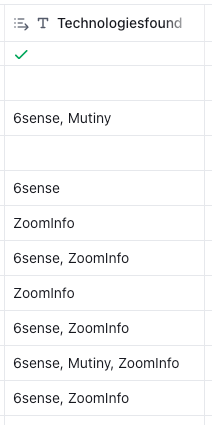

Technographic Signals: How Much They Invest in Sales

This is critical: Tech stack shows BUDGET for sales tools.

Must-have tools (1-2 minimum):

1. Account Intelligence/Intent Data (direct complements):

6sense (shows ABM maturity)

Demandbase (ABM platform)

Bombora (intent data)

ZoomInfo or Cognism (beyond basics - shows budget)

Clay

Already spending on account data = understand value + have budget

2. ABM/Marketing platforms:

HockeyStack (pipeline analytics)

Mutiny (website personalization / ABM)

Metadata (ABM advertising)

RollWorks

ABM approach = account research is critical

3. Sales Engagement platforms:

Outreach

Salesloft

Groove

Outbound motion = need context for messaging

4. Revenue Intelligence/Conversation Intelligence:

Gong

Chorus

Clari

Sales process sophistication = willing to invest in enablement

Segments to Prioritize

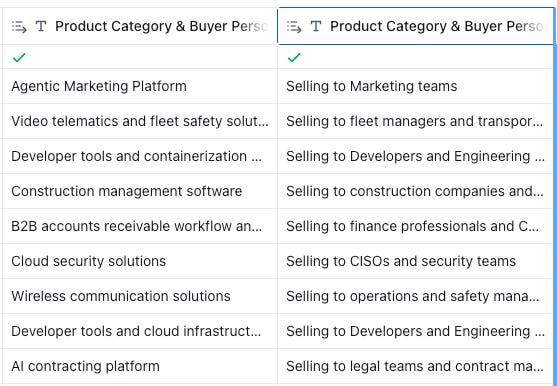

Based on everything above, here are the ICP segments in priority order:

Tier 1: Best Fit (go here first)

250-750 employees

20-50 sales reps (SDR + AE split)

Horizontal B2B SaaS

Has 2+ tech stack signals (ABM tools + Sales Engagement)

Actively hiring Enterprise/Mid-Market AEs

US/Canada

Tier 2: Strong Fit (secondary focus)

100-250 OR 750-1,000 employees

10-20 OR 50+ sales reps (smaller or larger than ideal)

Horizontal SaaS or tech-enabled services

Has 1 tech stack signal

Growing sales team (not necessarily hiring Enterprise AEs)

US/Canada

Companies to Explicitly Avoid

1. Too small: <10 sales reps → ACV too low, deal doesn’t pencil for founder time

2. Too large: 1,000+ employees → enterprise procurement and feature requests that derail roadmap

3. Transactional sales: High-velocity, short sales cycle businesses → Won’t see ROI from research tool

4. SMB-focused sellers → Data isn’t available via google Search, need scrapping tools. Different research needs (local market vs company intelligence)

5. Purely inbound → No outbound motion, no prospecting

Now that we have ICP v1, Step 3 is about HOW to build and get this list in our systems.

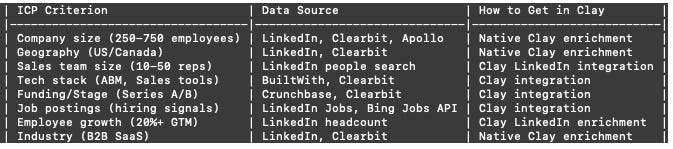

Step 3: Research data points

Now that we know our ICP, how do we actually build the account list?

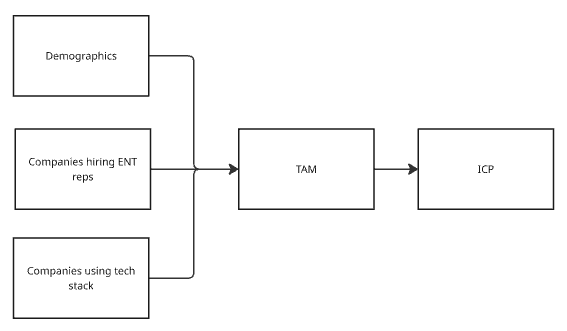

Here we have different was to build the account list of my ICP, I could start with getting the list of all SaaS companies but we would:

Here's a quick list on how I get the data to come up with my list of ICP accounts:

For those examples I would use Clay, but you can use other tools.

Three approaches:

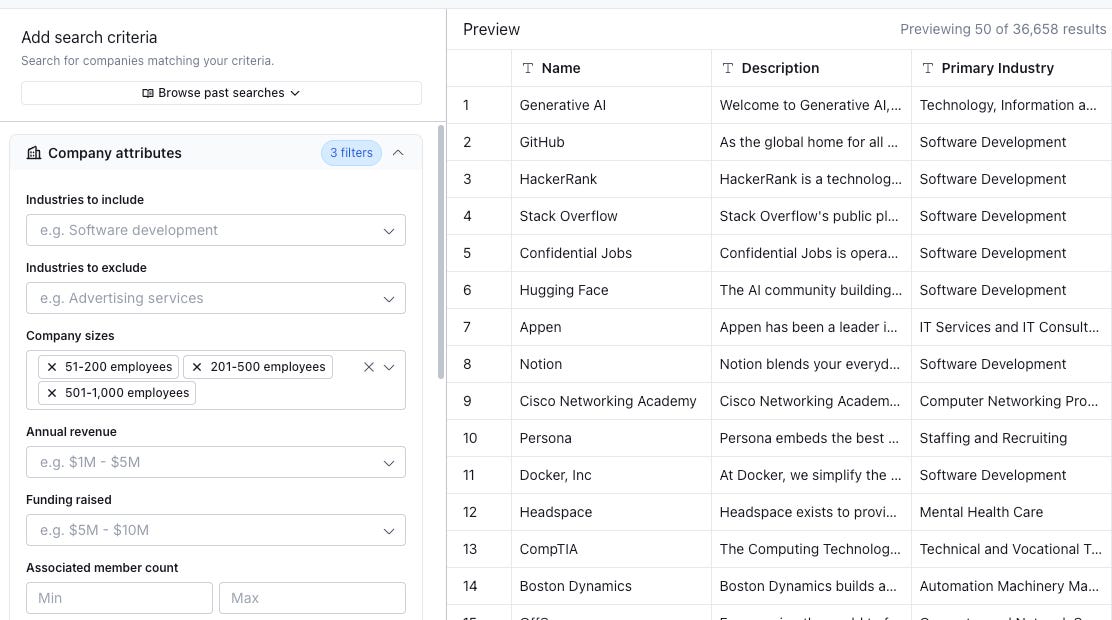

Option 1: Demographics (too broad)

Get all B2B SaaS companies, 50-1,000 employees, US/Canada

Result: 36,000 accounts

Problem: Expensive to enrich, not prioritized

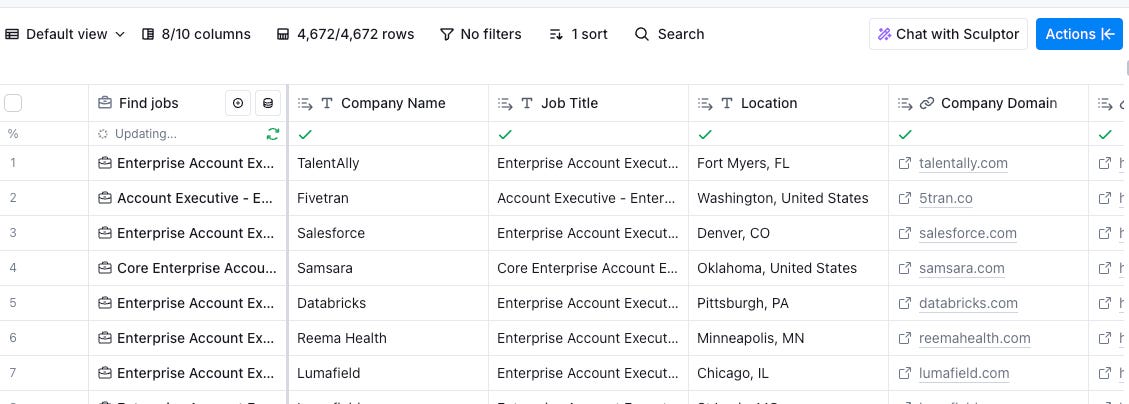

Option 2: Growth Signals (I’m using this)

Companies currently hiring Enterprise AEs/SDRs

In Clay: 4,600+ job postings

Why this works: They’re growing + logo acquisition = acute pain

Option 3: Tech Stack

Companies using specific tools (Mutiny, 6sense, etc.)

Use BuiltWith to find tool installations

My approach for Salesmotion (with option 2):

Starting with 4,600 job postings, I filter down:

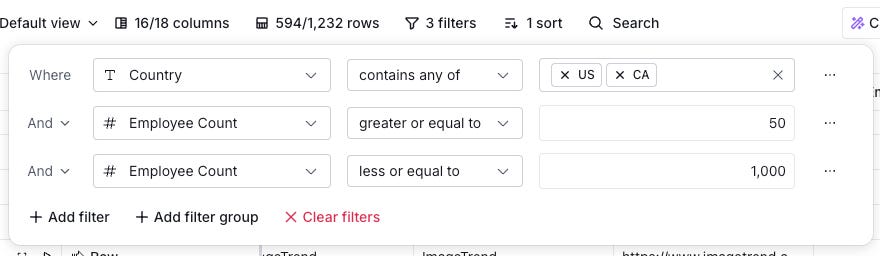

Dedupe → 1,232 companies hiring enterprise reps in November 2025

Filter by size (50-1K employees, US/Canada) → 594 companies

Exclude companies with <10 sales reps → 387 companies

Final list: 387 companies with:

HQ in US/Canada

10+ sales reps

Currently hiring Enterprise AEs

So we are going to use this list to score based on the criteria we mentioned earlier.

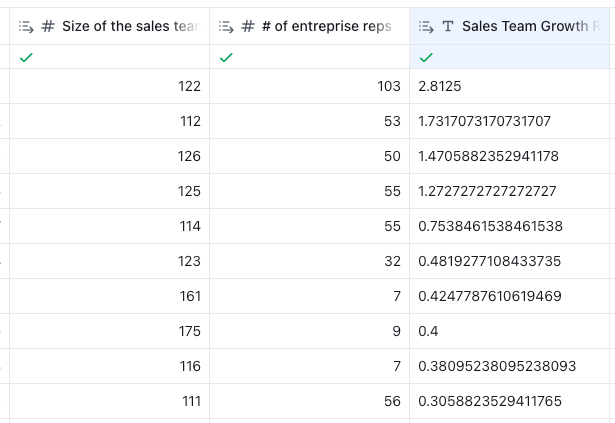

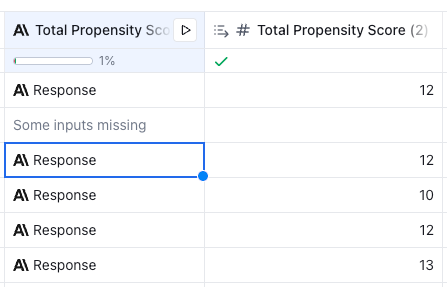

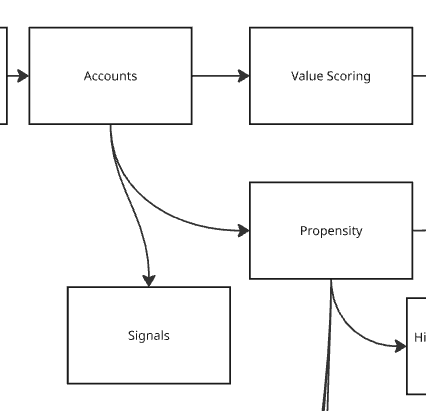

Step 4: Scoring System

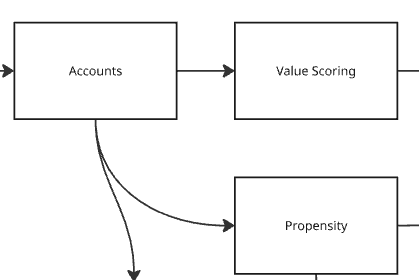

Two scores for each account:

Deal Size Score (Revenue Potential)

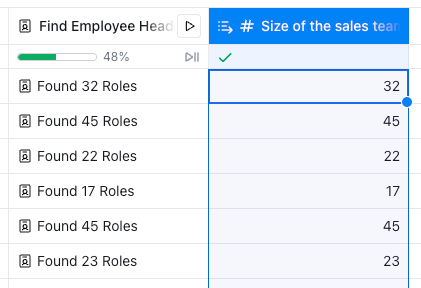

Number of sales reps (10 to 175 in our list)

Bigger team = more accounts tracked = higher ACV

Score: Propensity Score (Likelihood to Buy)

Industry/personas they sell to (based on company description

Size of the enterprise team (via Clay)

Size of the sales team (via Clay)

Sales Team Growth Rate Past 12 month

Tech stack used (via Builtwith)

Company age (via LinkedIn)

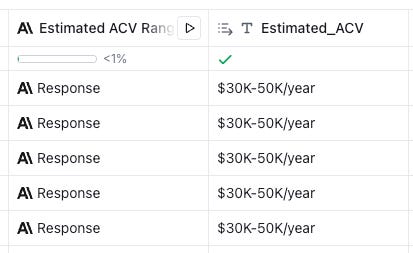

Use AI in Clay to score accounts across these dimensions.

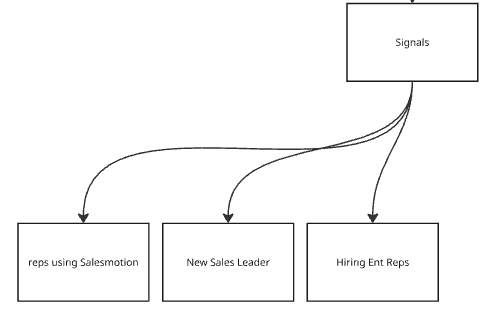

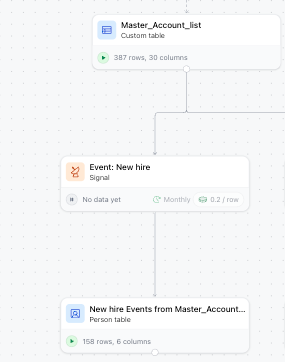

Step 5: Signals + Hit list

After scoring, layer in signals to prioritize outreach:

Priority 1: Product Data

Reps already paying for Salesmotion

If they work at ICP account → reach out to rep to ask for an intro (and offer a 3 months)

Priority 2: New Hires

New sales leader

New sales enablement leader

Priority 3: Hiring

Companies hiring Ent reps (our current list)

Hiring Sales Enablement/Ops roles

Priority 4: No Signals

If no signals → Cold outreach

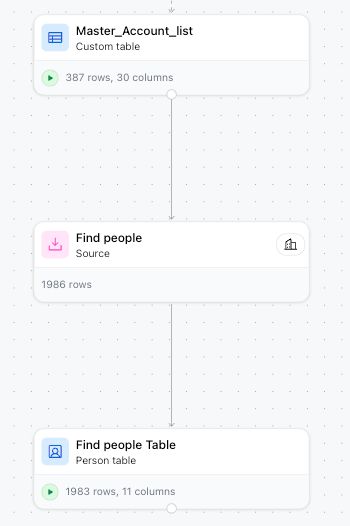

Step 6: Stakeholder Mapping

From our 387-account list, here’s who to target:

Economic Buyer (Decision Maker):

Sales leader: VP/CRO

Champions/Influencers:

SDR Manager / SDR Leader

Sales Enablement Manager/Director

Sales Operations Manager

Frontline Sales Manager (manages 5-10 AEs)

Revenue Operations (RevOps) - if focused on sales enablement

ABM team

End-users:

SDR/AE/Account Managers

Result:

13,000 total contacts

~2,000 economic buyers + champions (our focus)

Step 7: Messaging strategy

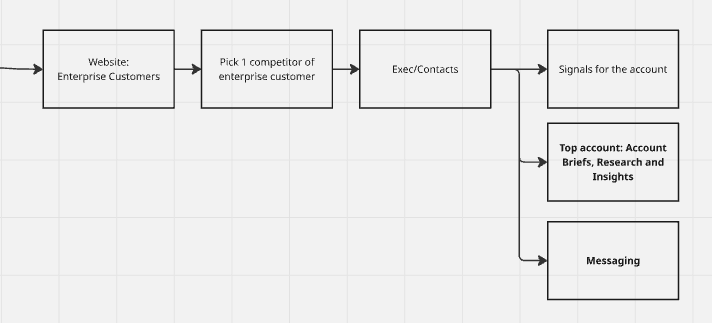

Here’s the Salesmotion advantage:

You can SHOW prospects what their reps would get, instead of telling them.

So let's use the Chef’s Sample Approach

Most outbound tells prospects what the product does. Better outbound shows them.

Think about it like a restaurant:

A bad waiter describes the dish (”It’s really flavorful, you’ll love it”).

A great chef sends you a sample to taste.

For Salesmotion, this means:

Don’t say: “We help your reps research accounts faster”

Do this: Send them a Salesmotion-style brief about one of their target accounts

Why Chef’s Sample works:

Demonstrates value instantly (they see what their reps would get)

Proves relevance (you did the work for their specific use case)

Makes them think: “Imagine if my reps had this for every call”

You’re the expert chef serving them a sample they can actually taste

Recipe:

Data points + Signals (if any) + The Chef’s Sample Framework = Messaging

Example with Docker (from our list):

So I’m going to write three emails using the data points from earlier with Docker (which is on the list) and show how we could use Salesmotion directly in my outreach.

With Clay, I can do this at scale for every company on the list.

Email 1: SIGNALS (Use case #1)

Subject line: Enterprise AE

Hi [First name], saw you’re growing your enterprise team.

Enterprise AE ramp takes 12 to 18 months to quota.

Our tool cuts ramp and shortens deal cycles.

By tracking buying signals for companies needing enterprise containers.

You work with data platforms like Confluent, so I pulled signals for Databricks:

→ 300+ infrastructure roles (K8s)

→ Multi-cloud Kubernetes at scale

→ IPO prep (governance critical)

This is what your reps would see automatically.

Interested to learn more?Email 2: ACCOUNT INTELLIGENCE (Use case #2)

Subject line: Account Research

Hi [First name], saw you’re hiring Enterprise AEs.

Their ramp takes 12-18 months to quota.

Part of the problem: spend 45+ minutes researching each account to prep calls. That’s less time actually selling.

Saw you work with data platforms like Confluent.

Here’s what your reps would see for Databricks:

→ Exec summary (2025 IPO prep, containerized Spark clusters)

→ SWOT (container security gaps for SOC 2/FedRAMP compliance)

→ POV (IPO requires enterprise container governance across AWS, Azure, GCP)

Account briefs in 30 seconds, not 45 minutes.

More selling hours = faster ramp.

Interested to learn more?Email 3: MESSAGING (Use case #3)

Subject line: outbound for CTOs

Hi [First name], saw you’re hiring Enterprise AEs for Docker.

Enterprise AE ramp takes 12-18 months—partly because generic messages don’t land C-level meetings.

Enterprise deals need VP/CTO engagement, not just manager-level conversations.

You work with companies like Confluent. Here’s what your reps could use for Databricks:

→ Message: IPO compliance → Container governance becomes board-level

→ Proof: [COmpany] solved multi-cloud governance pre-IPO

High-quality messages land C-level meetings.

More C-level meetings = faster ramp to quota.

Worth discussing?Those messages are pretty good. Always could be improved.

Here's what I’d A/B Test:

Shorter vs. more specific versions

More language specific to Sales leaders (faster ramp → hit ARR goals quicker)

Adding persona-specific angles

Sending full account brief vs. teaser

Different CTAs (ask for full Databricks examples)

The Complete System:

✅ Step 1: Business Analysis

✅ Step 2: TAM + ICP

✅ Step 3: Data Strategy

✅ Step 4: Scoring System

✅ Step 5: Signals + Hit List

✅ Step 6: Prospects (Who to target)

✅ Step 7: Messaging (How to reach them)

AI Prompts

Here are the prompts that I used to build this.

So you can use the same for your company:

Prompt 1: Business Model Analysis → Understand the pain, buyers, triggers

Prompt 2: ICP Definition & Micro-Segments → Define WHO to target

Prompt 3: Data Strategy → For each ICP criterion, WHAT data sources exist and HOW to find them

Prompt 4: Scoring System → Now that you know what data is available, HOW to score/weight it

Prompt 5: Buying Signals/Hit List → Layer TIMING signals on top (hiring, funding, leadership changes)

Prompt 6: Stakeholder Mapping → WHO to contact

Prompt 7: Messaging Strategy → HOW to be relevant

Prompt A: Chef’s Sample Brainstorming

Prompt B: Chef’s Sample Email Writing

Prompt 1: Business Model Analysis

Keep reading with a 7-day free trial

Subscribe to Outbound Kitchen to keep reading this post and get 7 days of free access to the full post archives.