How to Divide Your Outbound Market Into Territories (7-Step Guide)

TAM → SAM → ICP → territories.

Welcome to a new 🔒 subscriber-only edition 🔒 of my weekly newsletter of Outbound Kitchen. Each week, I dive into reader questions about scaling outbound and making it your #1 growth engine. For more: Launching Outbound, and Scaling Outbound

I got this question from a GTM leader in December:

“I’m reading your newsletter. A topic I find very interesting (and I don’t find elsewhere) is how to divide the SAM into territories for each rep. Is this something you plan to cover soon?”

This is the question nobody answers well. Not TAM for investors. TAM/SAM/ICP for territory planning.

Here’s the step-by-step process:

P.S. Before we start: TAM, SAM, and ICP are not fixed. They evolve as your product and GTM evolve.

New integrations → SAM grows (more companies can buy)

New use cases → ICP expands (new segments become ideal)

New markets → TAM grows (new geographies, new verticals)

New GTM resources → SAM grows (add French speakers → France becomes addressable)

Snowflake started selling only to ad tech and gaming. That was their entire ICP, maybe <1,000 companies. Now they sell to dozens of industries.

This isn’t a one-time exercise. Revisit it quarterly as your product and team grow.

Why This Matters

When companies plan their sales team, they use TAM instead of ICP.

“We have 100,000 companies in our market.”

But if your ICP accounts convert at 25-30% and everything else converts at 1% or 0%, you don’t have 100,000 accounts. You have a much smaller number that will actually buy.

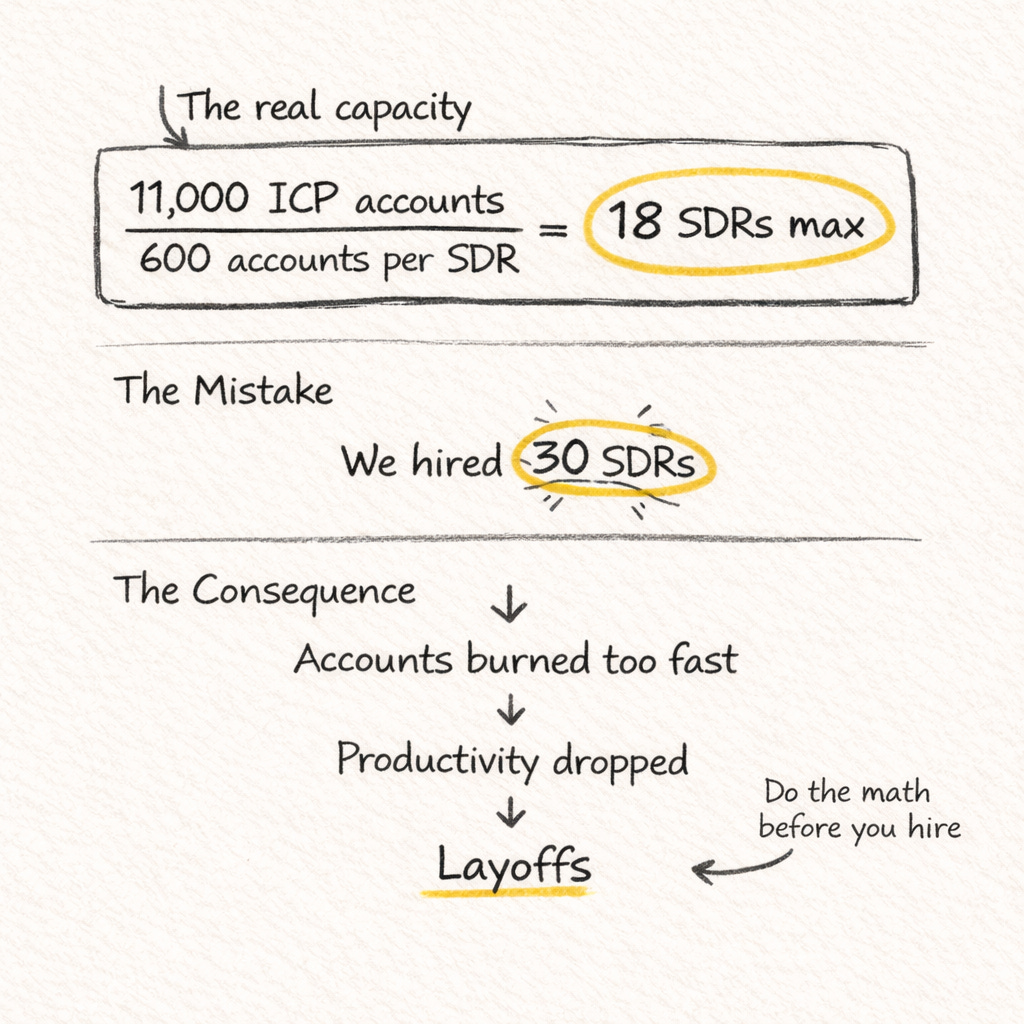

What happened at Chili Piper:

We overestimated the market. TAM looked huge—all B2B companies that book meetings.

Reality: ~11,000 accounts globally fit our ICP.

At 600 accounts per SDR (3-month contact cadence), that’s a maximum of 18 SDRs worldwide.

We over-hired. Gave reps “enough accounts.” But many had near-zero probability of converting. Productivity dropped. Eventually, we laid off part of the team.

If we had done this exercise before hiring, we would have known the real capacity of our market.

The 7-Step Process

Define your TAM → Total market size

Filter to SAM → Companies that COULD buy

Discover your ICP → Companies you SHOULD target

Define Anti-ICP → Accounts to exclude

Score all accounts → Every account has a tier

Calculate capacity → How many reps your market supports

Divide by equal potential → Fair territories

Step 1: Define Your TAM (Total Addressable Market)

What: Count the total number of companies in your market.

Output: A number. The upper bound.

This is your starting point. The broadest definition of who could theoretically be a customer.

Examples:

Chili Piper: All B2B companies that book meetings with prospects

Rippling: All employers (any company with employees)

Snowflake: All companies that store and analyze data

Wiz: All companies using cloud infrastructure

Owner.com: All restaurants

TAM is mostly useful for investors and market sizing. It’s not useful for territory planning on its own.

Step 2: Filter to SAM (serviceable addressable market)

What: Filter TAM to companies that COULD buy based on product requirements.

Output: A smaller list of companies that fit your product.

SAM filters for:

Right integrations (CRM, tech stack)

Right geography

Right use case fit

Examples:

Chili Piper

TAM: All B2B companies booking meetings

SAM filter: Uses Salesforce or HubSpot

SAM: B2B companies on supported CRMs

Rippling

TAM: All employers

SAM filter: Supported geos, 50+ employees

SAM: Mid-market employers in US

Snowflake

TAM: All companies with data

SAM filter: Already on cloud (AWS/GCP/Azure)

SAM: Cloud-adopted companies

Wiz

TAM: All companies using cloud

SAM filter: Meaningful cloud footprint

SAM: Companies with real cloud infrastructure

Owner.com

TAM: All restaurants in US

SAM filter: 1-10 locations, offers delivery

SAM: Independent restaurants with delivery

Step 3: Discover Your ICP

What: Identify the common traits of your BEST customers.

Output: A list of detectable signals that predict success.

The Definition Most People Get Wrong

Mark Roberge:

“A great ICP is based on LTV, not lowest CAC, and that’s where a lot of people get that message wrong.”

Broken intuition #1: ICP = where our inbound demand is That’s not necessarily who you built the product for.

Broken intuition #2: ICP = where we have the highest close rates Only true if they stick around.

The correct frame: ICP = companies where you solve a significant problem.

When you solve a real problem, customers renew, expand, and refer. That shows up as high LTV. LTV is the signal—not the definition.

How to Discover Your ICP

Quality data: Customer conversations (Gong), interviews, CS calls → “Why did you buy? What problem did we solve?”

Quantity data: External sources at scale (Clay, LinkedIn) → Validate patterns across your customer base

ICP Must Be Detectable

If you can’t find the signal in external data, you can’t build target lists at scale.

Chili Piper ICP traits: SDR + AE model, high inbound volume, routing complexity Where to detect: LinkedIn (SDR headcount), job postings (demand gen, RevOps)

Rippling ICP traits: Distributed workforce, tool sprawl, HR/IT/Finance Ops exists Where to detect: LinkedIn (multi-location, ops roles), job postings

Snowflake ICP traits: Data team exists, building analytics/ML/AI Where to detect: LinkedIn (data engineer titles), job postings (dbt, Fivetran)

Wiz ICP traits: Security team exists, compliance pressure Where to detect: LinkedIn (security roles), job postings (SOC2, compliance)

Owner.com ICP traits: High delivery volume, DoorDash/UberEats dependency Where to detect: Google Maps, Yelp, Uber Eats/DoorDash presence

Step 4: Define Anti-ICP

What: Identify accounts with near-zero probability of converting.

Output: A “do not contact” list.

These are companies where CAC doesn’t make sense and same for LTV. If you give these accounts to reps, it doesn’t matter how good they are, these accounts will never close.

Examples:

Chili Piper:

Anti-ICP: Not using Salesforce/HubSpot CRM

Why: Product doesn’t integrate

Rippling Anti-ICP: <30 employees, contractor-heavy, locked into PEO Why: Too small, no pain, switching cost too high

Snowflake Anti-ICP: No data team, Excel-only, on-prem only Why: No buyer, no use case

Wiz Anti-ICP: No cloud footprint, no security team Why: No attack surface, no one to sell to

Owner.com Anti-ICP: No delivery, fine dining, large franchises Why: No margin pain, corporate procurement

At Chili Piper, if we had scored all accounts upfront, we would have seen some had 0-1% win rates. We paid reps to work accounts that were never going to convert.

Step 5: Score All Accounts

What: Assign a tier to every account based on ICP fit.

Output: A ranked list of all accounts.

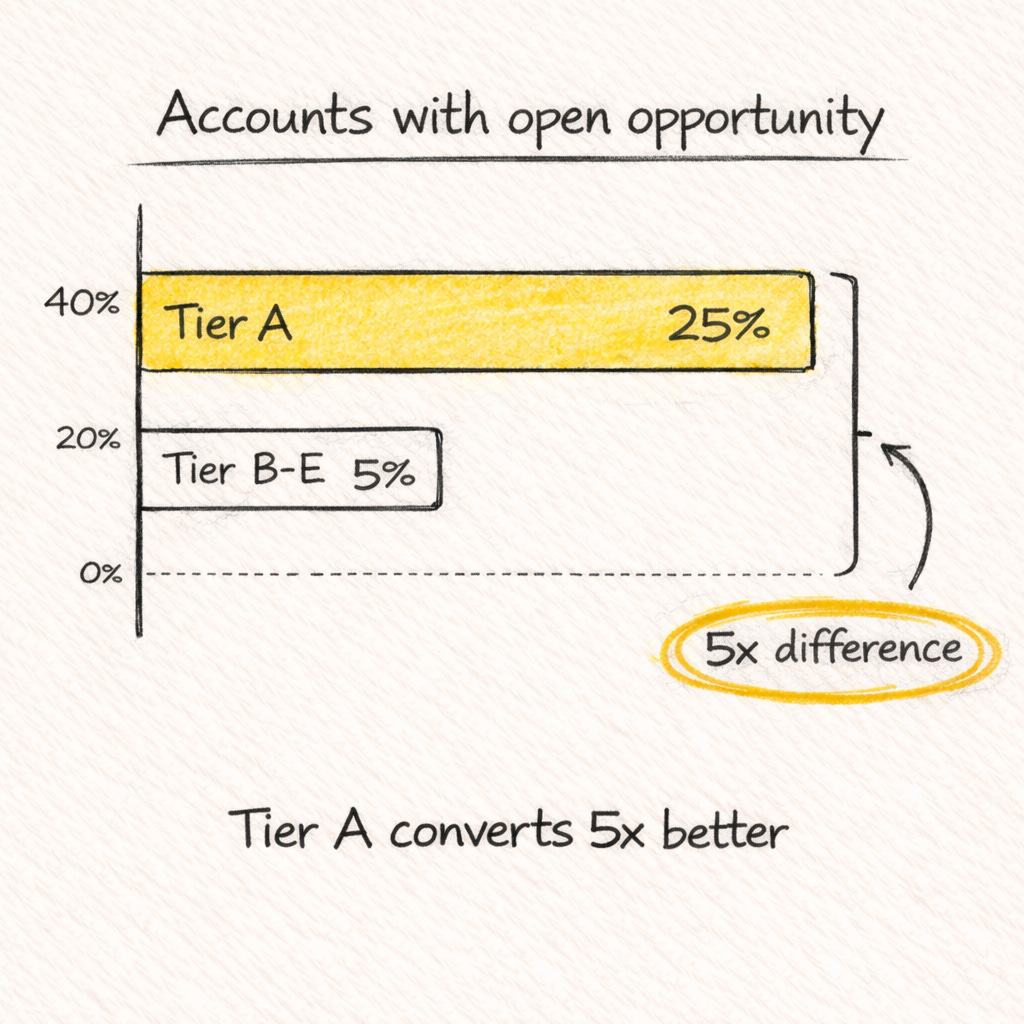

Why Score?

Snowflake’s data:

Tier A accounts: 25% had an open opportunity

Tier B-E accounts: 5% had an open opportunity

Tier A converts 5x better

If you don’t score, you don’t know how much real potential you have.

If you don’t score, you don’t know how much real potential you have. You might give reps accounts with 0% probability of closing.

How to Score

Use a simple 2-layer system:

Layer 1: Fit Score (0-100) — How well does this account match your best customers?

Layer 2: Value Prediction — What’s the potential deal size?

I covered the full scoring framework here

→ Quick Start: Build Account Scoring for Outbound

Step 6: Calculate Capacity

What: Figure out how many reps your market can support.

Output: A maximum headcount number.

The Formula

ICP Account Count ÷ Accounts per Rep = Max Reps

The Contact Frequency Rule

Accounts should only be contacted every 3 months. Touch them more often and reply rates tank.

This means:

If an SDR works 200 accounts/month

And accounts should only be contacted every 3 months

Each SDR needs 600 accounts minimum in their territory

The Chili Piper Example

ICP count: ~11,000 accounts globally

Contact cadence: Quarterly (3 months)

Accounts per SDR: 600

Max SDRs: 18 worldwide

If you hire 30 SDRs, you’re burning through accounts twice as fast. Reps run out of fresh accounts. Productivity drops.

The Key Insight: Optimize Before You Hire

Before adding headcount, ask: “Have we maxed out our current team’s productivity?”

Doubling productivity is cheaper and faster than doubling headcount.

I broke down the full capacity planning framework here

→ Here’s how to plan your 2026 outbound team (the right way)

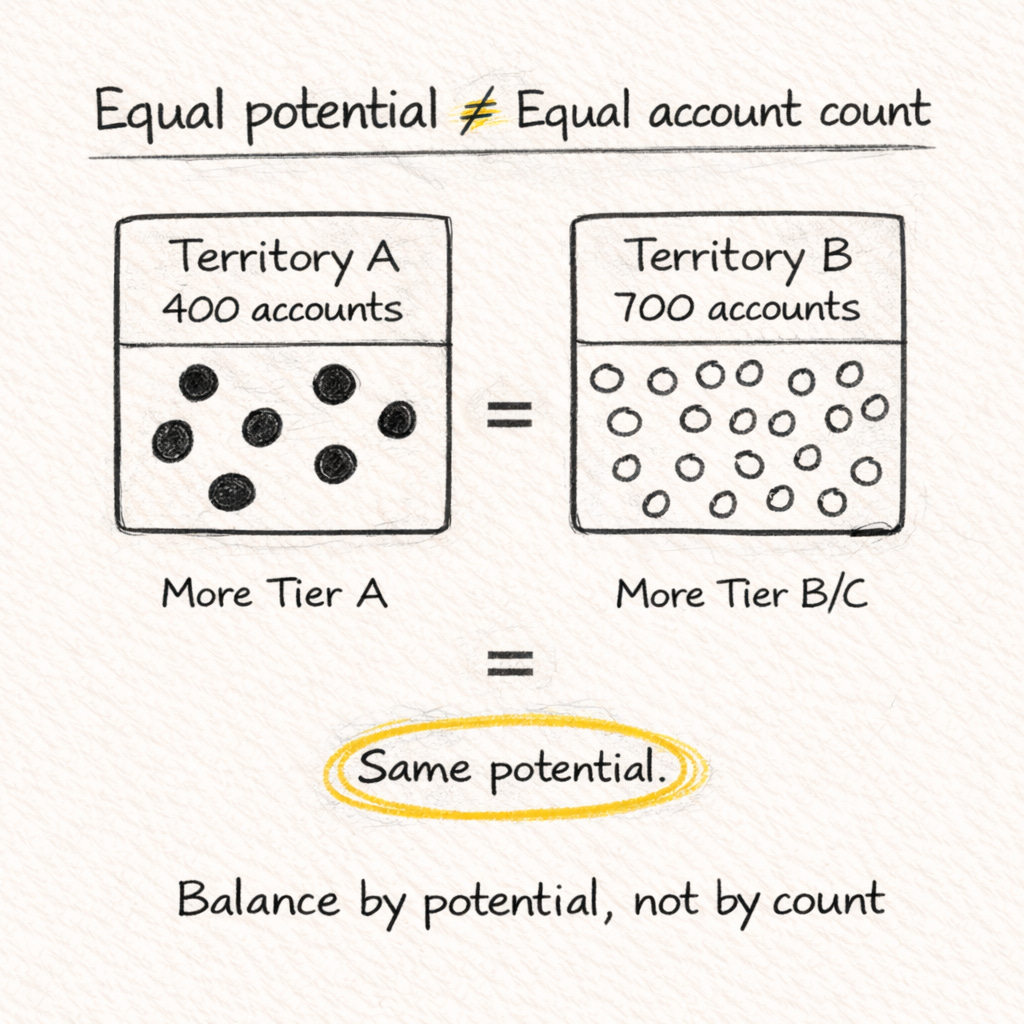

Step 7: Divide by Equal Potential

What: Create territories with equal potential, not equal account count.

Output: Fair territories where every rep has the same opportunity.

Start with Geography

Don’t over-complicate this. Divide by geography first—where are your ICP accounts?

If you have:

10,000 ICP accounts in the US

1,000 ICP accounts in Europe

You know your US team will be ~10x the size of your Europe team. That’s your starting point.

Vertical specialization (by industry) comes later, when you have the GTM team maturity. Companies like Snowflake can dedicate reps to financial services or healthcare. But that requires scale and enough accounts per vertical to justify it.

How to Divide

It depends on what data you have:

Early (no historical data) What you have: ICP definition but no win rate data How to divide: Equal ICP accounts per rep

Some traction What you have: Win rate data by tier How to divide: Equal Tier A accounts per rep, then balance the Tier B/C mix

Mature What you have: Deep historical data How to divide: Use conversion rates to balance expected pipeline per territory

Early stage: Make sure each rep has roughly equal ICP accounts.

With historical data: Make sure each rep has equal Tier A accounts (your highest converters), then balance the rest so no one is overloaded with low-probability accounts.

Quota Should Reflect Territory Maturity

If a rep is working a territory with proven data that it’s working, their quota should be higher than someone starting a new territory from scratch.

Equal potential ≠ equal quota. A mature territory with momentum should carry a higher target.

The Mechanics Depend on Your GTM

The exact process for territory assignment depends on your model—inside vs. field, segment splits, language requirements, existing customer relationships.

But the principle stays the same: balance by potential, not by count.

Where to Get the Data

Horizontal B2B SaaS: LinkedIn Sales Navigator + Clay → Headcount by function, company size

Restaurants: Datalane → Restaurant-specific data, delivery status

Ecommerce: Storeleads → Online stores, platforms

Benefits/Brokers: Benefitflow → Employer benefits data

Enrichment at scale: Clay → Combine sources, validate signals

Quick Reference: All 5 Companies

Chili Piper

TAM: B2B companies booking meetings

SAM: Uses Salesforce/HubSpot

ICP: SDR+AE, high inbound, routing complexity

Anti-ICP: No CRM integration

Data: LinkedIn, Clay, BuiltWith

Rippling

TAM: All employers

SAM: Supported geos, 50+

ICP: Tool sprawl, distributed, Ops roles

Anti-ICP: <30 employees, PEO locked

Data: LinkedIn

Snowflake

TAM: Companies with data

SAM: Cloud + analytics needs

ICP: Data team, building AI/ML

Anti-ICP: No data team, Excel-only

Data: BuiltWith, HG Insights

Wiz

TAM: Companies with cloud

SAM: Cloud + security pressure

ICP: Regulated, security team, compliance

Anti-ICP: No cloud, no security

Data: BuiltWith, HG Insights

Owner.com

TAM: All restaurants

SAM: 1-10 locations, delivery

ICP: High delivery, marketplace dependency

Anti-ICP: No delivery, fine dining

Data: Datalane, Google Maps

The Takeaway

Your TAM doesn’t build pipeline. Your ICP does.

The 7 steps:

Define TAM — Total market (for investors)

Filter to SAM — Companies that COULD buy (product fit)

Discover ICP — Companies you SHOULD target (LTV signals)

Define Anti-ICP — Accounts to exclude (0% probability)

Score all accounts — Tier every account by ICP fit

Calculate capacity — How many reps your market supports

Divide by equal potential — Start with geography, balance by ICP accounts or Tier A accounts

Which step is the hardest for you right now?

Defining ICP vs SAM

Finding the right data

Scoring accounts

Calculating capacity

Dividing territories fairly

Hit reply and tell me, I’ll cover the most requested topic in a future issue.

Elric

🔒 Paid Subscriber Bonus: The Territory Planning Toolkit”

Keep reading with a 7-day free trial

Subscribe to Outbound Kitchen to keep reading this post and get 7 days of free access to the full post archives.