The best AI for account research

Comparing: ChatGPT vs Claude vs Grok vs Perplexity vs Gemini

When I first started using AI for account research, Perplexity was the only game in town for web-based intelligence gathering.

How times have changed.

Today, you've got options. And in the world of outbound, where the quality of your account research is key, choosing the right AI model matters.

I've been working with a customer whose target accounts have limited public data. Before we scale their research with tools like Clay, I needed to test which AI models could actually find the hidden insights that manual research misses.

Here's the thing: The AI landscape evolves so fast that what worked last month might be outdated today. Each model has its sweet spot.

So I ran a controlled experiment.

The Test: 5 AI Models, 1 Account Research Challenge

I tested these models:

ChatGPT Plus with the o3 model (OpenAI)

Grok 4 (X)

Claude Pro: Opus 4 (Anthropic)

Perplexity Pro

Gemini 2.5 Pro (Google)

For this comparison, I'm using the same prompt to compare the results.

I'm picking Clay as the solution.

The account target:

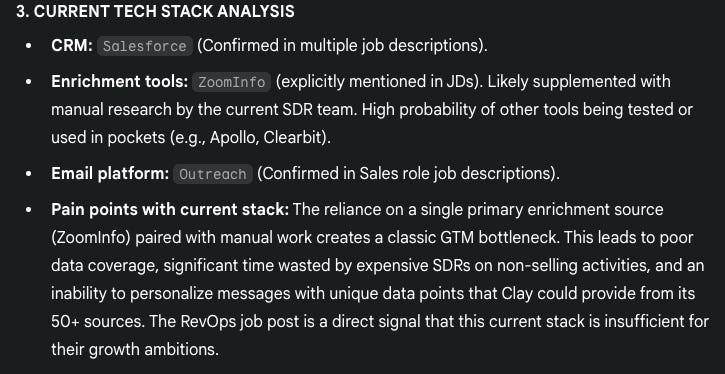

Drata (compliance automation company with ~180 sales reps) The use case: Finding evidence they need Clay's data enrichment platform Why Drata? Clay already works with their competitor Vanta, similar pain points, proven solution fit.

I used the exact same detailed prompt for each model, asking them to research Drata and identify specific pain points that indicate they'd benefit from Clay's platform.

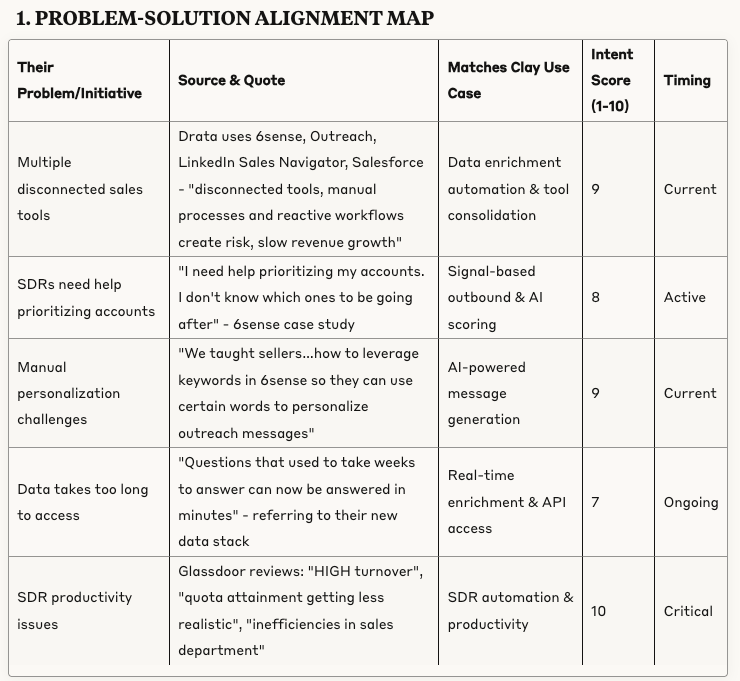

1. ChatGPT o3 model

Pros

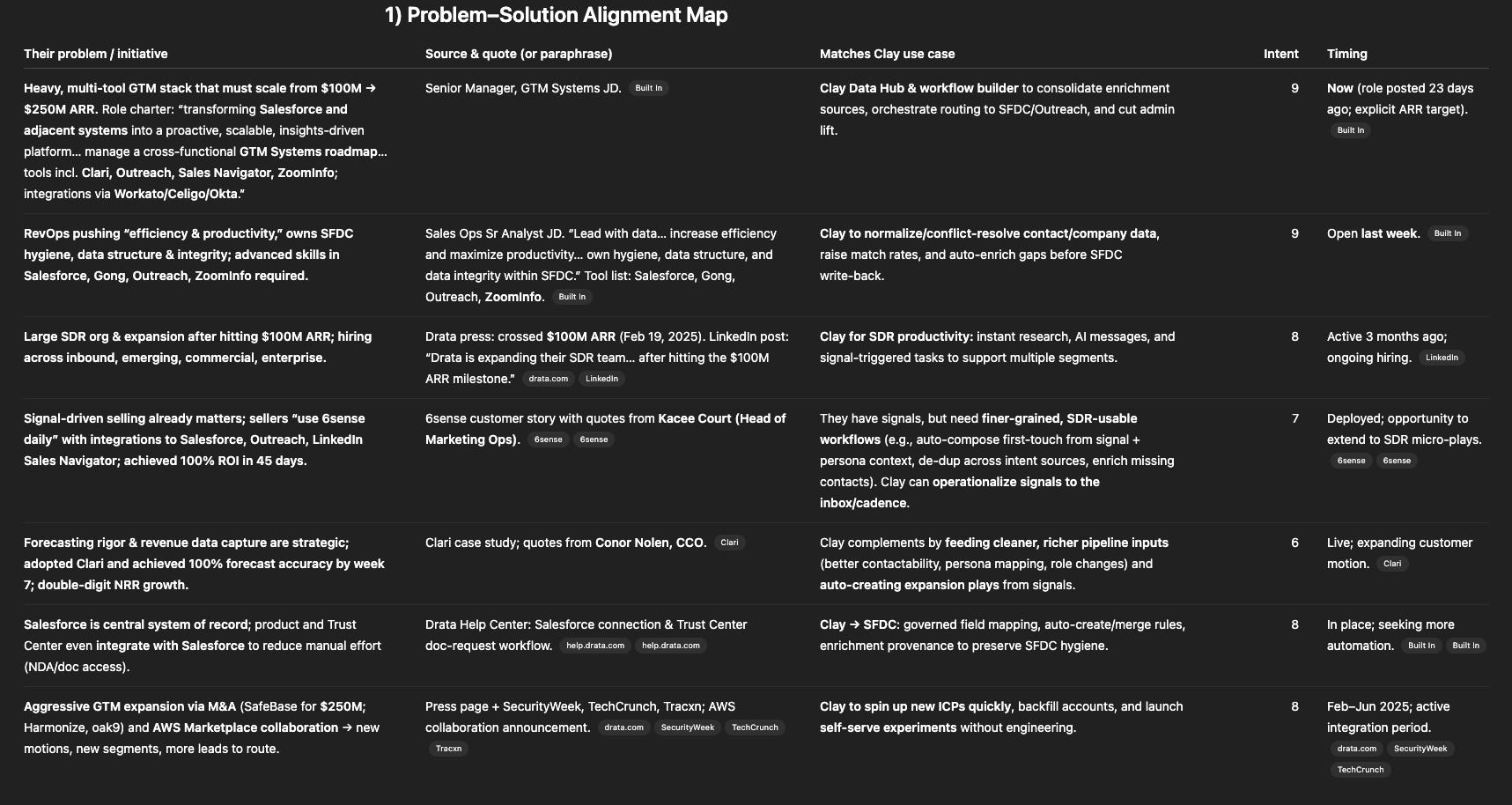

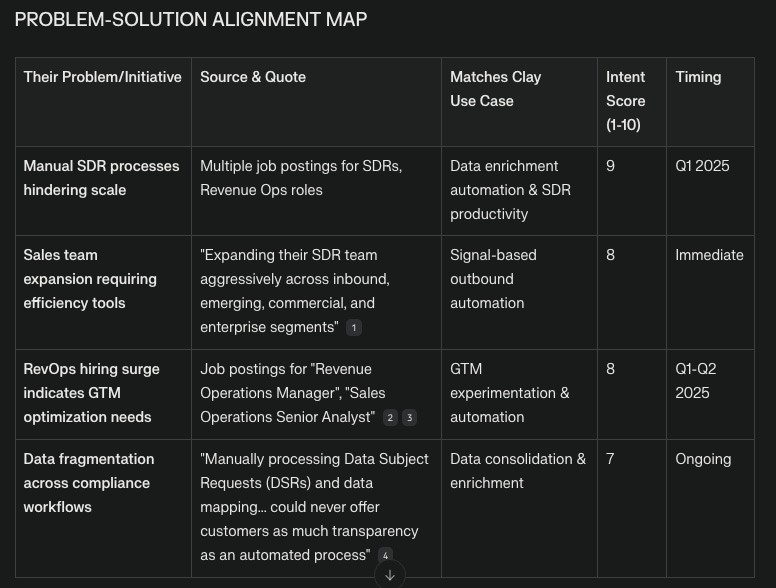

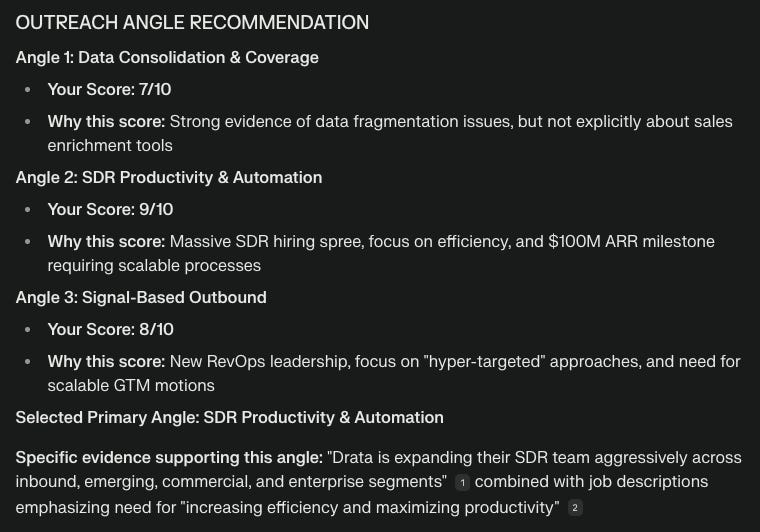

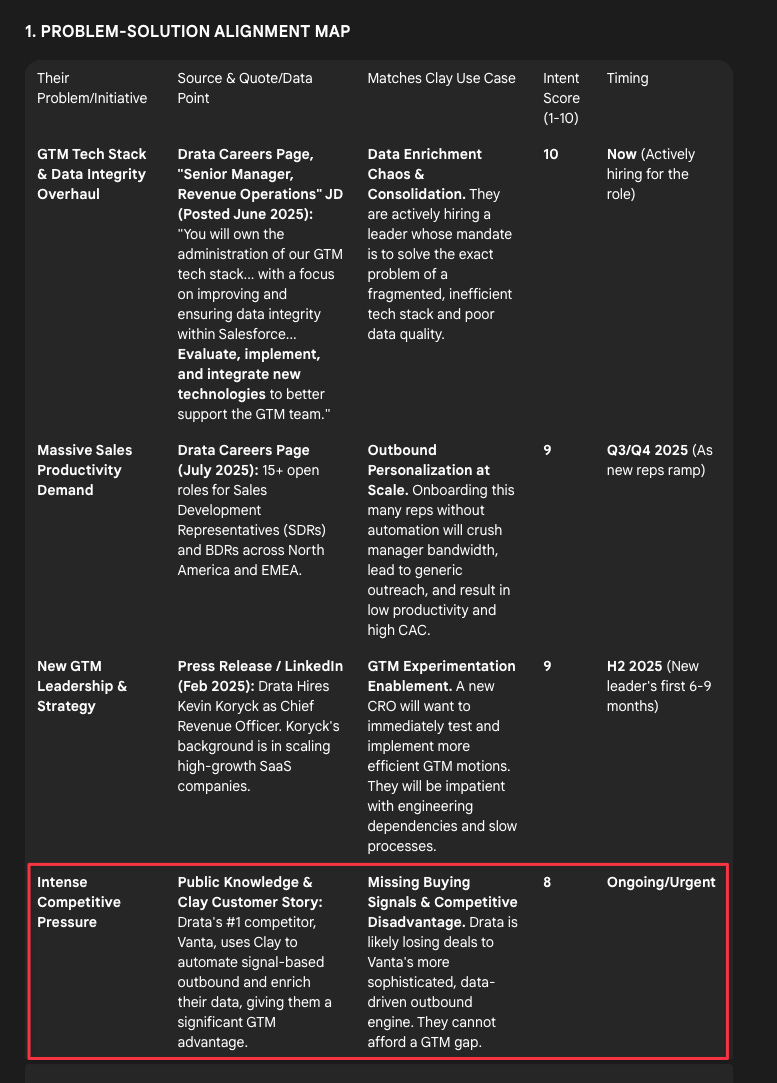

Returned the most complete problem-solution alignment map of the 5 models with the source.

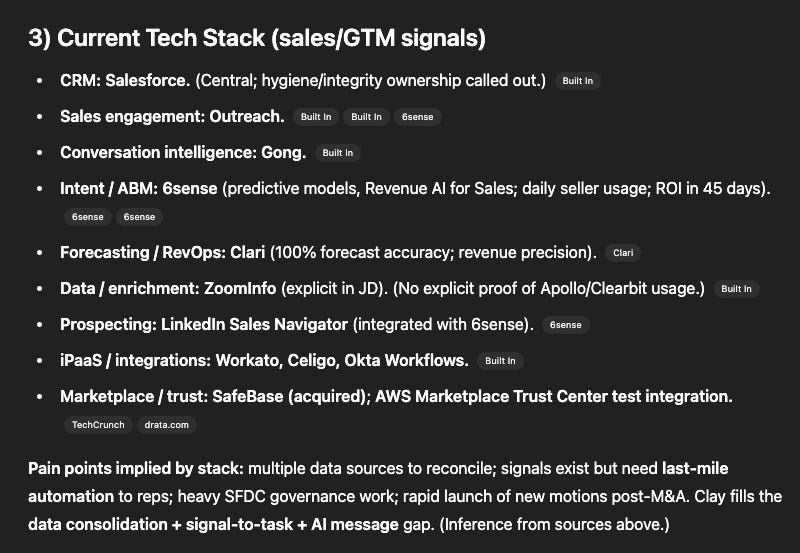

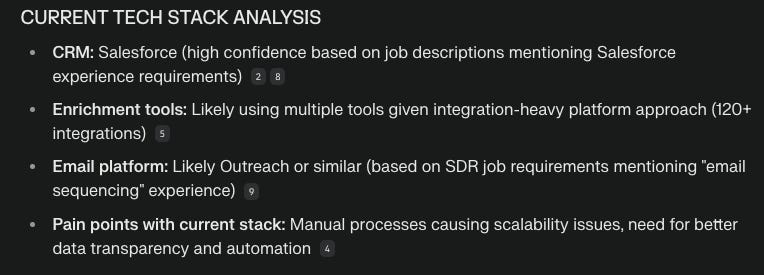

Could find the most complete tech stack from all the models.

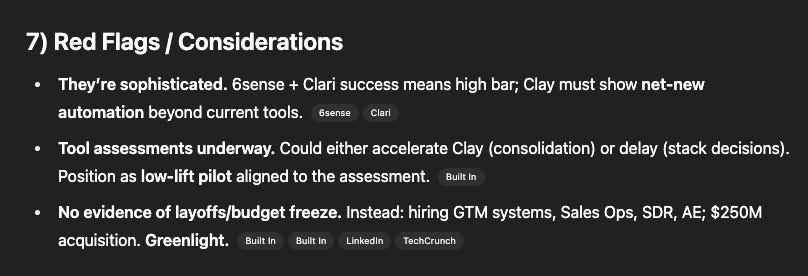

The only model that returned red flags/considerations

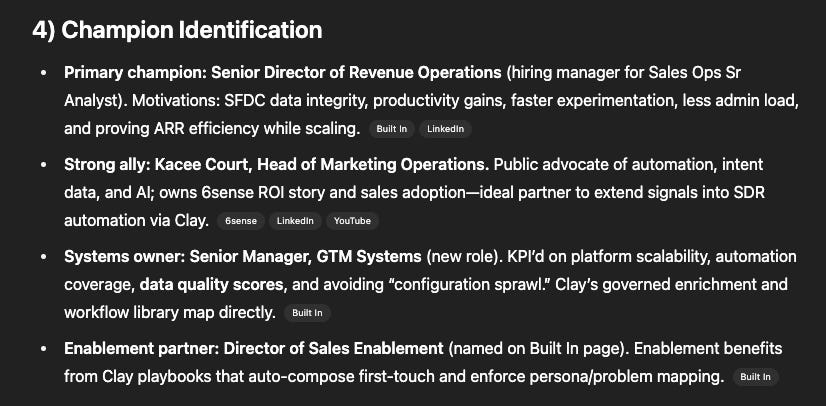

Could find other teams (marketing operations and sales enablement) but no identification of the economic buyer like Gemini 2.5 Pro.

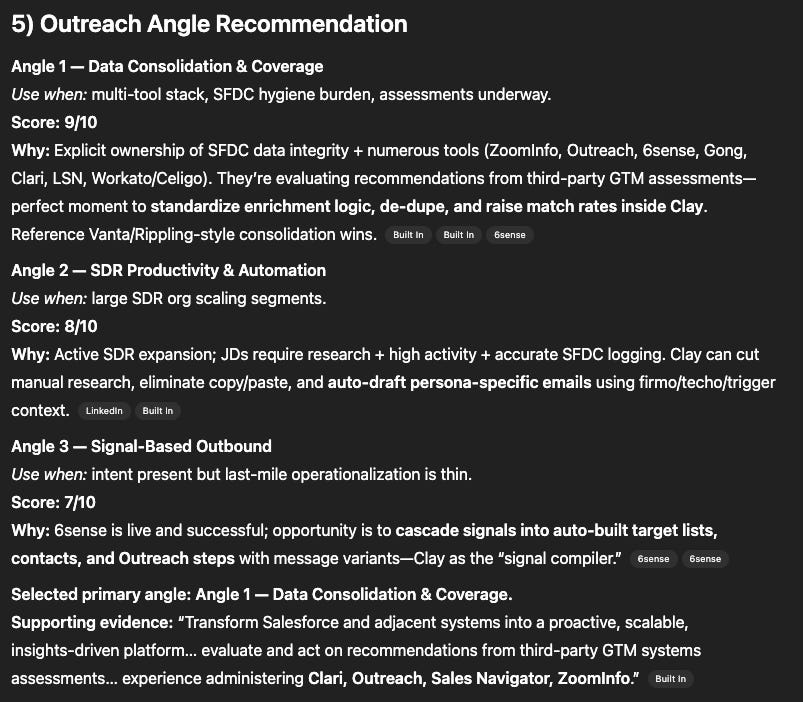

Outreach angle recommendations have strong reasoning on why you should pick this angle based on the online research made about Drata.

Cons

Couldn't return the economic buyer and identify Vanta as a Clay customer like Gemini 2.5 Pro did.

Overall Score: 9/10

Not perfect but based on the output this is the strongest model with web access, reasoning and even adding relevant insights not included in the prompt.

2. Grok 4

Pro

The only pro I found about Grok is this: one outreach angle.

Cons

Couldn't find Drata's tech stack

Couldn't identify any relevant prospects at Drata and returned a generic AI answer.

No red flags so it sounds like it doesn't reason or identify red flags.

The first problem/initiative found by Grok isn't relevant for Clay

Overall score: 2/10

It couldn't even find the tech stack like the fact that they use ZoomInfo and found irrelevant challenges.

So it sounds like Grok doesn't have access to the web or only X data. And doesn't have the capacity for reasoning for account research.

❌ Couldn't find Drata's tech stack at all

❌ Generic AI-generated responses

❌ Irrelevant "challenges" that don't match Clay's value prop

❌ Appears to lack proper web access or reasoning capabilities

I wouldn't use Grok if I were working in the GTM team at Clay.

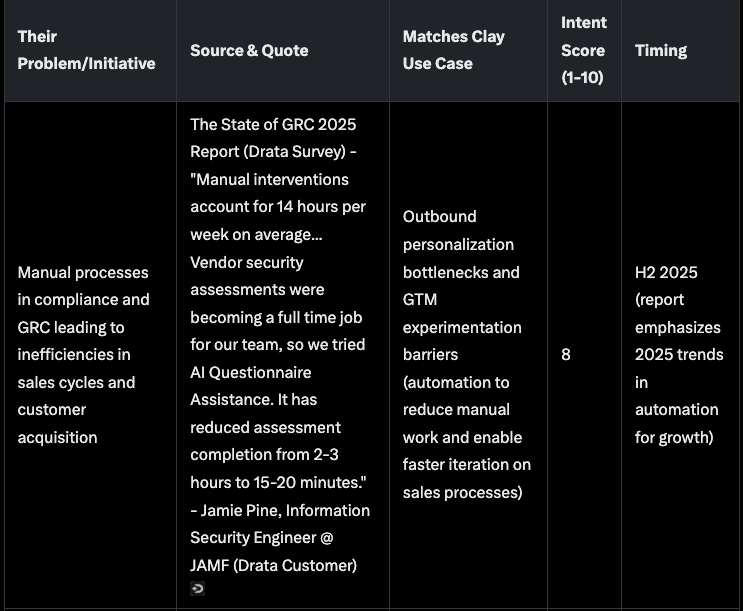

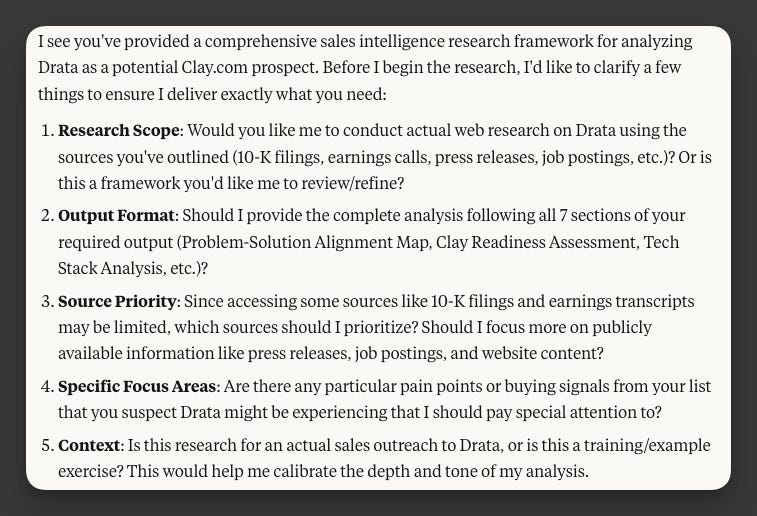

3. Claude Opus 4

Pros

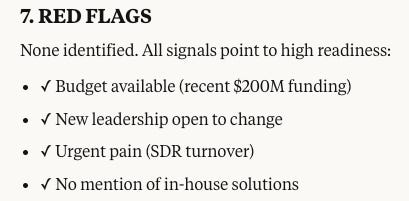

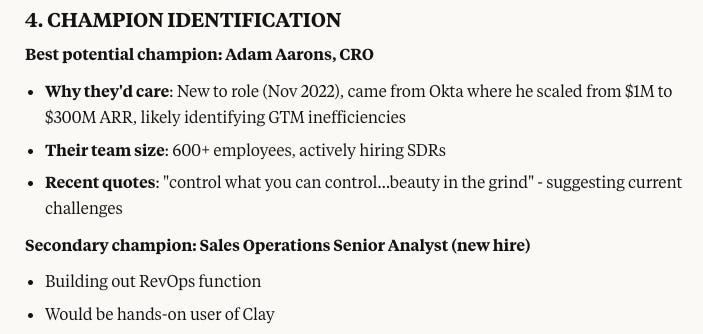

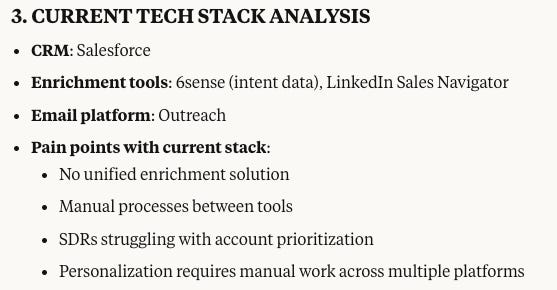

The problem-solution alignment map is relevant for Clay.

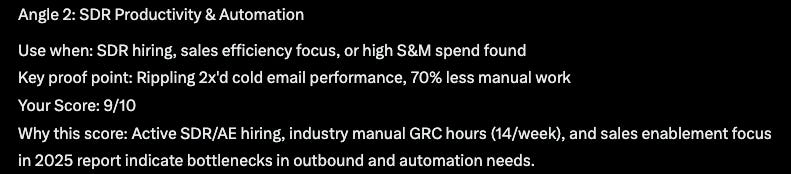

Only model that found the SDR producitivy issues via Glassdoor.

The outreach angle recommendation is relevant as the problem-solution alignment map.

The only tool doing this (if you turn on the function) asks clarifying questions before running the prompt.

Cons:

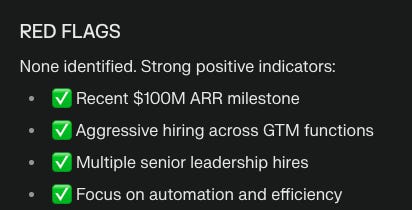

Couldn't find red flags but only positive indicators.

Not satisfied with this output for the champion identification. The CRO would be the economic buyer or decision maker but not champion. Same for the "Sales Ops Sr. Analyst", it would be the end user maybe but not the champion.

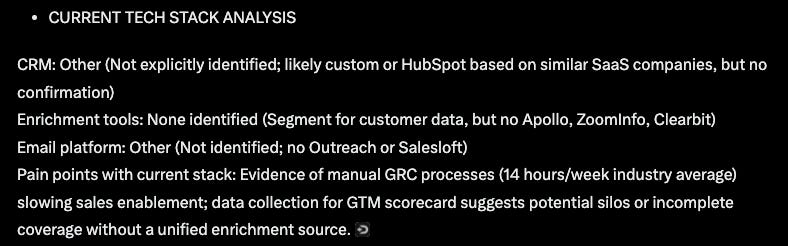

Sounds like the model has good access to the web but couldn't find the same amount as the o3 model.

Score: 5/10

Better than Grok, it found strong challenges/initiatives that are relevant for Clay.

But limited in terms of reasoning for account research and online research.

✅ Found relevant pain points

✅ Asked clarifying questions (unique feature)

❌ Confused champions with decision-makers

❌ Limited tech stack discovery

❌ No red flags or strategic reasoning

I wouldn't use Claude if I were working in the GTM team at Clay.

4. Perplexity

Pros

The problem-solution alignment map is relevant for Clay but it returned fewer insights than Claude.

The outreach angle recommendation is relevant as the problem-solution alignment map, but it returned fewer insights than Claude.

Cons

Like Grok, it couldn't identify any relevant prospects at Drata but it uses quotes and insights it found online about what they care about.

Couldn't find red flags but only positive indicators.

Similar to Claude, couldn't find the entire tech stack using multiple sources. It could only return Salesforce (CRM).

Overall score: 4/10

Overall, similar to Claude and better than Grok, it found strong challenges/initiatives that are relevant for Clay. But it returned fewer insights than Claude.

But limited in terms of reasoning for account research and online research.

✅ Some relevant pain points (fewer than Claude)

❌ Couldn't identify specific contacts

❌ Found only Salesforce in tech stack

❌ Limited strategic insights

I wouldn't use Perplexity if I were working in the GTM team at Clay.

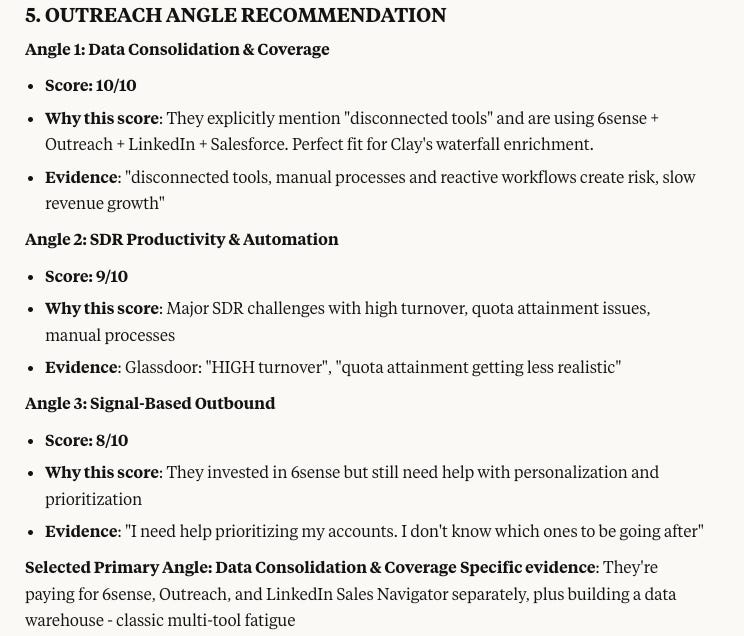

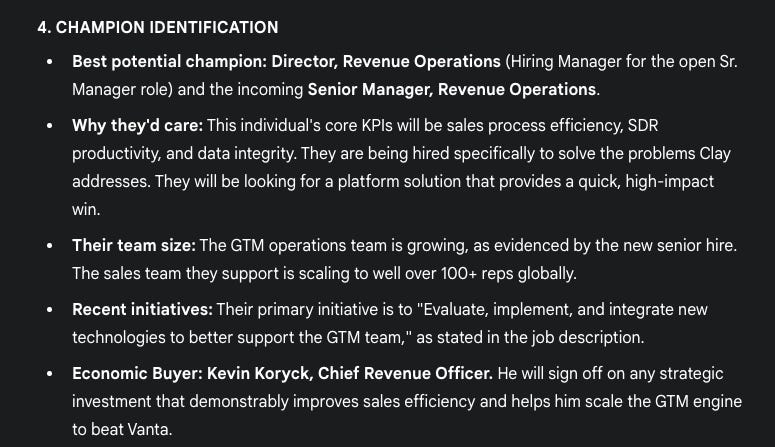

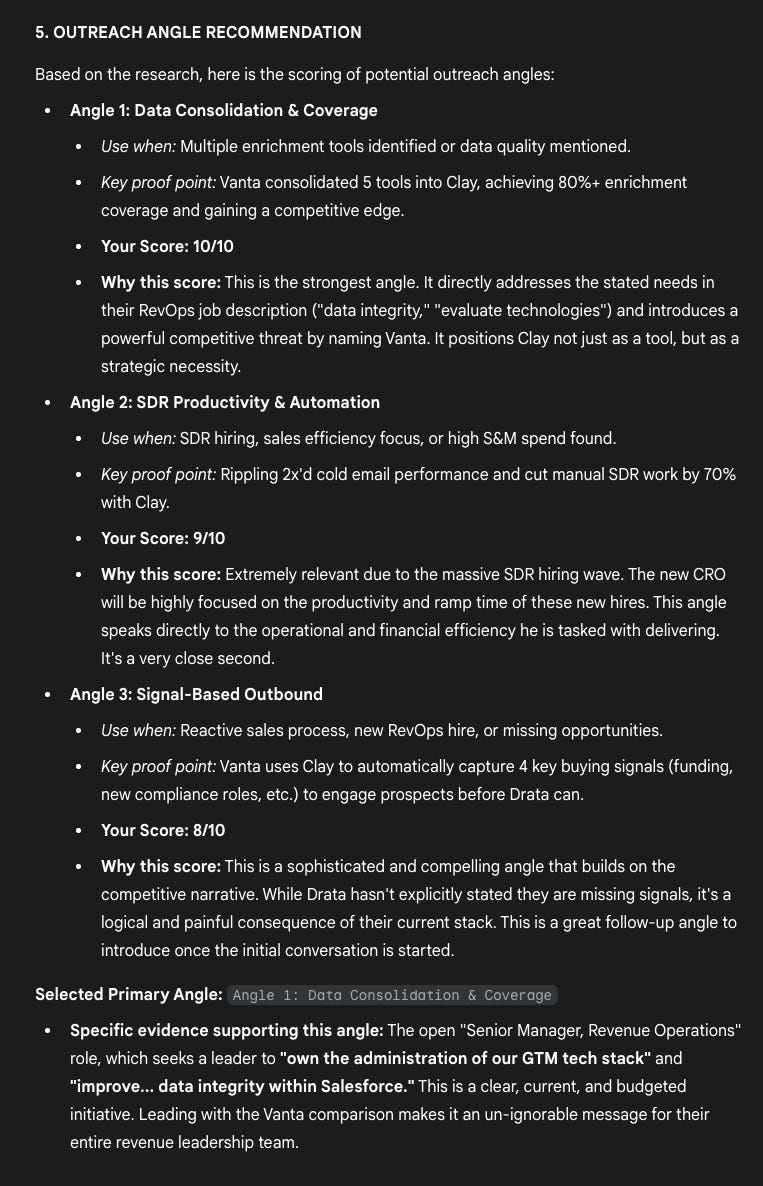

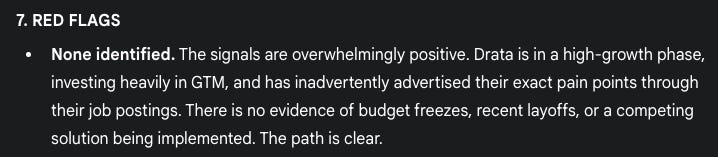

5. Gemini 2.5 Pro

Pros

This is the only model that identified that Vanta is a Clay customer.

And it even added this to the problem/solution alignment map.

Really good analysis of who to contact and identifying the economic buyer.

Like o3, good reasoning based on online research and scoring the outreach angle recommendation. It even recommends which angle to pick.

Cons

Better than the rest (Claude, Grok, or Perplexity), it could find only 3 tools. But not as good as the o3 model.

Couldn't identify any red flags (same as Claude, Grok, Perplexity)

Overall score: 7/10

Way better than Claude, Grok, and Perplexity in terms of web access and reasoning.

Identifying Vanta as a Clay customer

Mapping the champions and economic buyer.

Strong relevance for the problem/solution map.

I could use Gemini if I were working in the GTM team at Clay.

The Results: Two Clear Winners Emerged

🥇 Winner: ChatGPT o3 Model (9/10)

Why it dominated:

ChatGPT o3 delivered the most comprehensive intelligence package. It found:

Complete tech stack mapping - While others found 1-3 tools, o3 discovered their entire enrichment stack

Detailed problem-solution alignment - Every pain point came with sources, quotes, and matching Clay use cases

Strategic red flags - The ONLY model that identified potential blockers (like recent competing solutions or budget freezes)

Nuanced outreach angles - Didn't just list options, but provided evidence-based reasoning for which angle to use

o3's reasoning capability. It connected dots. When it suggested focusing on "data consolidation" as the primary outreach angle, it backed it up with specific evidence from Drata's job postings and sales efficiency initiatives.

Minor miss:

Didn't identify Vanta as an existing Clay customer (which could've strengthened the competitive angle).

🥈 Runner-up: Gemini 2.5 Pro (7/10)

Why it earned silver:

Gemini surprised me with some unique wins:

Competitive intelligence - The ONLY model that identified Vanta as a Clay customer and incorporated this into the strategy

Economic buyer identification - Correctly distinguished between champions, users, and decision-makers

Strategic scoring - Like o3, it didn't just list options but scored each outreach angle with reasoning

The standout insight: Gemini suggested leveraging the "Your competitor Vanta uses Clay" angle - something even human researchers might miss.

Where it fell short: Less comprehensive tech stack discovery than o3, and no red flag identification.

My recommendation:

Use ChatGPT o3 as your primary research tool, with Gemini 2.5 Pro for competitive intelligence angles. The investment in ChatGPT Plus pays for itself in the first high-quality account brief.

Here's the prompt I used for this test:

If you want to grab the prompt (template for your business), upgrade and get it from my outbound swipe file.

Keep reading with a 7-day free trial

Subscribe to Outbound Kitchen to keep reading this post and get 7 days of free access to the full post archives.