How Pigment Scaled to $100M ARR with Outbound

Pigment (Series D) is in the top 5% of all SaaS companies in revenue growth - Here’s their secret sauce.

Read time: 15 min

👋 Hey, Elric here! Welcome to this week’s free edition of Outbound Kitchen. Every week, I break down real questions about scaling outbound so you can turn it into your #1 growth engine. Thinking about upgrading to the paid newsletter? Here’s what you’ll get:

Instant access to 16 paid newsletters, including:

My Outbound Chef Kit: 100+ resources (email templates, cold call scripts, AI prompts, top outbound tools, and more, everything the best outbound teams use. Worth $1,000+)

The subscription costs $178/year (or $22/month). And the best part? You can try it free for 7 days. Cancel anytime.

But I think you'll love it!

👉 Start your free trial today.

This is my 3rd deep dive on outbound teams that actually know what they’re doing.

Today, let’s talk about Pigment’s outbound secret sauce.

Before we dive in, I’ve already broken down Rippling and Snowflake, 2 outbound Michelin-star machines.

I first heard about Pigment in 2022, when I met Alexis Valentin (ex-Head of BDR, now Global Head of Growth) at a B2B conference in Montpellier, France. He told me about the in-house outbound stack they were building, and I’ll be honest. I was impressed. Most companies just stack random tools and hope for the best. Pigment built their own.

There’s no public data on their outbound performance, but let’s do some quick math:

50 BDRs

5 Stage 2 opportunities per rep per month

$100K average deal size

That’s $25M in sourced qualified pipeline per month, or $300M per year.

Even at a 10-20% close rate, that’s $2.5M to $5M in revenue per month, from outbound alone.

Now you see why they’re scaling fast.

What’s on the Menu:

Part 1: How Pigment Scaled from 0 to Nearly $1B valuation

Day 1 – The big problem

Figuring out what works

Where they are now in 2025

Part 2: Pigment’s Outbound Secret Sauce

How they think about messaging

Their in-house outbound stack

Why they store all their GTM data in a data warehouse

How they structure their BDR team

How they leverage partnerships to scale outbound

Let's get cooking!

Part 1: How Pigment Scaled from 0 to a Near-Billion-Dollar Valuation

Day 1 – The Big Problem

Pigment was built to fix something that sucks: business planning is a disaster.

Back in 2019, Eléonore Crespo (ex-Google, ex-Index Ventures) and Romain Niccoli (ex-Criteo CTO) looked around and thought:

“Why the hell are companies still planning their future in clunky Excel sheets?”

The problem was obvious:

Business leaders were drowning in data but had no clue what actually mattered.

They had to make big decisions using outdated, static reports.

Planning tools were stuck in the past, and nobody liked using them.

So they built Pigment, a platform designed to make planning not suck.

Instead of just another boring finance tool, they launched something modern in a space packed with 236 outdated tools on G2.

Figuring Out What Works

Instead of building another Excel replacement, they focused on four things that actually matter:

Make it easy to use. Nobody wants to waste hours figuring out clunky software. Pigment made it visually simple, something finance teams could actually enjoy (or at least, not hate).

Ditch the old-school forecasts. Most tools make you set a plan and pray it holds up. Pigment built continuous forecasting, so businesses could adjust in real-time instead of reacting too late.

Integrate with what companies already use. Nobody wants to rip out their entire tech stack. Pigment made sure it worked with Workday, Netsuite, Salesforce, all the tools finance teams already rely on.

Go after companies that can’t afford to fail. Instead of chasing every business out there, they targeted fast-growing startups, companies that needed better planning before things fell apart.

By late 2020, investors noticed. A €24.1M Series A proved Pigment was onto something big.

Where They Are Now (2025 Update)

💰 $396.4M raised (because investors love anything that makes Excel look ancient)

📈 $145M Series D with Sandberg Bernthal Venture Partners, IVP, Meritech, Greenoaks, Felix Capital

📊 $850M valuation by May 2023

🚀 Tripled revenue, doubled customer base

The Growth Stats That Matter

Top 5% of all SaaS companies in revenue growth (according to their investors at IVP)

Massive clients: Unilever, Merck, Datadog, KAYAK, 6sense

50% of their customers are in the U.S.

90%+ of clients use Pigment across multiple teams (not just finance)

Launched Pigment AI + 150+ new features in 2023

Expanded beyond finance to serve HR, sales, and supply chain teams

What Their Sales Team Looks Like in 2025

Current ACV: $100K

Target personas: finance, sales, HR, supply chain teams

GTM team: 100+ people

BDR team: 50+ reps

Growth team: 10 people

Sales team

The Bottom Line

Pigment solved a real problem that no one else dared to fix.

Nobody wakes up excited to use Excel for forecasting.

They built for the right customers, fast-growing companies that needed planning to scale.

They kept innovating, instead of just selling the same product with a different UI.

That’s how you go from another SaaS startup to a near-billion-dollar machine.

Part 2: Pigment Outbound Secret Sauce

Now let's talk about the 5 reasons why Pigment is successful with outbound:

Their outbound messaging mindset

Their in-house outbound stack

Why they store GTM data in a data warehouse

Their BDR org

Their partner motion

1 - Their outbound messaging mindset

Alexis Valentin used to work for Facebook (Meta) and said:

“Selling for Facebook, Microsoft, or Google is easy. Slap that email domain on a message, and CMOs will actually want to talk to you.”

But what if you’re at a startup no one’s heard of?

What if you’re like Pigment 5 years ago, where no one was waiting for your email, no one expected your call, and you have zero brand advantage?

Now, you have to play a different game.

Your email needs to be the one email a CFO, CMO, or Chief Sales Officer actually responds to today.

To make that happen, you need:

Deep intel: Know their business better than they do.

Strong signals: Use data to time your outreach right.

A real point of view: Not “Hey, checking in,” but something that makes them think.

That’s Pigment’s outbound mindset. They don’t just send emails. They build armor around every BDR, like Iron Man.

Why?

Because it’s twice as hard for a Pigment BDR to land a meeting with a Fortune 500 CFO than it is for a legacy competitor that’s been around for 40 years and already has contracts in place.

But here’s the thing: Pigment knows their product is better.

They know they’ll win. It just takes time and effort.

So they don’t spam.

They don’t spray and pray.

Instead, every email, every call, every invite has real intent behind it.

And sure, they still get ignored, hung up on, and told to stop spamming. That’s the job.

But then, 6 months later, when that same CFO buys Pigment and emails back thanking the BDR for opening their eyes?

That’s the mission.

That’s why they play the long game.

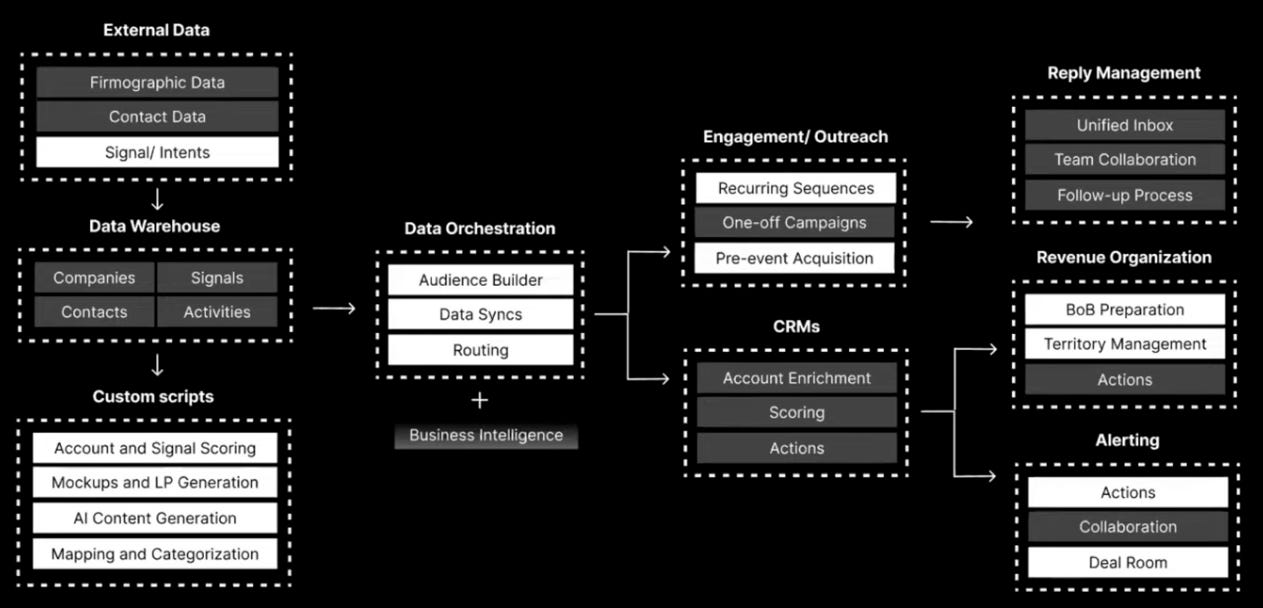

2 - Their In-house Outbound stack

Pigment built an in-house tech stack to support their outbound, and BDR efficiency, including tools for capturing market intelligence and automating processes.

They built their own revenue stack in-house—with a dedicated growth engineering team (aka GTM engineering).

Why?

Because at that time, GTM engineering tools (like Cargo, Clay, etc) didn't exist.

They Invested in Their Stack Early

Most startups wait too long to build a real tech stack. Pigment went all in from the start.

💡 The result?

50K target accounts (NA + EMEA)

Automated outreach for mid-market (500-1,000 FTEs)

BDRs focused on enterprise (1,000+ FTEs)

ICP evolution: Started with scale-ups & tech, now selling to Fortune 500 across all industries

Automation + Creativity = More Pipeline, Less CAC

Outbound isn’t just sending more emails. It’s about efficiency.

Pigment combines:

Data collection + segmentation → So reps don’t waste time on bad accounts

Automated outreach → To hit more accounts without scaling headcount

Creativity & Copywriting → To actually stand out in inboxes

This approach doesn’t just help sales, it also reduces customer acquisition costs (CAC).

BDRs Shouldn’t Waste Time on Research

Most BDRs waste hours digging through LinkedIn, writing bad emails, and personalizing by hand.

Pigment’s outbound stack solves that by delivering:

The right account

The right contact

The right moment

The right context

The right asset (visuals, data points, mockups)

So instead of researching, BDRs just prospect.

Their Outbound Stack (Built for Efficiency)

Here’s the tech stack that makes it all work:

BigQuery – Stores & processes all GTM data

N8N – Automates workflows

Sales Nav – Finds the right people

Salesforce – CRM

Captain Data – Web scraping & data enrichment

Looker + DBT – Advanced data analytics

Bannerbear – Automates personalized visuals

Gong – Call Intelligence

Phantombuster – Automates LinkedIn & web scraping

Reveal – Partnership-driven insights

G2 – Intent data & market signals

ZoomInfo - Intent data & contact data

Here's their outbound process:

Buying Signals

Now let's focus on how Pigment simplifies the process by focusing on only the best signals.

Here’s how they do it:

1️⃣ The Problem: Too Much Data

They track 50,000 accounts

They collect 10,000+ buying signals per day with sources like G2, job postings, ZoomInfo, or Reveal (partnership)

They have BDRs in 4 offices

If they just dumped all that into Salesforce, it would be chaos.

So instead, they filter out the noise and only push high-quality signals to their GTM team.

2️⃣ Prioritizing the Right Accounts

Not every intent signal is worth chasing.

They only route 10-15% of accounts with the strongest buying signals

They don’t rely on just one provider (because one tool is never enough)

They score signals before pushing them to reps

This way, BDRs only focus on the accounts most likely to buy.

3️⃣ Why They Store Everything in a Data Warehouse (Not a CRM)

Most companies shove all intent data into their CRM. Pigment doesn’t.

🚨 Why?

1️⃣ CRMs can’t handle it. 10,000 signals a day? That’s how you create technical debt and slow down your system.

2️⃣ Scoring needs context. Instead of pushing raw data, they store it in a data warehouse, score it properly, then send only the final score to the CRM.

💡 Example:

A company hires 200 people.

In those 200 job descriptions, Pigment finds 160 mentions of one competitor.

That’s a buying signal. They flag it, score it, and push only the score to Salesforce.

Instead of flooding BDRs with raw data, they give them a simple action: “This account is hot, go talk to them.”

4️⃣ How They Experiment With Buying Signals

Pigment doesn’t just follow standard intent data, they test new signals and track if they actually convert into revenue.

Two of their biggest success stories?

G2 intent data

Job postings

They capture the signals, test them, and double down on what works.

Here are 2 Real-Life Examples of Buying Signals in Action

Example 1: G2 Intent Data

Step 1: Spotting the buying Signal

One day, their team noticed a CPG account kept checking G2 reviews, not just once, but multiple times a day.

What were they looking at?

Their product category (which means they’re in the market)

Alternatives to a competitor (which means they’re shopping around)

🚨 Huge buying signal and should prioritize this account.

Step 2: Finding the Right Person

The team got to work:

Used Sales Nav to figure out who was in that location

Found a team of 5 on LinkedIn

They found the right people fast

Now they had a target. Time to make the outreach stand out.

Step 3: Cold Outreach That Actually Worked

👨🍳 The recipe:

Relevant account

Right timing (They were actively researching)

Right person (They found decision-makers on LinkedIn)

Right message (Not just another cold pitch)

They created a custom mockup of their product:

Pigment platform + Prospect’s company logo & colors

Sent it through email, LinkedIn, and phone calls. After a few touches, boom, positive reply.

The prospect agreed to meet. Before this, they had never even heard of Pigment.

Step 4: From Cold Lead to Top 20 Customer

Fast forward 8 months, this account closed and became a Top 10-20 customer.

The customer later told Alexis (the Head of BDRs) that the mockup outreach was a delight.

Example 2: Job Postings

Here’s how it works for an account owned by the growth team:

Step 1: Spot the buying signal

A company posts a job for a Finance Manager.

New hire = new priorities = new budgets

Job description = clues about pain points (Are they looking for a new tool? Replacing something outdated?)

Step 2: Find the right person to contact

Match the job posting to the right account.

Find the hiring manager

Analyze the job description: What’s their focus? Implementing a new tool? Fixing a broken process?

Step 3: Automate Smart, Personalized Outreach

Now comes the good part: turning this into a cold outreach play.

Custom messaging based on the job posting.

Sent automatically via email, LinkedIn, and text.

No generic cold emails. No random pitches.

Just a hyper-relevant message that lands at the perfect moment.

Step 4: The Prospect Replies → Route It to the Right Team

Once the prospect responds? Boom. The lead is routed to the right rep.

Outbound Messaging

Visual prospecting

Pigment uses product screenshots in their cold emails.

If you’re selling something totally new or replacing some outdated legacy tool, prospects don’t always “get it” right away.

A screenshot shows, not tells. It makes your product feel real instead of just another vague SaaS pitch.

And for Pigment, this is a game-changer. Their biggest competitors are legacy tools with clunky interfaces. A quick side-by-side visual? Instantly proves why they’re better.

Instead of manually making images for every prospect and BDRs, Pigment uses Bannerbear to automate the whole thing.

This means they can scale personalized visuals, like adding a prospect’s logo, company name, or a use-case-specific screenshot, without extra work.

Here's a cold email example:

How they Alert Their Sales Team

Pigment pushes the right signals directly where sales reps already work: Salesforce and Slack.

Here’s how it works:

2 Types of Alerts in Salesforce

Instead of dumping everything into Salesforce and hoping reps figure it out, they created two custom objects:

Insights → External buying signals that help reps personalize outreach or spot companies ready to buy. These include:

Job postings

G2 & website visits

LinkedIn followers

Previous Pigment users at new companies

Engagements → Marketing-related activity that shows a prospect is warming up. This includes:

Demo requests

Webinar sign-ups

Gated content downloads

Real-Time Alerts in Slack

Pigment also pushes all signals into a dedicated Slack channel for each opportunity.

💡 Why?

Sales, Marketing, and CS all see the same info in real time

No more waiting for reports, everyone is aligned instantly

It keeps deals moving instead of losing momentum

The Big Picture: Make It Easy, Make It Actionable

Most companies bury signals in dashboards and expect reps to “go find them.” Pigment flips that:

Right info, right place, right time

No wasted time searching for data

Instant visibility for teams who don’t live in Salesforce

3 - Why they use their data warehouse for their TAM and GTM data

Most companies treat their Total Addressable Market (TAM) like a messy spreadsheet. Pigment does the opposite.

They store everything in one powerful data warehouse, the single source of truth for their revenue teams.

Why Does This Matter?

Because when you have full control over your data, your sales team can actually focus on selling instead of:

Wasting time on bad leads

Searching for missing info

Manually updating records

How to Do the Same?

Simple: Own your market data.

Think of your data warehouse like your private vault:

Nobody else has your exact dataset: it’s your competitive edge.

You control how fresh it is: automate updates (cronhooks, APIs, or enrichment tools).

You choose the data sources: LinkedIn, G2, Job postings, ZoomInfo, etc.

You score your data: Accounts, prospects, and buying signals

You can even mix both worlds:

Use B2B data providers like ZoomInfo, Store Leads or People Data Lab.

Enrich your own dataset with extractions using Captain Data, Phantombuster, or internal tools.

The Catch? It’s not magic. It takes work.

Time – Setting this up isn’t a weekend project.

Technical knowledge – Someone needs to understand data architecture.

Cost – Data engineers don’t come cheap.

The modern data stack you’ll need:

ETL (Extract, Transform, Load): Fivetran or Airbyte to move data.

Data Warehouse: BigQuery, Snowflake, or Redshift to store everything.

Modeling: DBT to clean and structure the data.

rETL (Reverse ETL): Hightouch or Census to push data back into sales tools.

4 - The BDR Org

Pigment built a 50-person BDR team in 3 years, but instead of chasing headcount, they focused on productivity, skill development, and career progression.

Focus on weekly performance

BDRs at Pigment work enterprise deals, which means 3-6 month sales cycles. Most companies would track performance quarterly. Pigment said nope, they track BDR performance weekly instead.

Why?

Keeps urgency high.

Problems show up faster, so managers can fix them before it’s too late.

More agility = better results.

Most companies give BDRs way too much time before stepping in. By the time they realize something’s wrong, it’s already Q4 and pipeline is wrecked.

Productivity > Headcount

I spoke to Pigment’s Head of BDRs, and he was clear:

🚫 They don’t want a 200-person team.

✅ They want their 50 reps to be way more effective.

And here’s why:

BDRs are expensive. More than tech. More than tools. A 100K OTE rep needs to generate serious pipeline to justify the cost.

Instead of hiring blindly, they focus on:

Faster ramp times → New hires generate meetings sooner

Higher conversion rates → Fewer meetings wasted

Better pipeline quality → More deals actually closing

A 20% productivity boost across 50 BDRs? That’s like hiring 10 extra people, without the extra overhead, management headaches, or wasted salaries.

Some might call this controversial. But look at companies scaling fast without bloated sales teams. They don’t just throw bodies at the problem. They make the reps they have better.

BDR Career Growth

Most companies treat BDRs like disposable employees:

12-18 months in the role

Forced AE promotion (whether they’re ready or not)

High turnover, wasted experience

Pigment said screw that and built a 4-tier BDR Academy that keeps top reps for 2-4 years while actually making them better.

Here’s how their system works:

📌 Level 1 BDRs: Measured on meetings booked + conversions (50/50 split).

📌 Level 2 BDRs: Measured on accepted pipeline.

📌 Level 3-4 (ECS): Measured on pipeline + closed deals.

💡 ECS = Enterprise Corporate Sales. It’s a hybrid BDR/AE role where senior BDRs support deals instead of being pushed into an AE role too soon.

Why does this matter?

Enterprise sales isn’t mid-market. Selling to CFOs requires real business acumen, not just booking meetings. You don’t learn that in 12 months.

Deals take an army. It’s not just AE + BDR. You need Solution Consultants, Legal, Marketing. Senior BDRs keep deals moving behind the scenes.

Better career path = lower turnover. Most SaaS companies lose BDRs because they have nowhere to go except AE. Pigment gives them options: partnerships, enablement, mid-market sales, etc.

Pay Structure That Actually Makes Sense

Pigment actually ties pay to impact.

💰 Level 1 BDRs → 50/50 split between meetings booked & conversions

💰 Level 2 BDRs → Paid only on accepted pipeline

💰 Level 3-4 (ECS) → Paid on pipeline + closed deals

💡 Why this works:

Early-stage BDRs focus on booking meetings—because that’s what they can control.

As they grow, comp shifts to pipeline and revenue, so they care about quality, not just volume.

Keeps BDRs engaged longer instead of pushing them out after 18 months.

In-Office > Remote

Here’s something surprising: If Pigment could start over, they’d only hire in-office BDRs.

Why? They believe enterprise sales isn’t something you learn on Zoom. You learn it:

By overhearing sales calls.

By grabbing lunch with experienced reps.

By getting quick, informal coaching.

Their hybrid policy isn’t random—they structure office days to maximize collaboration. And leadership travels between global offices to keep teams aligned.

5 - Their Partner Motion (on top of outbound)

In January 2023, Pigment layered partnerships on top of inbound and outbound, what they call a “nearbound overlay.” This boosted win rates by 5-10% for deals with partners involved.

In just 1 year, Pigment’s partner program delivered:

16% of new logos sourced from partners

40% of closed deals had a partner attached

80% of deployment deals involved a partner

Co-sell partner attach rate jumped from 31% to 64% after using their partnership tool (Reveal)

Cross-Functional Alignment

Instead of making partnerships a separate thing, they stuck PartnerOps inside RevOps. That means RevOps, Partnerships, and Revenue teams actually talk to each other. This makes data cleaner, tracking easier, and decisions faster.

How Pigment Uses Data

They pull intent data from G2, ZoomInfo, and Reveal to spot which accounts are warming up.

Every 2 weeks, they email partners with insights, and guess what? More partners start registering opportunities.

BDRs + AEs + Marketing actually using partners

SDRs and AEs don’t ignore partnerships (which happens in most companies). Thanks to Reveal, they can easily rope in partners on Salesforce and Slack.

Marketing also uses partner data to run hyper-targeted co-marketed events.

Why you should care

If you’re leading GTM, here’s what Pigment’s case study means for you:

Relying only on outbound or inbound is risky. Partnerships can create a more stable revenue stream.

5-10% higher win rates on partner-attached deals? That’s real money.

Pigment proves that using intent + partner data = smarter selling.

The only reason this works is that they got Sales, Marketing, RevOps, and Partnerships to actually sync.

Without a partnership tool and CRM integration, their system falls apart.

Resources for going deeper:

Video/podcast:

Articles:

Business planning startup Pigment raises $145M in rare French tech mega-round

How Pigment increased win rates 5-10% with a nearbound overlay & Reveal

Growth Twins Substack

Centralizing Your Total Addressable Market to streamline sales operations

That’s it for today! Who should I unpack next?

See you in the next newsletter.

Cheers,

Elric

Want my outbound swipe file with 100+ resources: sequences, scripts, AI prompts, and frameworks (worth $1,000+)?

Upgrade your Outbound Kitchen subscription today for just $22/month and get it all.

Don’t let another week slip by without turning outbound into your top growth engine!

👉 Start your free trial today.

As soon as you're ready, here’s how I can help:

Outbound Consulting Call: Need quick help? Book a 40-min session here.

Outbound Private Chef:

Part-time, I’ll build, optimize efficiency, and execute your outbound strategy.

Coaching/Advising: get tailored advice to fix your strategy, boost efficiency, and drive results.

Interested? Reply to this email or hit me up at bonjour@elriclegloire.com

This is fantastic, the level of detail and screenshots is great!