How to Scale Outbound: A Step-by-Step Math Guide

Stop overhiring and start scaling smarter. This step-by-step guide shows how to model outbound growth and align SDR output with AE capacity.

Read time: 6 min

Welcome to a new 🔒 subscriber-only edition 🔒 of my weekly newsletter of Outbound Kitchen. Each week, I dive into reader questions about scaling outbound and making it your #1 growth engine. For more: Live Outbound Classes | Podcast

Most founders and GTM leaders think hiring more Account Executives (AEs) equals more revenue.

But that’s exactly how you burn cash fast.

I’ve seen this scenario play out too many times: A company hires a wave of AEs without the pipeline to support them. Deals dry up. Top talent leaves. Others get let go quietly.

Why does this happen?

Finance plans are usually based on wishful thinking, not real metrics. Without precise outbound math, ambitious plans fail.

Today, I’ll show you step-by-step how to fix that.

In this part 1, we’ll tackle:

Simple outbound math: SDR and AE capacity planning.

Simple hiring plan: How many reps you really need based on real pipeline data.

In Part 2, we’ll tackle advanced metrics like growth model, funnel efficiency, quality metrics and CAC.

The Foundation: 2 Equations for Outbound Success

Scaling outbound comes down to mastering two critical formulas:

1. Outbound Capacity (Owned by BDRs/Full-Cycle AEs)

Tracks how many opportunities (S1/S2) your SDRs generate each month:

Accounts → Touches → Conversations → Meetings (S1 Opportunity) → Sales Accepted (S2 Opportunity)2. Sales Capacity (Owned by AEs)

Measures how many opportunities an AE can handle and convert:

S1 Opportunity → S2 Opportunity → ARRGolden Rule: Both equations must scale together. Neglect one, and your growth stalls.

Case Study: How Rippling got it right

Early at Rippling, each AE needed 35 accepted demos (S2s) monthly. But as Rippling scaled, they reduced this target significantly, thanks to:

Higher ACV: Each deal was bigger, reducing the total needed.

Better Win Rates: Improved closing skills meant fewer demos required.

Sales Stages Defined:

Stage 1 (S1): Scheduled Demo – initial prospect meeting.

Stage 2 (S2): Sales Accepted – prospect advances in the pipeline.

Initially, Rippling’s benchmark was 35 S2s per AE. Today, that number is lower due to these improvements.

Let’s Begin:

Before we dive in, this guide focuses exclusively on:

Outbound sales (BDRs and outbound-focused AEs).

Assume AEs focus strictly on closing, while BDRs handle outbound sourcing.

These metrics are specific to outbound-only opportunities:

Win Rates (from one of my previous companies):

Inbound: 30%

Outbound: 15%

Sales Cycle (from one of my previous companies):

Inbound: 20 days

Outbound: 40 days

🚩 The Problem: Your $2.3M Gap

You aimed for $5M ARR, but only landed $2.7M ARR.

There's your clear gap: $2.3M ARR.

Current Team:

8 AEs (dedicated closers)

6 SDRs (dedicated pipeline builders)

Step-by-Step Guide: The Math Behind Scaling Outbound

Step 1. Gather Your Historical Data

To accurately model your gap, start with actual data from the last 3–6 months:

ACV (Average Contract Value)

Sales Cycle Length

Stage 2 (Sales Accepted/SAL) → Closed Won (Win Rate)

Stage 1 (Meeting/SQL) → Stage 2 (Meeting to Qualified Opportunity Conversion)

Monthly AE and SDR productivity (Stage 1 Opportunities generated per month)

Current Metrics Example:

ACV: $25k

Sales Cycle: 4 months

Stage 1 → Stage 2 conversion: 50%

Stage 2 → Closed Won: 20%

AE Capacity: 30 S1 opps/month per AE

SDR Capacity: 15 S1 opps/month per SDR

Step 2: Calculate Your Realistic Baseline

Use your data to see exactly what your current team can produce realistically:

Plug today’s metrics + rep counts into a simple sheet.

Let the math roll up to ARR.

If the baseline already hits the finance plan, stop reading and go celebrate.

Baseline Calculation Example:

SDR output: 6 SDRs × 15 S1/mo = 90 S1/mo (1,080 S1/year)

Stage 2 opps/year: 1,080 × 50% = 540 S2/year

Closed-Won deals/year: 540 × 20% = 108 deals

ARR baseline: 108 × $25k = $2.7M ARR (matches your reality!)

Step 3: Identify Your Pipeline Gap

Baseline vs. Board Plan:

ARR target – Baseline ARR = Revenue Gap

Convert the gap to:

Won deals needed

S2 opps needed

S1 demos needed

Pipeline Gap Example:

Convert your $2.3M gap to actual pipeline needs:

Additional deals needed: $2.3M ÷ $25k ACV = 92 wins

Additional Stage 2 opps: 92 ÷ 20% = 460 opps

Additional Stage 1 opps: 460 ÷ 50% = 920 opps (~77/mo)

Step 4: Check AE Capacity (Can your AEs handle the demand?)

Do you need more AEs? Or not enough pipeline?

AE Capacity Example:

Current AE monthly capacity: 8 AEs × 30 S1/mo = 240 S1/mo

Current SDR pipeline: 90 S1/mo

Your AEs have unused capacity. You need more pipeline, not more AEs.

Step 5: Size Your SDR Team (Feed the AE Capacity)

Clearly calculate how many additional SDRs you need:

SDR Team Calculation Example:

Realistic SDR productivity (year 1): 15 S1/mo × 75% ramp productivity = ~11 S1/mo per SDR

Additional SDRs required: 77 additional S1s/mo ÷ 11 S1/mo per SDR ≈ 7 new SDRs

Recommended team:

SDRs: Increase from 6 → 13 total

AEs: stay at 8

SDR to AE ratio: from 0.75 to 1.6

6. Build the Hiring Timeline

Plan hires backward from your revenue impact goals, considering ramp times:

In this scenario: Hire SDRs first, verify pipeline surplus, then scale AEs.

Now the real question: do you hire BDRs or AEs first?

If you’re an early-stage startup with no inbound leads, I’ve seen founders bring on BDRs first. Why? To help them or the GTM lead book meetings and build pipeline from scratch. Once that’s working, then they hire AEs to start closing deals.

But if you already have demand (demo requests, PLG motion, etc), some companies hire AEs first. They want to prove that someone other than the founder can close deals. Once that’s solid, then they build the outbound engine and hire BDRs to scale it.

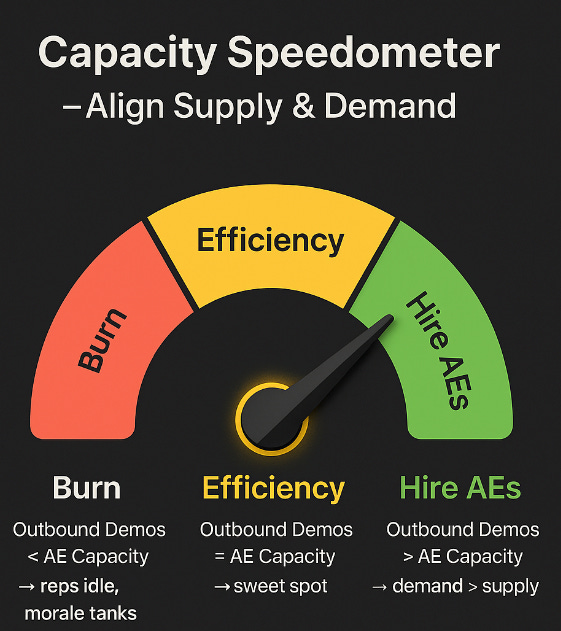

If you already have a team, run the math:

Outbound Meetings < AE Capacity → Hire BDRs first

Outbound Meetings ≈ AE Capacity → Sweet spot

Outbound Meetings > AE Capacity → Hire AEs first

Step 7: What's next?

Start with your current gap and get your historical data.

Do you need more AEs or more BDRs? Plan accordingly.

Can you improve your conversion rates?

Increase your ACV?

Accelerate your sales cycle?

Implement Weekly Dashboard Metrics ("Speedometer")

Regularly monitor these leading indicators weekly:

SDR Metrics: Activities → Stage 1 Opps

AE Metrics: Stage 1 → Stage 2 → Closed-Won

Step 8: Common Pitfalls to Avoid

Hope Math: Avoid inflating your conversion rates; trust your historical data. → Review Quarterly: update ACV, win rates, and outbound conversion rates.

Premature Hiring: Never add AEs before you consistently exceed their pipeline needs.

Ready to put this into action?

If you’re a paid member (or start your 7-day free trial), you can grab my spreadsheet model:

Plug in your numbers

Toggle scenarios

Real-time updates

⬇️ Get the spreadsheet below ⬇️

Keep reading with a 7-day free trial

Subscribe to Outbound Kitchen to keep reading this post and get 7 days of free access to the full post archives.