How Rippling Scaled Outbound to $570M+ ARR

(and how to replicate it)

Read time: 18 min

👋 Hey, Elric here! Welcome to this week’s free edition of Outbound Kitchen. Every week, I break down real questions about scaling outbound so you can turn it into your #1 growth engine. Thinking about upgrading to the paid newsletter? Here’s what you’ll get:

Instant access to 16 paid newsletters, including:

My Outbound Chef Kit: 100+ resources (email templates, cold call scripts, AI prompts, top outbound tools, and more, everything the best outbound teams use. Worth $1,000+)

The subscription costs $178/year (or $22/month). And the best part? You can try it free for 7 days. Cancel anytime.

But I think you'll love it!

👉 Start your free trial today.

Next Live Outbound Class: The Scaling Recipe: from 0 to 50 BDRs in 3 years.

Building a BDR team from scratch? Learn how Pigment did it from Alexis Valentin, Global Head of BDR: hiring, comp plans, data, and team efficiency.

🗓 Tomorrow: Nov 6, 9 AM PT / 12 PM ET / 6 PM Paris

P.S. Can’t make it? Register on Luma, and I’ll send you the recording.

Rippling’s #1 Growth Engine for Reaching $570M ARR (and how to replicate it)

Let's unpack the $570M ARR Outbound Machine.

Rippling has built an outbound sales powerhouse that brings in a staggering $48-50 million ARR each year, all fueled by their current SDR organization. For a company that sells essential tools like HR, payroll, IT security, and device management SaaS to SMBs and mid-market companies, outbound has been a key lever for explosive growth.

Today’s newsletter dives deep into Rippling’s #1 growth engine—outbound sales. We’ll not only break down the stages of their outbound strategy but also explore the evolution of their sales team and share real examples of their cold email tactics.

Here’s what's on the menu for today:

Part 1: Rippling’s Growth Story

Why Rippling has grown so rapidly and the foundation that set them apart.

Part 2: The 4 Stages of Outbound Evolution

How Rippling strategically scaled their outbound approach in stages, adapting to each new level of growth.

The 4 Stages of Rippling’s Outbound Journey

Stage 1: Founder-Led Sales (June 2016): Where it all began, with the founders directly selling to early customers.

Stage 2: The First GTM Architect (May 2017): Bringing in their first Go-To-Market hire who shaped Rippling’s early sales playbook.

Stage 3: Programmatic Outbound & Foundational Sales Team (Q3/Q4 2017)

Stage 4: Launching a Full Outbound SDR Organization (2022-Present): Building a specialized team with 200+ SDRs, complete with real-life cold email examples from Rippling.

#1 Rippling's Growth Story

The growth trajectory:

Revenue Expansion: Rippling doubled its ARR from $175 million in 2022 to $350 million in 2023, a remarkable 100% year-over-year growth.

$570 million in Q1 2025

Early Momentum: In 2018, the company was already seeing 20-25% monthly ARR growth, even reaching 29% in January 2019.

Customer Loyalty: With a 200% net dollar retention (NDR) by 2022, every dollar earned grew to nearly $2 the following year as customers expanded their usage.

Driving factors behind Rippling’s success:

Product Investment: Rippling’s commitment to deep R&D allows it to build multiple business lines simultaneously, an approach that requires significantly more engineering resources than a typical point-SaaS company. Compared to their competitors: 30% of their headcount are engineers.

Large Market Opportunity: By positioning itself as a “compound” software business—serving HR, Finance, and IT—Rippling can capture a far broader total addressable market (TAM) than single-product SaaS companies.

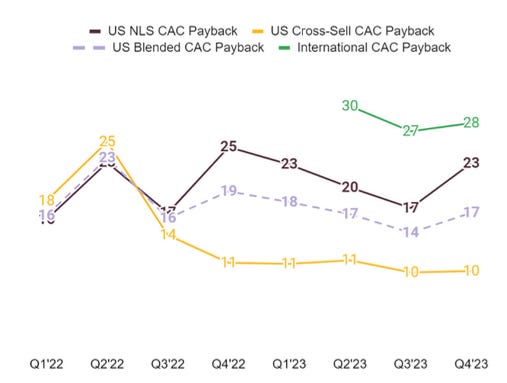

Sales Efficiency and Low CAC: With a highly efficient sales and marketing engine, Rippling keeps customer acquisition costs (CAC) low and sees faster returns. For example, while Rippling’s overall CAC payback is 17 months, cross-sell CAC payback is just 10 months—considerably better than the SaaS industry average of 28 months.

Note: CAC includes the full costs of sales, account management, & marketing (both payroll and marketing budget), as well as the net cash loss from IM and Pro Svcs teams (IM + Pro Svcs 1x bookings, less payroll costs). Expenses are counted within the quarter, except Marketing spend is from the prior quarter. The recurring gross profit added

is calculated based on New ARR from NLS and Cross-Sell, multiplied by the company’s consolidated gross profit % (excl. IM and Pro Svcs costs, which are in CAC). Excludes reseller and revenue share pricing changes. International ARR includes both core SaaS ARR closed by in-country reps and the Global ARR attached to int’l deals. Cross-sell includes AM cross-sell and Spend & Global AE cross-sell.

Building on Strong Foundations

Product-Market Fit: Rippling’s offerings resonate with the needs of companies across industries, targeting businesses with up to 2,000 employees.

Multi-Persona Selling: By addressing the needs of HR, Finance, and IT, Rippling strengthens relationships and maximizes the value delivered to its clients.

Product Diversification: Rippling has rapidly expanded from a single product to over 30, launching an average of five new products per year. This ongoing expansion is central to its strategy, aiming to be for employee data what Salesforce is for customer data.

Key Metrics and Industry Context

Revenue Milestones: Rippling scaled from $0 to $350 million in ARR by 2023, supporting a $14 billion valuation.

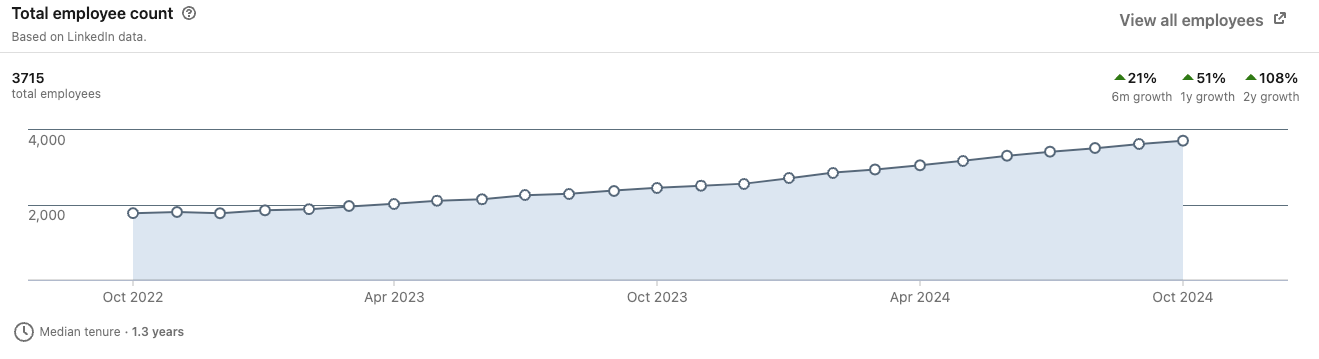

Team Growth: The company has scaled its GTM team from 0 to 1,500 members by 2024, reflecting its rapid growth.

Efficiency Benchmark: Rippling’s CAC payback period of 17 months outperforms the average SaaS company’s 28 months, positioning Rippling as a leader in sales efficiency and profitability.

Rippling operates in an incredibly competitive space (seriously):

G2 Map Snapshot: There are 677 listings in the Core HR category alone. To put that in perspective, Cognism’s competitive landscape has around 172 competitors—Rippling is playing on a much more crowded field.

Positioning Strategy: Rippling positions itself as a premium product in a market flooded with options. Despite this, they’re winning against their direct competitors with impressive success rates, ranging between 31% and 70%.

Takeaways:

Outbound Excellence: Rippling’s optimized outbound approach is central to its success. The company’s ability to continuously engage new customers has been a powerful engine for growth, particularly as it expanded into multiple product lines.

They focused their efforts mainly on programmatic outbound, and only launched their outbound SDR team in 2022 at $100-175m ARR.

Compound Model Advantage: Adding new products and expanding market reach enables exponential growth, especially in compound software models.

Customer Expansion: High NDR rates showcase the value of upselling and cross-selling to existing customers.

Sales Efficiency: Lower-than-average CAC payback periods indicate a highly efficient sales machine, a competitive advantage in long-term profitability.

Rippling’s strategy combines a robust outbound approach with product innovation and market expansion. Its compound business model, strong R&D, and efficient sales are key ingredients in its high-growth recipe, making it one of the standout success stories in SaaS. In a crowded, commoditized market, Rippling’s strategy is paying off.

2. The 4 Stages of Outbound Evolution

Now let's talk about their #1 growth engine and how it evolves.

Here are the 4 stages:

Stage 1: Founder-Led Sales (June 2016)

Stage 2: First GTM Hire: The Architect of Rippling’s GTM Strategy (May 2017)

Stage 3: Programmatic Outbound and Foundational Sales Team (Q3/Q4 2017)

Stage 4: Building an Outbound SDR Organization (2022-Present) + real cold email examples

Stage 1: Founder-Led Sales (June 2016)

The CEO Parker Conrad focused mainly on building the product.

It took Rippling 18 months to bring home their first dollar of revenue. They spent a hefty $10 million to build the minimum viable product (MPV).

Stage 2: First GTM Hire: Building Rippling’s GTM from Scratch (May 2017)

When Matt Plank joined Rippling, he wasn’t there to “lead” a team; he was there to create one from the ground up. As employee #5 and now CRO, Matt rolled up his sleeves, diving into cold calls, emails, and closing deals to lay the foundation for Rippling’s growth.

Building Blocks: The Early Strategy

Laser-Focused ICP: Matt focused in on small, high-growth YC companies with under 100 employees. Why? Because they were using the power of getting introductions from investors to their portfolio companies.

No Fancy Tools, Just Results: Matt kept it simple with just Salesforce, basic outreach sequences, and a lead database, enough to get results without overcomplicating things.

Competitors: Rippling entered a space crowded with big players like Gusto and Zenefits.

First Messaging attempts:

Initially, they went with:

“We’re an all-in-one HR solution.”But it didn’t click. So, they shifted, acknowledging competitors directly and focusing on what set Rippling apart:

“I’m sure you’re already automating HR and payroll. But what about the rest? Who’s setting up computers and managing accounts for all the tools your new hire needs?”Solving the Onboarding Nightmare

The Real Pain: A decade ago, onboarding was simple—just set up email and a conference line. Now, companies juggle 20-50 tools per hire, especially for engineers, often done manually.

Rippling’s Fix: Rippling automated the setup and account creation, saving companies hours and eliminating headaches.

Key takeaways

Get Your Hands Dirty: Great GTM leaders don’t just strategize from afar. They’re in the trenches, building the playbook firsthand.

Stop Playing it Safe: In crowded markets, generic pitches won’t cut it. Rippling succeeded by addressing real pain points and acknowledging competitors head-on.

Solve Real Problems: By focusing on automating manual tasks, Rippling became indispensable to customers—doing what competitors couldn’t.

Stage 3: Programmatic Outbound and Foundational Sales Team (Q3/Q4 2017)

At this stage, Matt has found some success and now needs to build a strong sales team that can scale. He starts by SDRs and AEs from his network and focuses on programmatic outbound as the primary strategy to drive demand.

1. Programmatic Outbound as the Main Channel

Programmatic outbound is a sales approach that relies on automation and data to reach a large pool of potential customers. For a growing company like Rippling, it’s a cost-effective strategy because it scales without needing a full team of SDRs for every outreach. Instead, it’s about setting up smart systems to connect with a high volume of prospects quickly and efficiently.

Why Use Programmatic Outbound?

Cost-Efficiency: Unlike hiring a large team, programmatic outbound is affordable and scalable. All you need is a well-targeted database and the right software to handle the heavy lifting.

Massive Reach: With a well-built contact list, you can reach hundreds of thousands of prospects—your Total Addressable Market (TAM)—through automated, targeted outreach.

Predictability: This approach is reliable because it runs on a clear formula: Send X emails * Conversion rate = Generate Y leads. You can set benchmarks for success based on your response rates and adjust over time.

How It Works

Imagine programmatic outbound as a simple numbers game:

For every 3,000 emails sent, you might expect 15-30 demos (based on a 0.5%-1% conversion rate).

To measure success, focus on two key metrics: emails sent and conversion rate (responses that turn into booked meetings).

The Role of Mech SDRs

To manage responses, they hired specialized SDRs (called “Mech SDRs”) who handled replies, engaged with interested leads, and booked meetings. Each SDR had a monthly target of 50-60 demos, making this model efficient for customer acquisition.

Scaling Programmatic Outbound

Scaling this model is straightforward: simply add more quality leads to the database and send more emails. As long as you have a large enough leads to target, you can keep this cycle going and increase the flow of new leads. The constraint is your TAM.

2. Growth Model: The Revenue Math

Balancing Demand and Sales Capacity

In sales, success isn’t just about hiring more reps. Adding more team members is only effective if there’s enough demand (demos) to keep them productive. To avoid underutilizing reps, Matt needs to ensure a steady flow of demos before expanding the sales team.

Example Calculation: How Much Demand Does Each AE Need?

In Rippling’s early days, each AE needed 35 accepted demos (S2s) per month to hit their targets. As the business grew, they required fewer demos to meet the same goals because of two key factors:

Higher Deal Values (ACV): Each deal was worth more, so fewer deals were needed to reach revenue targets.

Improved Win Rates: The team got better at closing deals, so each demo was more likely to turn into revenue.

Understanding the Sales Stages (S1 and S2)

Stage 1 (S1): Scheduled Demo — the first meeting with a prospect.

Stage 2 (S2): Sales Accepted — when a prospect moves to the next stage of the sales process.

Rippling calculated how many S2s (accepted demos) each AE needed every month. Early on, 35 S2s per AE was the target. Today, that number is lower due to increased deal size and win rates.

Aligning Sales Capacity with Demand Generation Capacity

Think of demand generation and sales capacity like gears in a machine; if one gear moves faster than the other, the machine won’t work smoothly.

Here’s how it breaks down:

Sales Capacity: How many deals your team can handle.

Demand Generation Capacity: The volume of S2 that can be created through marketing and outbound efforts.

If sales reps have the capacity to handle 10 new deals in 40 hours but only 7 qualified demos are generated, the extra capacity goes to waste. The two must be aligned to maximize productivity and efficiency.

The Reality: Hiring more reps doesn’t automatically mean more demos or revenue. The real question to answer is:

How will you generate enough opportunities for every rep?

3. Hiring Strategy and Culture Fit

Who to Hire First:

Matt begins by hiring SDRs and AEs from his own network, focusing on candidates ready for the demands of a startup environment.

Creating a Growth Path:

Initially, most promotions come from within, helping build a core team that understands the culture. Once the team grows to around 30-50 reps, he starts looking for external hires to bring in fresh perspectives.

4. Structuring the AE Team for Scale

Types of AEs: Matt introduced three specialized AE roles to support the company’s growth:

Core New Logo AEs – handle all new business.

Account Managers (AMs) – focus on existing customers, especially cross-selling.

Product AEs – a unique team specializing in new product launches. They co-sell with Core AEs or AMs when expertise on a new product is needed.

Why Product AEs:

As Rippling introduced new products that targeted different audiences, even top AEs couldn’t keep up with every launch. Product AEs solve this by acting as specialists, handling complex or highly specific offerings.

5. Challenges in Scaling Programmatic Outbound

Managing Deliverability

As Rippling scaled email outreach, email deliverability became an issue. High volumes of outbound emails can lead to lower inbox placements or spam flags.

Database Limits

Eventually, Rippling ran into the constraint of account availability; they could only send emails to so many potential customers (their TAM). When they reached the ceiling, they had to rethink their strategy to meet growth targets.

Next stage

Matt faced a classic challenge for a VP: some reps couldn’t keep up with the pace of growth. The company was outgrowing them. When this happened, Matt’s solution was to adjust roles to better fit each rep’s skills or, when necessary, bring in fresh talent from outside. This approach was key to maintaining momentum, but it required clear communication to manage expectations and reduce frustration.

For reps, it wasn’t always easy—growth at Rippling was a fast-moving train, and staying on board meant adapting to rapid changes. Those who felt left behind often chose to leave, as staying no longer felt right for their career paths.

Rippling’s journey with programmatic outbound followed a similar path. Programmatic outbound was a powerful engine for early-stage growth—until they ran into a wall. About two years ago, they hit the limit of their target database, with too few accounts remaining to meet their ambitious growth goals. This constraint forced Rippling to adapt its outbound strategy to ensure they could keep scaling effectively.

Key Takeaways from Stage 3

Demand Drives Sales Capacity: Only hire more AEs when you’re sure you can generate enough demos to have enough pipeline to close. Building a sustainable demand pipeline is crucial to avoid wasted capacity.

Programmatic Outbound Works Well Early On: Programmatic outbound is an efficient and cost-effective way to build initial momentum. It’s great for reaching a large audience at a low cost, but its effectiveness can plateau as you exhaust your potential leads.

Role Specialization Supports Growth: They Introduced product AE roles to handle complexity better and support ongoing product expansion. This also prevents burnout among Core AEs who may struggle to sell diverse products effectively.

Communicate Growth Expectations Clearly: Fast growth can cause friction. As some reps struggle to keep up, it’s essential to manage expectations and communicate career progression opportunities. Reps may grow out of their roles, and moving them into new positions aligned with their strengths can help them feel valued and supported.

Stage 4: Building an Outbound SDR Organization (2022-Present)

Here’s what’s fascinating about Rippling’s outbound team:

For both sales and marketing, demos booked per month is the key metric that drives everything.

And here’s a bold statement from Rippling’s GTM leadership: Outbound SDRs are simply more productive than AEs when it comes to outbound.

The SDR org reports directly to the CRO. It’s rare to see SDRs separated from both marketing and sales. But Rippling does it differently—they’ve positioned the SDR team as the bridge between both departments.

Their main channel is calls. They book 50% of their outbound demos via cold calling.

Most companies stick to cold accounts, but Rippling took outbound further:

Customer Expansion: Using existing customer data to drive cross-sell and upsell.

Market Expansion: Leveraging outbound to break into new countries.

Channels/Partnerships: Building new pipelines with strategic partners.

Why did Rippling wait until 2022 to build an Outbound SDR team?

Rippling initially relied on programmatic outbound for early growth. They automated outreach to thousands of accounts, but eventually hit a wall.

There were only so many relevant accounts, and they needed to get more demos from each one. To continue scaling, they needed a new approach.

So, in 2022, they invested in an Outbound SDR team to improve results through targeted, and account-based outreach.

On top of that, they still run programmatic Outbound and testing tools like clay to improve their results.

Why Launch an Outbound SDR Team?

Maxing Out Programmatic Outbound: With limited accounts to email, Rippling needed a way to increase conversions on existing accounts.

Investment Decision: Building an SDR team is expensive: it requires investment in people, tools, and office space. To make this cost worthwhile, they had to ensure the unit economics made sense for the business.

Human Advantage: Rippling found that SDRs doing outbound prospecting outperformed AEs doing their own outreach. To lead the initiative, they hired Ashley Kelly to scale this outbound team from scratch.

Fast forward 18 months, and Rippling has around 200 outbound SDRs achieving a conversion rate of 3-7%, significantly higher than the 1% from purely programmatic outbound. This meant they could get 30-70 demos from the same accounts that once yielded only 10.

Their Outbound SDRs currently book 1,300 demos per month, 50% of those demos are booked on the phone, with generating an average pipeline of $41.6 million per month. Even at a 10% win rate, that’s $4.16 million in new ARR monthly, or about $48 million annually from outbound alone.

High Touch, High ACV: Their SDRs focus on mid-market and enterprise accounts with an ACV between $20,000 and $100,000, making the high-touch approach worthwhile. This strategy allows for more control over Customer Acquisition Cost (CAC) and improves payback.

Why Rippling chose an outbound SDR team over AI?

Here’s why Matt believes humans will always outperform AI in outbound sales:

#1: Account Fit: Finding the Right Companies

AI and Machile Learning are great for filtering and identifying companies to provide the best accounts to the SDR team, using a mix of rules (like company size and industry) and machine learning models.

For their account scoring they use:

Rules based: Criteria Company size, industry

A Machine Learning model - owned by the data science team

Manufacturing: red industry for them

How long they been around for

Social media presence: followers

But even with AI’s help, it’s still a person—an SDR—who needs to reach out.

How AI Helps: AI narrows down potential accounts based on specific criteria, such as the company’s size, industry, social media following, and growth patterns.

Human Role: SDRs then prioritize and engage these accounts, adding a personal touch that AI simply can’t provide.

#2: Finding the Right Contacts

Who you reach out to is just as important as which company you target. AI can store contacts in a database, but contacts go out of date fast—people change jobs, titles, or leave companies altogether.

Why It Matters: The more contacts you have within each target account, the bigger your potential reach. Instead of reaching out to one person, SDRs can connect with 6-7 key contacts within an account, maximizing chances of success.

Human Role: SDRs verify and update contacts in real-time, ensuring they reach the right person. AI alone can’t keep this data current.

#3: Intent and Event Signals (Marketing led)

Timing is everything. Marketing signals, such as a prospect visiting a demo site or downloading a piece of content, indicate interest. But real-life events—like a company raising funds or a prospect changing jobs—often signal when they’re most open to new solutions.

Tech & AI’s Role: AI helps track these signals and push them into the CRM, flagging accounts with recent activity or significant events.

Human Role: SDRs interpret these signals and use them to reach out at just the right moment, maximizing the chance of engagement.

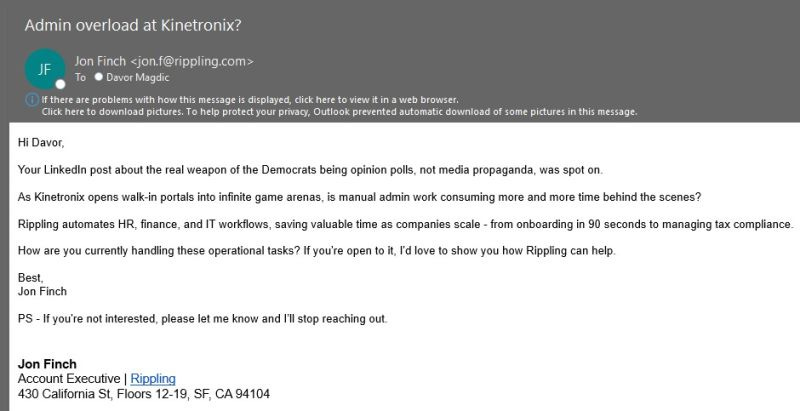

#4: Personalization: Crafting the Right Message

Personalization is more critical now than ever, and while AI can help generate templates, only humans can judge what’s appropriate. SDRs know how to adapt the message to match the prospect’s tone and context.

The AI Limit: AI-generated templates can go wrong—imagine an AI email saying, “I saw your father passed away. Sorry to hear that. You should check out Rippling.” That’s insensitive and wouldn’t build any trust.

Human Role: SDRs review AI-generated messages, adapting them with empathy and tact, ensuring the outreach feels genuine. Rippling is testing Clay for this.

#5: Saturation: Staying Top-of-Mind

Effective outreach means appearing on a prospect’s radar from multiple angles. The goal is for prospects to remember your brand, which requires a mix of emails, calls, LinkedIn messages, and sometimes even in-person meetings.

The Limit of AI: AI can send emails and track digital interactions but can’t cover every touchpoint. Relying only on emails is easy for a prospect to ignore.

Human Role: SDRs reach out across channels, making each contact memorable. When prospects recognize the brand from various channels, they’re more likely to respond.

Scaling the Outbound SDR Team

The Ideal SDR Profile

Rippling looks for certain qualities when hiring SDRs that set candidates up for success:

Coachability: Can they take feedback and improve?

Motivation: Do they have the drive to meet ambitious goals?

Organization: Are they able to handle multiple tasks efficiently?

Adaptability: Can they navigate a fast-changing environment?

Rippling often hires people with backgrounds in recruiting or non-tech sales roles. These fields develop skills that transfer well into outbound sales, like understanding people, making persuasive pitches, and staying persistent.

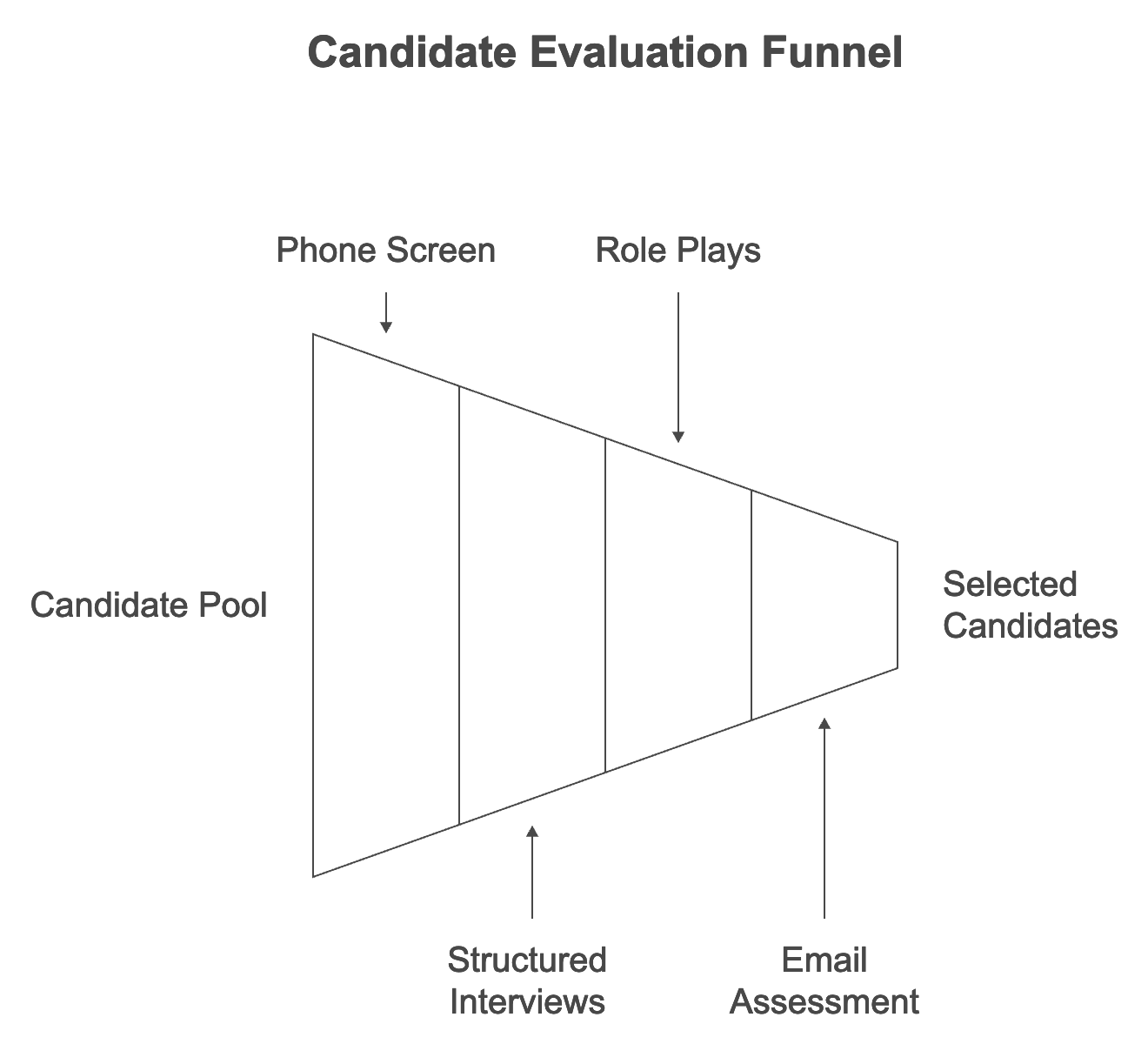

Hiring Process

Phone Screen: Initial call to assess interest and fit.

Interviews: Structured interviews to evaluate core skills and cultural alignment.

Role Plays: Candidates go through two role-playing exercises to see how they handle real sales scenarios, especially looking for coachability (how well they take feedback).

Email Assessment: Candidates are tested on their ability to write effective cold emails, including skills like mirroring language to match the prospect’s tone.

Compensation Plan (Comp Plan)

The SDR comp plan balances base pay and commissions, with adjustments based on location:

Total On-Target Earnings (OTE): Median in the U.S. is $90,000.

70% Base Pay

30% Commission

Quota: SDRs are paid based on successful demos (Stage 2) held with a qualified decision-maker. Quotas vary depending on region, product, and customer segment, and SDRs are motivated to move fast, so compensation is tied to these quick wins rather than long-term revenue.

Team Structure and Leadership

Rippling’s revenue organization is extensive, with about 1,300 people and a dedicated Sales Development team of 350. They structure the team for optimal support and management at every level:

1 Global VP: Ashley Kelly, overseeing all SDR activities.

4 Third-Line Managers: Manage large sections of the SDR team with a 4:1 ratio of managers to direct reports.

10 Second-Line Managers: Each oversees 2-3 teams, ensuring focused support.

46 Frontline Managers: Directly manage small teams of SDRs, maintaining a 4-5:1 ratio for hands-on coaching.

290 SDRs in Total:

200 Outbound SDRs

90 Inbound and Mech (hybrid) SDRs who handle leads, respond to cold email inquiries, and support programmatic campaigns.

SDR Specializations

The SDR team is specialized into roles that support various stages and types of outreach:

New Logo SDRs: Focus on acquiring brand-new clients.

Customer-Focused SDRs: Work with existing clients to upsell and cross-sell.

Channel/Partnership SDRs: Target partner networks and channels to expand Rippling’s reach.

This structure, from specialized roles to layered management, ensures that Rippling’s SDR team is equipped to handle the demands of a growing customer base while keeping a laser focus on high-quality prospecting and lead generation.

Technology Stack

Sales Tools: Outreach, Chili Piper, Scratchpad, Salesforce, Quotapath, ZoomInfo, LinkedIn Sales Navigator, Gong, Demandbase

Data and Analytics: Snowflake, Fivetran, Mozart, Mode, Tableau; five data engineers maintain and score their total addressable market (TAM).

Here are some examples of Cold and programmatic Emails (2024):

For context, I found those emails on LinkedIn, and X.

Ashley Kelly sheds some light on their approach to outbound emails:

“This one was just good old-fashioned outbound, but with the right triggers and messaging tailored to the relevant persona.”

Rippling’s approach isn’t one-size-fits-all—they tweak their messaging based on intent, segment, industry, and persona. While this sequence isn’t groundbreaking, it’s packed with well-timed insights that resonate deeply with the right prospect at just the right moment.

And here’s an interesting detail: their CFO, Adam, stays closely involved with the SDR team, regularly discussing real-world examples of why Rippling’s product resonates with buyers like him. He even met with the SDRs to share firsthand insights, showing them exactly what makes the messaging effective from a buyer’s perspective.

September 2024

August 2024

June 2024

Key Takeaways from Stage 4

Human Touch Still Matters: Despite advancements in AI, Rippling values human insight for outbound, particularly in areas like account selection, contact verification, and personalization.

Outbound SDRs Drive Results: Investing in a dedicated outbound SDR team paid off, with conversion rates and demo bookings higher than with programmatic outbound alone.

Strategic Investment in People and Tools: Rippling’s success required a significant commitment to hiring, training, and managing a large SDR team, supported by a robust tech stack for data and outreach.

Tailored Outreach Strategy: By specializing roles within the SDR team and optimizing multi-channel engagement, Rippling maximizes their reach and sustains growth across mid-market and enterprise segments.

Key Takeaways from Rippling outbound strategy

1. Rippling’s Outbound Strategy is a Masterclass in Phased Growth

Key Insight: Rippling didn’t just build an outbound engine overnight. They scaled it in well-defined stages, each tailored to the company’s growth and evolving goals. Their approach is a blueprint for creating a scalable outbound machine that doesn’t collapse under its own weight.

Founder-Led Sales: Before scaling, the founders sold the product themselves, gaining firsthand insights.

GTM Architect Role: The first GTM hire did more than manage—they built the entire outbound foundation.

Programmatic Outbound: Systematic, automated outreach allowed Rippling to build momentum without overloading their SDRs.

Dedicated SDR Team (2022): Only after exhausting programmatic outreach did Rippling add 200+ SDRs. Each phase was planned, with every team expansion meeting specific growth needs.

2. Demand-Driven Sales Capacity: Don’t Scale Until You’re Ready

Key Insight: Rippling didn’t rush to hire SDRs and AEs—they scaled when they were sure they could generate enough leads to fill everyone’s pipeline.

Balance is Everything: Each new AE was added only when Rippling’s pipeline could sustain them. Without demand, reps risk being underutilized.

The Math Behind It: Each AE’s monthly demos directly linked to revenue targets, carefully aligning sales and demand generation.

3. Outbound SDRs Over AI: Why Rippling Invested in People for Personalization

Key Insight: Rippling didn’t replace SDRs with AI—they leveraged AI for insights and left relationship-building to human SDRs. The human touch added context, flexibility, and precision to outreach.

Why AI Helps but People Matter: AI helped filter accounts, but SDRs were the ones connecting and driving conversations.

Real Conversations Win: SDRs honed in on key decision-makers, tailored messaging for each persona, and built rapport—crucial in the mid-market space.

4. High-Touch Personalization Wins in Complex Sales

Key Insight: Rippling’s SDRs personalized every touchpoint for high-value prospects, using insights and real-world signals. This wasn’t your standard “spray-and-pray.”

Data-Driven Personalization: Rippling used intent and event-based signals (like recent funding rounds) to reach out at the perfect moment.

Multi-Channel Engagement: SDRs combined emails, LinkedIn messages, and calls, ensuring prospects encountered Rippling across channels.

5. Outbound Sales as a Revenue Engine: $48M ARR from SDRs Alone

Key Insight: Outbound sales alone drive a huge part of Rippling’s ARR. By focusing SDRs on mid-market and enterprise accounts, Rippling turned outbound into a consistent revenue stream.

1,300 Demos per Month: Half of these demos come from cold calls, with an average pipeline of $41.6M/month.

Strategic Team Structuring: Their SDRs are split by focus—new logos, customer expansion, and channel partners—ensuring no opportunity is missed.

6. Specialized AE Roles for Focused Growth

Key Insight: Rippling didn’t rely on one type of AE; they diversified roles to fit specific growth goals.

Product AEs: Specialists for new product lines that require deep knowledge.

Account Managers: Focused on customer success and cross-selling to existing clients.

7. Low CAC Payback and High Efficiency: Benchmark-Busting Performance

Key Insight: Rippling keeps CAC low (17-month payback) by structuring sales processes to maximize return.

Cross-Sell Efficiency: By tailoring cross-sell strategies, Rippling’s CAC payback for those efforts dropped to 10 months, better than the industry average.

That's it for today. What company should I do next?

References:

Rippling Revenue, Valuation, and growth rate

Rippling: The $11.3B company raising $ without pitch decks

Rippling builds self-serve data culture through access and accuracy

Science of Scaling: Funnel and Revenue Math with Rippling's Matt Plank

Rippling’s 2024 Investor Memo Series F

The Outbound Equation: How to make outbound work in 2024

LinkedIn: The toughest part of building your first SDR team is how to manage it

LinkedIn: How long will this type of cold-email go on?

Moving into new markets: 5 lessons we learned taking Rippling global

Can Rippling Beat Gusto? $36m Revenue “Not Far Away” Says CTO

Want my outbound swipe file with 100+ resources: sequences, scripts, AI prompts, and frameworks (worth $1,000+)?

Upgrade your Outbound Kitchen subscription today for just $22/month and get it all.

Don’t let another week slip by without turning outbound into your top growth engine!

👉 Start your free trial today.

As soon as you're ready, here’s how I can help:

Outbound Consulting Call: Need quick help? Book a 40-min session here.

Outbound Private Chef:

Part-time, I’ll build, optimize efficiency, and execute your outbound strategy.

Coaching/Advising: get tailored advice to fix your strategy, boost efficiency, and drive results.

Interested? Reply to this email or hit me up at bonjour@elriclegloire.com