How Owner.com Scaled Outbound to $40M+ ARR

Deep Dive, and how you can apply their outbound recipe.

Read time: 25 min

👋 Hey, Elric here! Welcome to this week’s free edition of Outbound Kitchen. Every week, I break down real questions about scaling outbound so you can turn it into your #1 growth engine. Thinking about upgrading to the paid newsletter? Here’s what you’ll get:

Instant access to 16 paid newsletters, including:

My Outbound Chef Kit: 100+ resources (email templates, cold call scripts, AI prompts, top outbound tools, and more, everything the best outbound teams use. Worth $1,000+)

The subscription costs $178/year (or $22/month). And the best part? You can try it free for 7 days. Cancel anytime.

But I think you'll love it!

👉 Start your free trial today.

My 4th deep dive on ⭐️⭐️⭐️ outbound teams.

Today, we’re breaking down Owner.com’s outbound playbook.

Unlike my previous deep dives on giants like Snowflake (2K reps, 300+ SDRs), Rippling (300+ SDRs), and Pigment (50 BDRs).

This one is different. Owner.com is an “early-stage” company (20+ BDRs)running outbound at an elite level.

They don’t just “do” outbound.

They treat it like a Michelin-starred dish, precision, discipline, the right ingredients, tools, and team.

The Quality of the Ingredients

Hiring RevOps & Enablement early → Set reps up for success from day one.

Investing heavily in outbound data

Niching down → Focused ICP.

Leveraging account scoring with ML models

Cutting out anything Non-Revenue Generating activities

And more…

But even the best ingredients mean nothing without precision tools:

A data warehouse → Predictive account Scoring, and routing

AI sims → Faster ramp time

A fully optimized outbound tech stack → To cut out most of Non-RGA

And more…

And just like a Michelin-starred kitchen, everything runs with precision and discipline, with their brigade team!

Most teams run outbound like a messy kitchen.

Owner.com? They run it like a world-class restaurant.

What You’ll Learn in This Deep Dive:

The key factors behind Owner.com's outbound success

How to structure a high-performing outbound sales team

Strategies for effective outbound messaging and targeting

The role of technology in scaling outbound efforts

🚨 Heads up 🚨

Today’s breakdown is all about SMB and the restaurant industry, but don’t tune out, you can apply these lessons to Mid-Market and Enterprise too, (and other industries).What’s on the Menu Today:

Brief overview of Owner.com

Owner.com's Journey to Outbound Excellence

Key milestones in developing their outbound strategy

Initial challenges

Their Owner.com Outbound Recipe: results, teams, processes, tech stack, etc.

Let's get cooking:

Brief overview of Owner.com

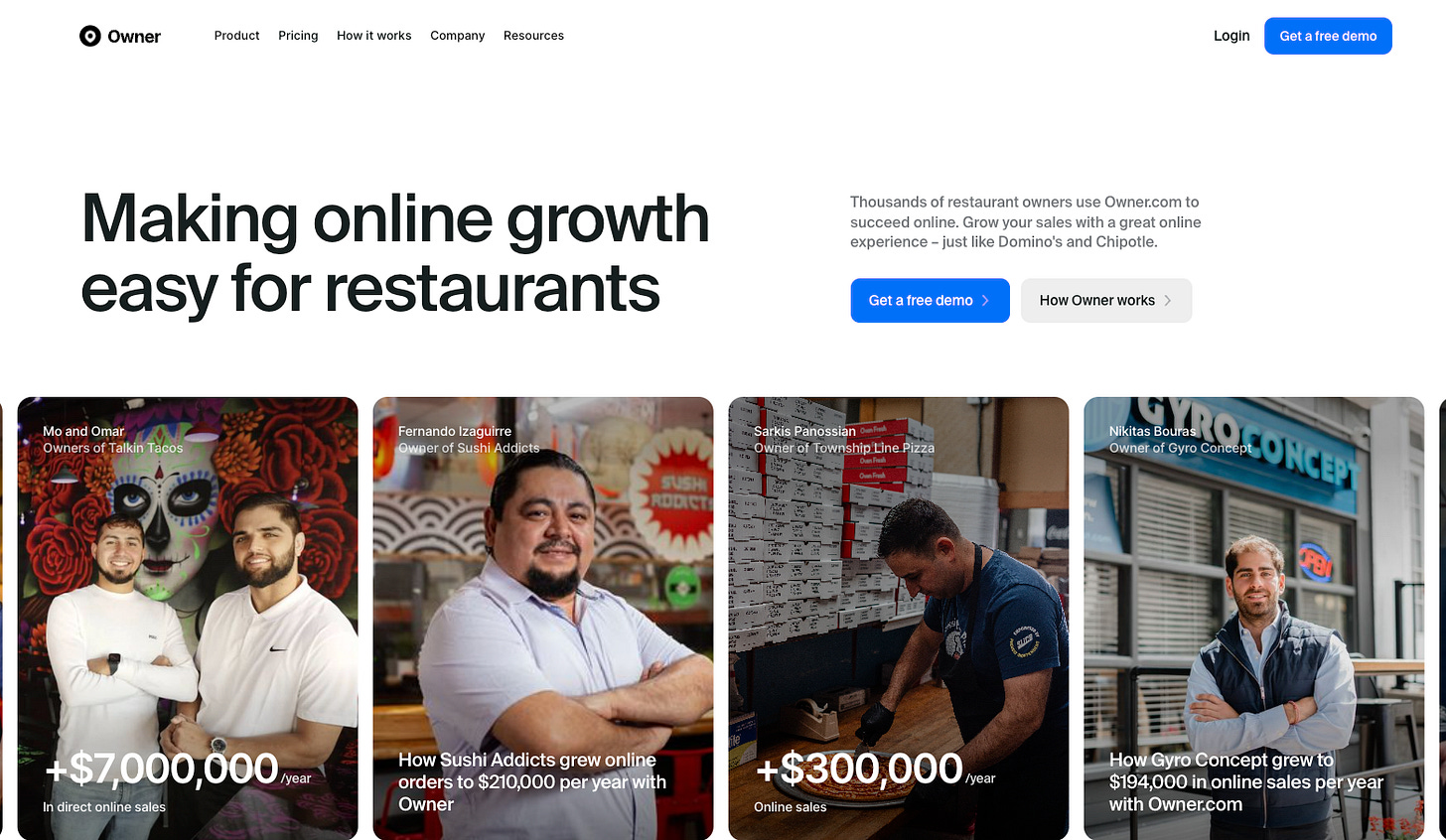

Owner.com is basically Shopify for restaurants.

Key Facts:

Founded: 2018

Founders: Dean Bloembergen, Adam Guild (CEO)

Funding: Raised $179M

2025 Revenue: around $40M ARR (Updated June 2025)

Lead Investors: Activant Capital, Alt Capital, Redpoint Ventures, SaaStr Fund

Series C: Raised $120M at a $1B valuation

The Market & Sales Motion:

Industry: Restaurants (Vertical SaaS)

Target Customers: SMB restaurant owners

ACV:

$6K (2024)

$8-9k (June 2025)

Sales Cycle: 1-7 days (crazy fast)

Why their outbound team is considered ⭐️⭐️⭐️?

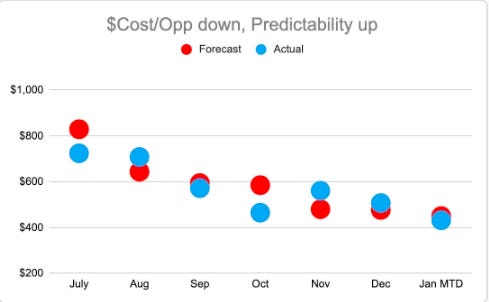

Most people on LinkedIn love to say, “If your ACV is under $30K, SDRs don’t make sense.” They claim outbound is too expensive, CAC is too high, and it won’t be profitable.

Owner.com proves them all wrong.

Almost 3x YoY growth → Scaling at 8-figures ARR.

On track for $100M ARR by 2026.

From $2M to nearly $30M ARR since Kyle Norton (current CRO) took over.

$72K ARR per BDR every month with a CAC ratio of just 0.13.

$6K ACV, 1-7 day sales cycle.

Most teams rely on brute force, more calls, more emails, more reps.

Owner outbound motion runs on surgical precision.

Deeply system-driven. Every step is optimized for speed and efficiency.

Data-centric. Reps have real insights on who to target and when.

Tech-enabled. Kyle was a BDR leader first. He knew the pain of bad outbound. He built a system that helps good reps become great.

Owner.com's Journey to Outbound Excellence

Before we talk about the exact reasons why they are ⭐️ ⭐️ ⭐️ at outbound.

Let's talk about their market, product, and GTM strategy:

Company background

Market Opportunity

The restaurant industry is huge, with almost $1 trillion in sales in 2023 (in the US).

But here’s the real opportunity: most independent restaurants are way behind on digital.

Big chains like McDonald’s and Domino’s?

They’ve already figured it out. They have entire teams dedicated to digital marketing, loyalty programs, and online ordering.

Independent restaurants?

Most of them are still struggling. They rely on outdated websites, pay insane fees to third-party apps, and don’t have the tools to compete.

Owner.com is going after the ones who need it most.

500,000 potential restaurants in the U.S. fit their target profile.

Right now, they’re focused on the top 30,000: the ones most likely to convert.

Fast-casual, fine dining, quick service, every type of independent restaurant needs better digital tools.

Why This Market Is Growing Fast

Restaurants have no choice but to go digital. If they don’t, they lose customers to chains and third-party platforms.

More orders are happening online. People expect to order from a restaurant as easily as they order from Amazon.

Most restaurants still don’t have the right tools. That’s the gap Owner.com is filling.

The opportunity is massive. And the demand is only going up.

Product

Problem solved

Small restaurants aren’t failing because they’re bad at what they do. They’re failing because the game is rigged against them.

Big tech and corporate chains have stacked the deck:

Uber Eats, DoorDash, Grubhub → Charge insane fees, sometimes 30%+ per order. Restaurants barely make money.

They don’t share customer data. The platform owns the relationship, not the restaurant.

Chains like Domino’s are spending billions on marketing and tech, making it almost impossible for small restaurants to compete.

Owner.com Gives Local Restaurants the Same Firepower

They built a full-stack digital platform to help small restaurants take back control:

Online ordering (no more paying 30% to third-party apps).

Website builder with built-in SEO to drive local traffic.

Loyalty programs, email & text marketing to keep customers coming back.

AI-powered email marketing that automates outreach so restaurants can focus on running their business.

A mobile app for each restaurant, just like the big chains.

Why It’s Different

Flat pricing. No per-order commissions. No hidden fees. Just a predictable monthly cost.

Built for restaurant owners, not tech people. No coding, no marketing degree needed, just tools that work.

Constant updates. They keep adding new features, improving the platform, and making sure restaurants stay ahead.

Small restaurants can’t afford to keep playing by big tech’s rules. Owner.com helps them break free, own their customers, and compete with the big guys: without losing their profits.

GTM strategy

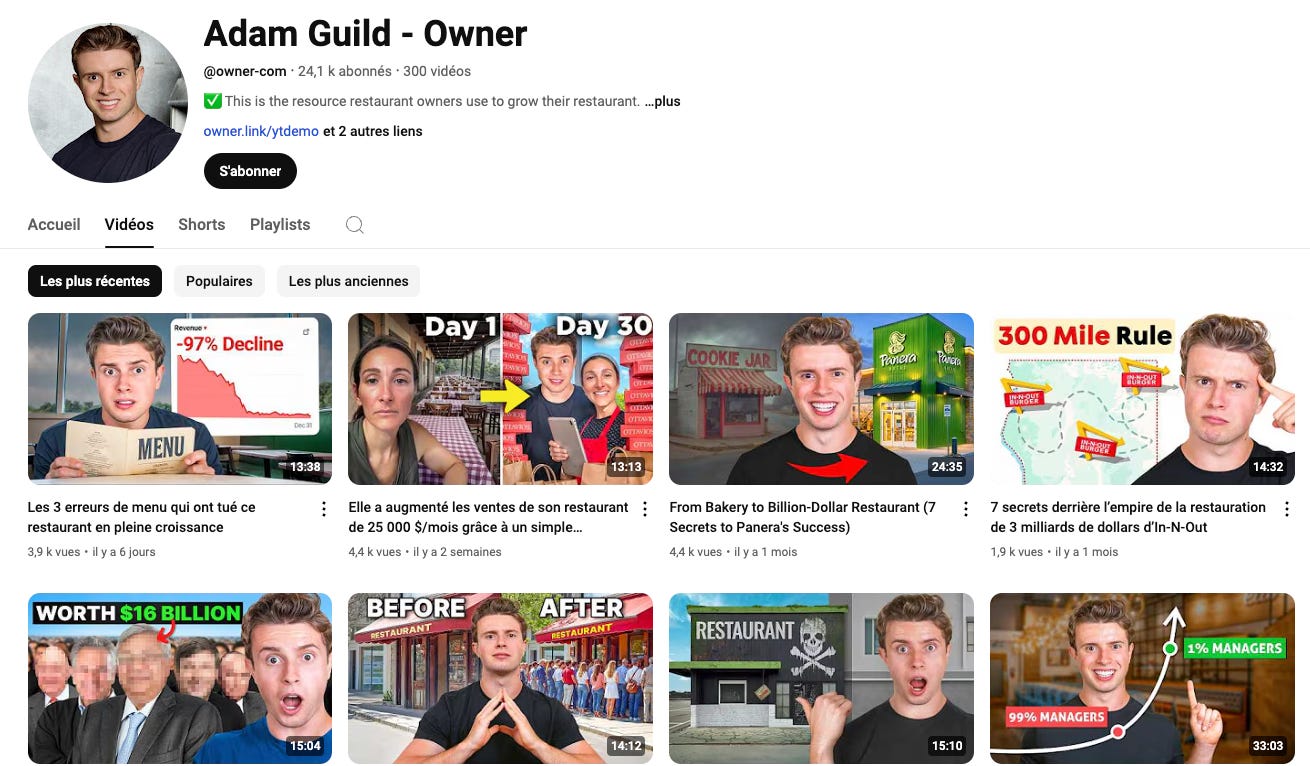

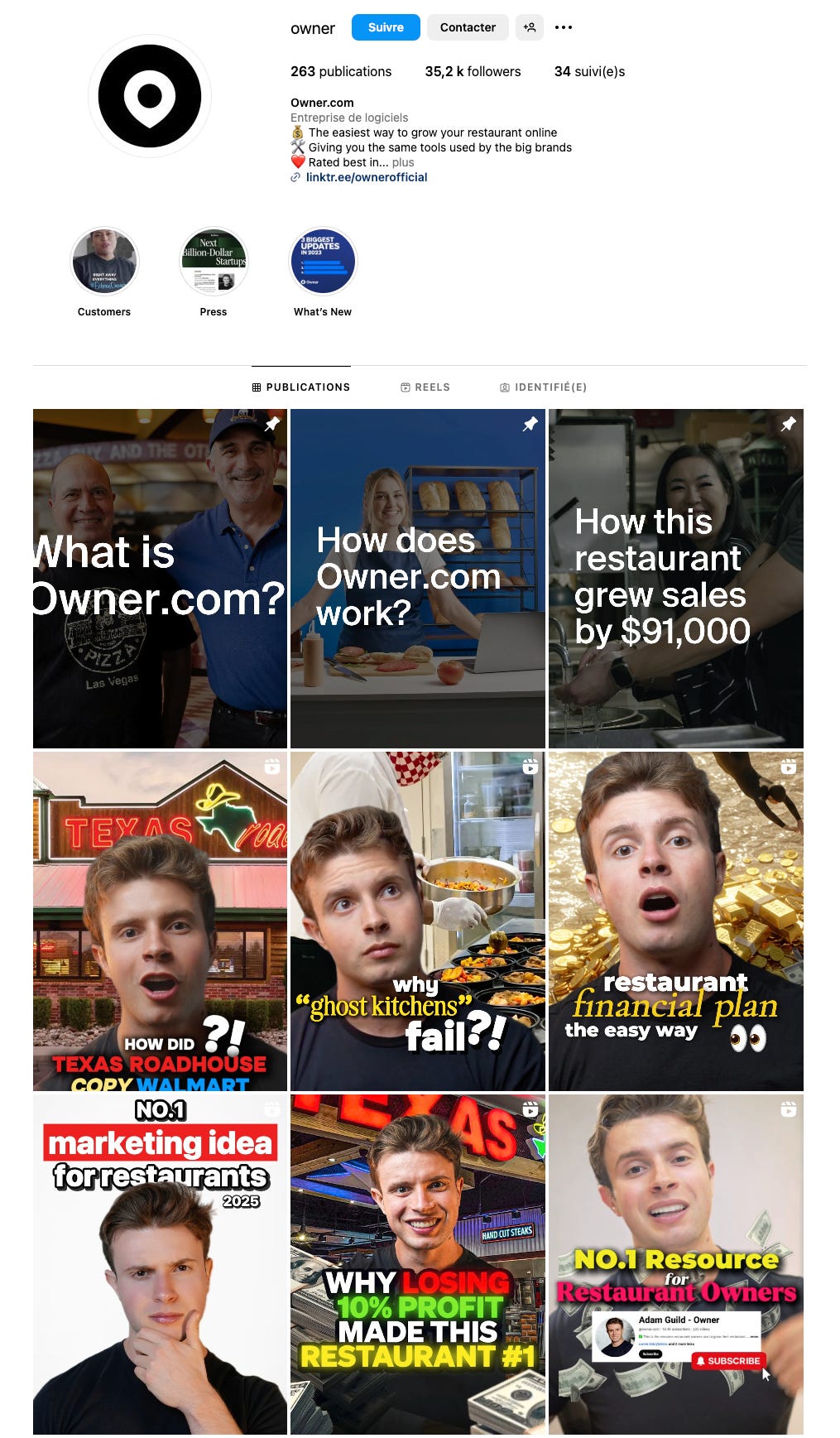

Outside of their sales team, saw that the Owner team is great at creating educational content for restaurant owners.

Content Marketing

Most restaurant owners don’t understand digital marketing. They know how to make great food, but when it comes to websites, SEO, or online ordering, they’re lost.

Owner.com teaches them how to win online.

They put out a ton of free content to help restaurants grow, including:

Step-by-step guides on how to improve their digital presence.

Blog posts (SEO) breaking down restaurant marketing strategies, what works, what doesn’t.

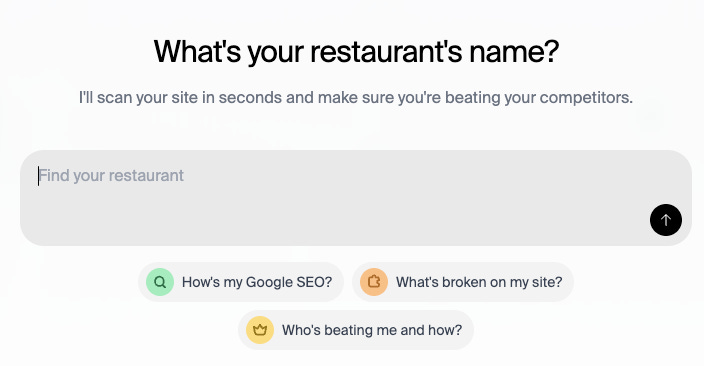

Free tools that show restaurants how they rank against competitors in their area.

The strategy is simple: Help restaurant owners before selling to them.

Some of the biggest topics?

Local SEO vs. social media → Most restaurants waste time on Instagram instead of ranking higher in Google search.

Menu engineering → How small changes in a menu can increase sales.

The Restaurant Marketing Guide → A complete playbook on how to get more customers without relying on third-party apps.

They’re everywhere, SEO, blogs, Instagram. Their founder, Adam Guild, is also all over YouTube and Instagram, breaking down marketing tactics in ways that actually make sense to restaurant owners.

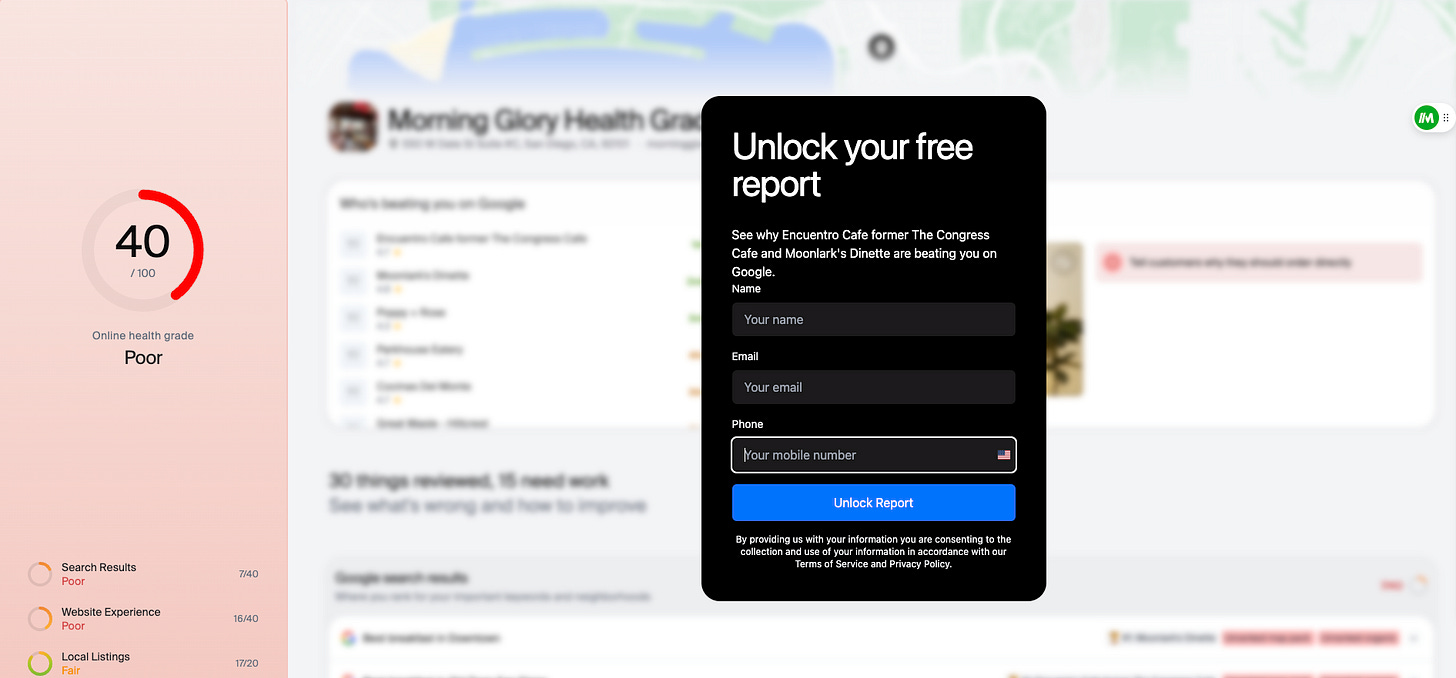

RestaurantGPT - Website grader that shows restaurants how they rank against competitors in their area.

Key milestones in developing their outbound strategy

(and the sales team)

Founder Led Sales 2018 - 2022

Back in 2018, Adam Guild (CEO) was the sales team, making cold calls, talking to restaurant owners, and asking a simple question: “How can I help?”

At first, the company was called ProfitBoss, and the goal was to help restaurants drive more in-store traffic. It was working, until COVID-19 hit.

Suddenly, restaurants didn’t need foot traffic anymore. They needed to survive.

When the business started stalling, Adam didn’t sit back and wait, he went straight to restaurant owners and asked: “What do you actually need?”

The answer was loud and clear:

Delivery apps were killing their profits. Uber Eats, DoorDash, and Grubhub were taking massive cuts.

They felt trapped. They didn’t own their customer relationships, third-party platforms did.

They needed a way to take back control.

And that’s when Owner.com was born. The company pivoted to help restaurants own their online business.

Built a platform for direct online ordering.

Gave restaurants control over their customer data.

Stopped them from relying on third-party apps to survive.

In 2021, they officially rebranded as Owner.com, and today, they help thousands of restaurants take back their profits, their customers, and their future.

Sales led - 2022

In June 2022, Owner.com brought in Kyle Norton as CRO to build and scale sales from the ground up.

The situation?

$2M ARR.

One sales manager, four reps.

Two reps weren’t the right fit and left quickly.

So they rebuilt everything.

End of 22: SDR Pilot

At the end of 2022, they ran a small SDR pilot, just a couple of reps testing the waters, seeing if outbound could work.

The feedback? It was working.

So they doubled down.

Started with 1-2 BDRs.

2023: Scaled to 10-12 as the motion proved itself.

2024: Over 20+ BDRs driving pipeline every day.

Initial challenges

Before scaling the sales team Kyle fixed 3 problems with the sales team:

Churn

Outbound reps were wasting time

Fixing the Team

Churn

Initially, Owner.com had issues with customer churn because they signed on any restaurant interested. So with their ops/data team, they focused on ICP + scoring to fix that before hiring more people.

Most sales teams take any deal they can get. If someone is willing to sign, they close. But the truth? Not every deal is worth it.

When Owner.com changed its sales approach, they started saying no to 40% of prospects they would’ve gladly closed just two weeks earlier.

And the result? Fewer deals closed in the short term.

In Kyle’s first month running sales, they closed less than the month before. The next month? Even fewer. From the outside, it looked like things were getting worse.

Then came a board meeting.

Everything pointed in the right direction: better customers, cleaner deals, stronger pipeline. But when Jason Lemkins (board member) heard the update, he shut it down with one brutal truth:

“Sounds great, but none of it’s showing up in your revenue number. Let me know when that happens.”

Sales teams love to talk about efficiency, deal quality, and better-fit customers, but at the end of the day, if revenue doesn’t go up, none of it matters.

By the next board meeting, revenue caught up. The painful short-term dip turned into long-term, sustainable growth.

The Lesson?

Saying no to bad deals feels risky, but closing bad deals is worse.

Fixing sales quality slows revenue at first. If the team isn’t ready for that, they’ll panic and go back to old habits.

The only thing that matters is what shows up in revenue. No one cares about efficiency if it doesn’t turn into growth.

Outbound Reps Are Wasting Time

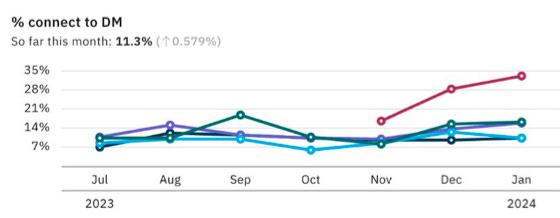

When Kyle joined they struggled with bad contact data and terrible connect rates: 3%. Why? Because BDRs waste half their time calling bad leads or doing their own research to fix bad data. That’s a broken system.

If a company gives BDRs bad leads and bad data, they’re basically telling them it’s okay to work 2.5 days a week. That’s a disaster for outbound teams.

Fixing the Team

Kyle took over a team with one manager and four reps. Two of those reps weren’t the right fit for where the business was at that stage. Instead of dragging it out, they moved on fast and rebuilt with the right people.

The Owner.com Outbound Recipe

Now, let's talk about their outbound playbook:

Their results

Talent:

Hiring Early-Stage Reps

Hyper-specialization

BDR Team

Invest early in RevOps and Enablement

Outbound processes:

Targeting: the power of a niche ICP

How they built their ICP scoring system with Machine Learning

Invest Early in their outbound/data infrastructure

Outbound messaging

Tech stack (and how they use AI)

Scaling challenges (at 100+ GTM reps):

Knowledge base

How they Keep Change from Becoming Chaos

Why are they bringing XDRs back to the office

Results

Around 30 million ARR the sales team as of, like, Q1 2025 is going to be about 60 people.

Growing almost ~3x year over year (YoY) at 8-figures in ARR

Will hit 9 figures in ARR by the end of 2026 (!!!)

Exceptional expansion revenue economics

From 2m to 30m ARR - since Kyle Norton took over the team

$72K ARR CW per BDR monthly with a 0.13 CAC ratio

83% BDR hiring success rate over 23 months

<3 month ramp time

33% of new ARR, Outbound was 79% of new ARR from Jan ‘23 to July ‘23

7 BDR to AE promotions in 24 months since first BDR hire

Scaled from 4 to 60 reps (AEs + XDRs)

1:20 ops-to-sales ratio

Talent

Hiring Early-Stage Reps

Most early-stage startups mess up sales hiring. They bring in the wrong people at the wrong time, then wonder why reps struggle.

Here’s the reality:

When a startup is small (<$2M ARR), everything is broken. No playbooks. No processes. Just chaos, constant fires, and a ton of uncertainty.

At that stage, startups don’t need polished “experienced” reps. They need pirates and romantics.

Jason Lemkin said it best, early-stage sales teams should be filled with people who believe in the mission and thrive in the mess. These reps:

Don’t wait for someone to fix things. If the pitch deck sucks, they stay up late fixing it. If messaging is off, they rewrite it themselves.

Aren’t scared of rejection. They don’t need a perfect ICP or perfect collateral to start making calls.

Figure things out. They aren’t waiting for a BDR, a solutions engineer, or a pre-built process. They do whatever it takes to close deals.

But here’s the mistake founders make: They try to bring in enterprise reps at $2M ARR.

It never works. Enterprise reps are used to structure, decks, playbooks, support teams, established brands. Put them in an early-stage startup, and they freeze. Suddenly, there’s no one to spoon-feed them a demo, and they struggle.

What Owner.com did differently

When Owner.com was scaling SMB sales, they made a different bet:

Instead of hiring unproven reps and hoping they worked out, they hired proven performers and paid at the top of the market.

The goal was simple: Bring in people who could just get the job done. No hand-holding. No excuses.

Experience alone wasn’t enough. The reps still had to be adaptable, curious, and coachable. Because experienced reps who refuse to change? Useless.

This strategy worked early on, but now things have changed.

Today, Owner.com is well past the scrappy phase. Onboarding is dialed in. The management team is rock solid. The training process is structured. So now, the hiring strategy shifts:

Earlier-career hires. More coachable, more adaptable, lower cost.

Promote from within. Build future AEs from the ground up.

Long-term team development over quick wins.

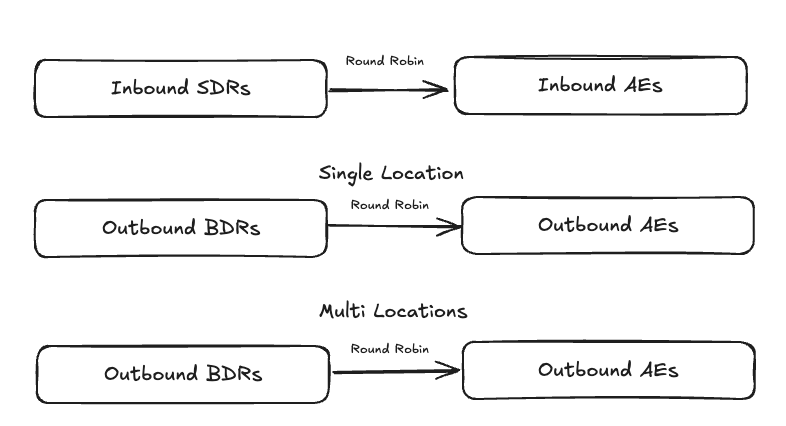

Team structure: Hyper-specialization

Here’s how they do it:

Inbound Team: Dedicated SDRs and AEs handling inbound leads.

Outbound Team: Split into BDR/AE Single-Location and BDR/AE Multi-Location teams.

No AE-BDR pairing: Instead, they use a round-robin system to prevent drop-offs in pipeline due to fast promotions.

Why do they split inbound and outbound? Because outbound deals are closed differently than inbound deals.

No Full-Cycle AEs – And It Works

Instead of forcing AEs to do everything, they run a 2 BDR : 1 AE model.

Why? Because it’s more productive than full-cycle AEs.

Outbound BDRs → Focus only on cold accounts, filling the pipeline.

Outbound AEs → Focus only on closing deals from BDR-sourced pipeline.

They can do outbound, but not like BDRs. Instead, they prioritize strategic outreach:

Work on closed-lost deals

Leverage customer referrals

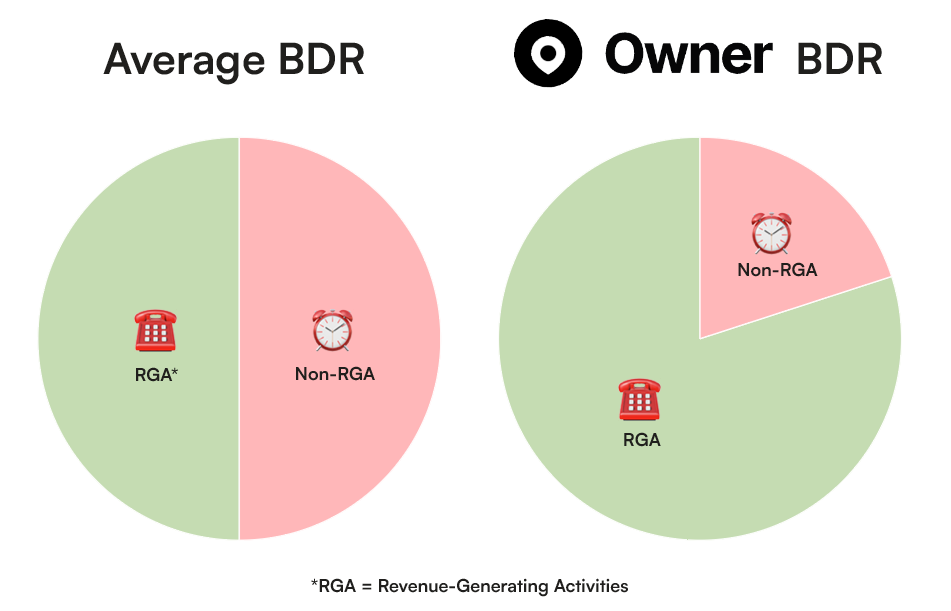

Their BDR team (outbound)

Earlier we talked about their outbound results.

If we compare BDRs from other teams to BDRs at Owner.

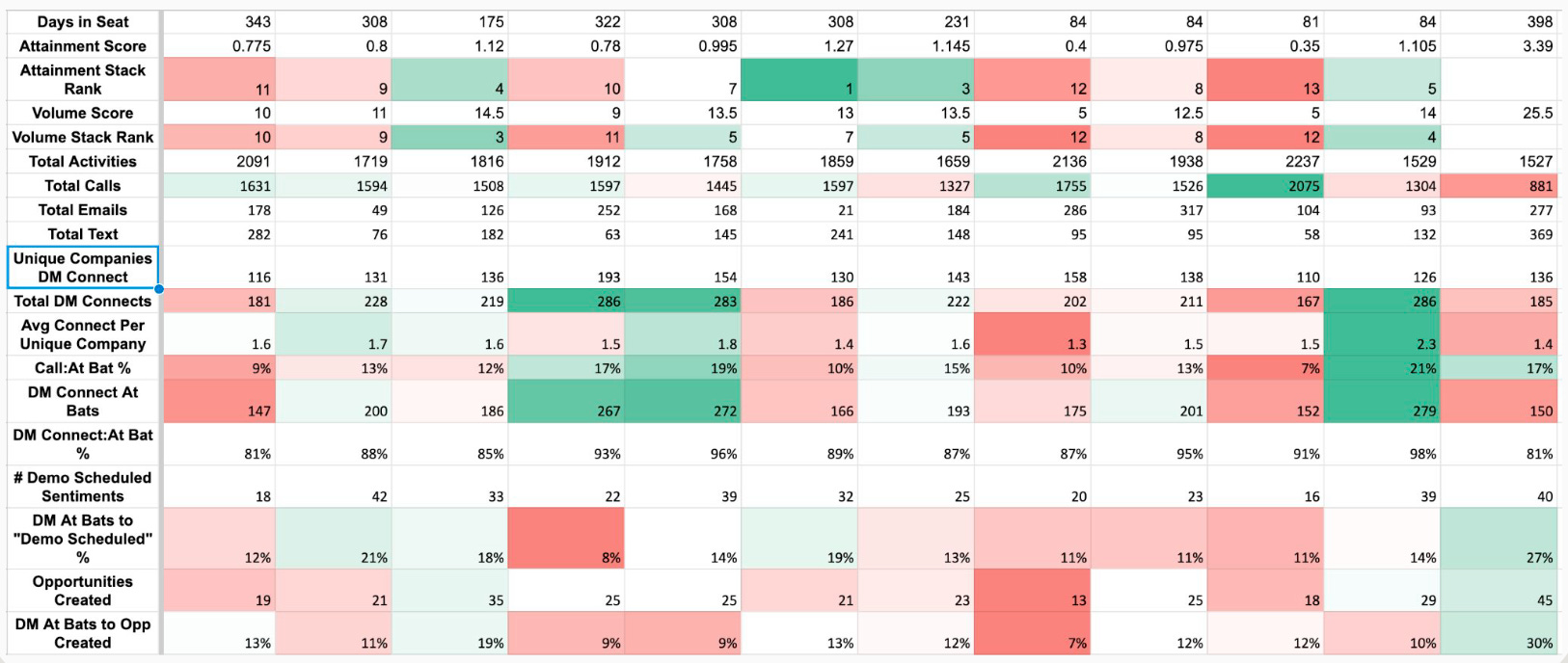

Owner BDRs spend up to 80% on prospecting activities thanks to:

They only call the right accounts and prospects

They eliminated Non-Revenue Generating Activities

They invested early in RevOps & Enablement

1. They only call the right accounts and prospects

Built 2 predictive scoring models: one for win rate, one for potential ACV → BDRs only target the best ICPs.

Fixed their data quality issues: connect rates with decision-makers jumped from 3% to 16-20%.

No wasted time on account selection: accounts are routed, not picked based on personal preference.

2. They eliminated Non-Revenue Generating Activities

Most BDRs waste time on:

❌ Calling bad numbers

❌ Researching Tier 3 accounts

❌ Manually picking accounts based on personal preference

At Owner.com:

✅ Pre-researched accounts: for each restaurant, they get the closest customer (instant social proof).

✅ Best-fit ICP accounts are routed into SalesLoft sequences. Not manually or based on preferences

✅ Their outbound messaging adapts to account maturity

✅ BDRs don’t touch bad data

3. They invested early in RevOps & Enablement

1:20 Ops-to-Sales ratio, this means BDRs don’t waste time figuring stuff out.

Onboarding includes AI-powered simulations trained on real conversations.

Constant coaching, repetition, and training → BDRs ramp faster and perform better.

They've invested early in RevOps and Enablement

Most founders and GTM leaders wait too long to invest in RevOps and enablement. They see it as a “later” problem, something to think about once the sales team is big enough. But by the time they realize they need it, they’re already behind.

Here’s the real challenge: It’s a chicken-and-egg problem.

Scaling sales teams without RevOps and enablement? Painful. Reps struggle, onboarding is slow, data is a mess.

Hiring RevOps and enablement too early? Expensive. A $200K leadership hire spread across six reps? That changes CAC fast.

So when’s the right time? As soon as there’s proof the company is scaling.

Owner.com brought in contractors first, because full-time hires didn’t make sense at the early stage. The moment there was real traction, those roles became full-time. By $3M ARR, RevOps and enablement were in place. By $4-5M, they were full-time.

Most startups do this too late

Looking back, they should’ve done it even earlier.

The company went from $5M to $12M+ ARR in a year: at that scale, the cost of RevOps and enablement was nothing compared to the revenue growth.

Today, there are seven full-time people across RevOps and enablement, and even that’s not enough.

They’re running a Revenue Leadership Academy, revamping onboarding, and reworking positioning to set up for even bigger growth.

The mindset is simple: What does a $75M ARR company look like? And how fast can they get there?

The lesson?

If growth is real, invest early. The pain of NOT having RevOps and enablement slows everything down.

Start with contractors. But be careful, this space is full of “consultants” who don’t know what they’re doing. Vet them hard.

Once the path to scale is clear, go all in. Because the companies that wait too long always regret it.

Processes

Targeting: the power of a niche ICP

For Vertical SaaS, finding the right customers is way easier than for Horizontal SaaS. Why? Because horizontal SaaS tries to sell to 10+ industries at the same time. That’s a mess. You can’t be everything to everyone. Owner.com had it simple: restaurants. But even within that, they went deeper.

You can start breaking their ICP down into:

Single-location restaurants

Multi-location

Independent

National chains

International chains

Types of restaurants (pizzerias, fine dining, etc.)

And started to focus on independent restaurants.

They started filtering out bad-fit customers and only targeted the ones that actually made sense. The result? Less churn, higher revenue, and a way smoother sales process.

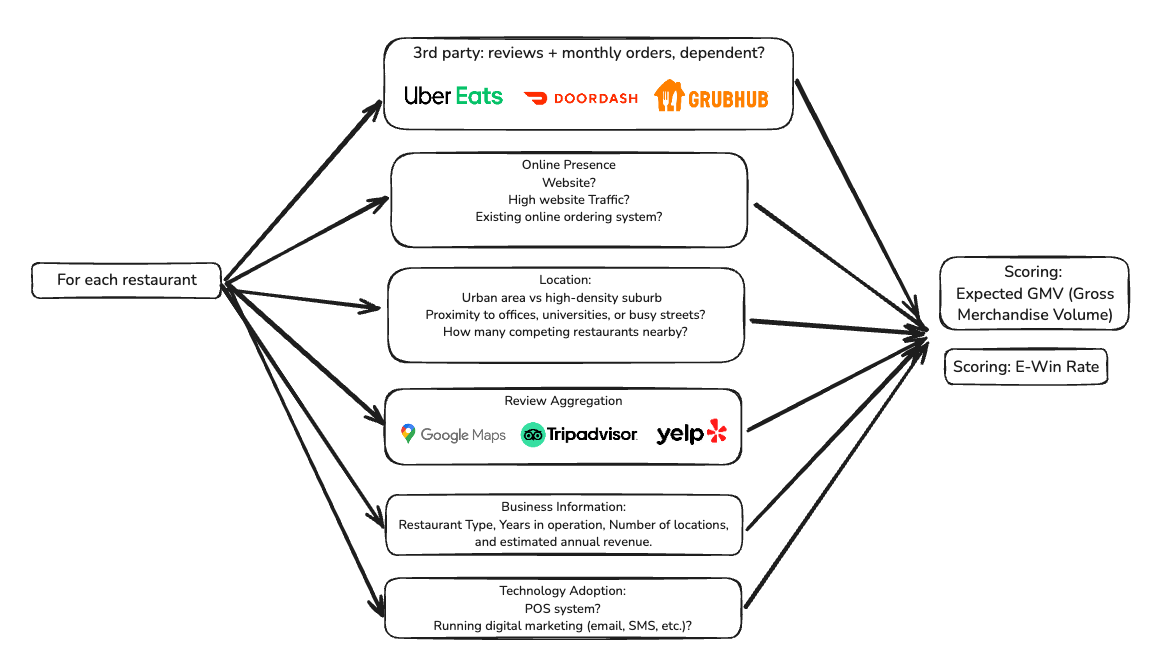

How They Built Their ICP Scoring System (with Machine Learning)

They scraped 500,000 restaurant accounts, ran them through an ML model, and narrowed it down to 30,000 high-potential accounts.

Each account got two scores:

Expected GMV (Gross Merchandise Volume) – How much money they likely generate.

E-Win Rate – How likely they are to buy based on past data.

Instead of relying on reps picking accounts based on gut feeling, they used data.

The Data Points Behind Their Scoring Systems:

Restaurants are all over the place. Some make money, some don’t. Some are growing, some are dying. How do you know who’s worth chasing?

They built a system that looks at:

Online reviews & traffic → Are people even looking for this place?

Third-party marketplace volume → How much are they selling on Uber Eats, DoorDash, etc.?

One of the biggest signals? Third-party order volume.

If a restaurant is pulling in serious volume on Uber Eats, they’re probably paying crazy fees to these platforms. That’s Owner.com’s perfect target: restaurants that need to take control of their online orders.

I was doing some research on what other data points they potently could use to score their accounts:

Restaurant Type

Pizzerias → Heavy online delivery = good fit.

Fine dining → low online ordering = bad fit.

Online Presence

Do they have a website?

How well does it rank on Google?

Do they have an existing online ordering system?

Social media activity & follower count.

Third-Party App Listings

Are they on DoorDash, Uber Eats, Grubhub?

What’s their customer rating and review count?

How dependent are they on third-party delivery apps?

Example: A restaurant that gets 70% of its orders from third-party apps is a prime target for Owner.com.

Review Aggregation

Yelp, Google Reviews, TripAdvisor ratings.

Review frequency & sentiment analysis.

Business Information

Years in operation

Number of locations

Estimated annual revenue.

Menu Pricing

Average check size

Customization options.

Location Data

Are they in an urban area or high-density suburb?

Proximity to offices, universities, or busy streets?

How many competing restaurants nearby?

Customer Demographics

Age distribution in the area (millennials & Gen Z = better fit).

Local income levels.

Technology Adoption

Do they already use a POS system?

Are they running digital marketing (email, SMS, etc.)?

Also here’s how they could estimate annual revenue (based on my assumption):

Review Count & Frequency

If a restaurant has 1,000+ Yelp reviews, it’s likely doing big business.

More frequent reviews = higher foot traffic.

Online Ordering Presence:

If they rely heavily on Uber Eats but don’t have their own online ordering, that’s an opportunity.

Number of reviews on 3rd party apps

Monthly orders

Average Check Size

Look at menu prices.

Multiply by estimated daily covers (based on review volume & seating capacity).

Revenue Estimates: Public business databases provide estimated revenue.

Growth Signals: If a restaurant is expanding from one to multiple locations, they’re a high-value target.

Digital Marketing Sophistication: If they’re running social media ads but have no real strategy? Perfect for Owner.com.

Competitive Landscape: If they’re in an area full of restaurants but few have online ordering, that’s a massive opportunity.

They built a predictable outbound machine by using real-world data to score leads. The result?

Better win rates

Higher ACV

No more reps guessing who to reach out to

Scale outbound predictably

They go after the restaurants that will actually buy, stick around, and have a higher ACV.

They've invested early in their outbound/data infrastructure

Most outbound teams burn money without realizing it. They hire BDRs, hand them a messy lead list, and then wonder why 50% of their time is wasted.

The reality? Outbound only works if the data is good.

A typical outbound BDR spends 30-50% of their time chasing bad leads, fixing data, or trying to figure out who to call.

That means they’re only working 2.5 days a week, the rest is wasted. This can be even more extreme if we consider activity into B & C tier accounts and contacts.

At Owner.com, if a lead isn’t fully enriched, it doesn’t go to the BDRs. It gets sent back to marketing for cleanup. No rep is expected to waste time fixing bad data.

Before they tackled this problem, only 40% of their prospect data was accurate, their connect rate was 3%.

After investing in proper data infrastructure? That number jumped to 85%.

The results?

BDRs became 2x more efficient.

Each rep started bringing in $60K+ in Closed-Won ARR every month.

Call-to-decision-maker connect rates went from 3% to 16%.

Booking rates jumped from 4% to 16%.

How They Did It

Started with a basic database → Then built internal scrapers and enrichment tools.

Reached 90% + accuracy in-house + Integrated mobile phone numbers from People Data Labs → But it wasn’t scalable.

Switched to Datalane → Better data → Increased call-to-connect rates to nearly 20% and BDRs could make 40% more calls

That is the difference between booking 1 vs 2 meetings per day.

Most outbound teams fail because they try to scale before fixing their data.

Owner.com didn’t hire more than a couple of BDRs until they nailed this. Once they did? Outbound became a predictable revenue engine.

Smart targeting + Clean data = Profitable outbound.

Keep the data clean

Most companies start with decent data. Then it turns into a mess.

Reps log calls inconsistently. Data isn’t structured. Metrics become useless. And suddenly, no one knows what’s actually working.

Clean Data = Better Sales

How They Keep It Clean

1️⃣ Track the right call dispositions. Not all calls are the same. They group call outcomes in a way that actually helps measure real conversion rates:

Connect rate → Did they pick up?

DM Connect Rate → Did they reach a decision-maker?

DM Connect: At Bat → Was there a real conversation?

DM At Bat: Demo Scheduled → Did it turn into a meeting?

2️⃣ Train BDRs on how to log calls correctly. No random call notes. Every call is classified properly.

3️⃣ Review the data regularly. No “set it and forget it.” There’s a system to check and improve it constantly.

Why This Matters

Without clean data, sales teams guess instead of improve.

Outbound messaging

Use Local Proof

Before a BDR even picks up the phone, Ops/Data has already done the work. They pull the closest successful restaurant near the prospect, so the BDR can start the call with a name drop:

“…, we’re working with Billy’s Pizza up on 3rd Street, do you know them?”This immediately makes the conversation more relevant. It’s not some random pitch, it’s about what’s working for restaurants just like them.

Adapt the Pitch Based on Maturity

Not every restaurant is in the same place with online ordering, so the approach changes depending on where they are:

✅ If they already use Uber Eats, DoorDash, or Grubhub?

If their SEO is strong → “Why are you still paying third-party fees when you could drive more direct orders?”

If their SEO is weak → “Right now, people search for ‘best pizza near me’ and find competitors. What’s your SEO strategy?”

✅ If they don’t have online ordering yet?

“Let’s talk about why restaurants who add direct ordering grow faster or add more revenue than those who don’t.”

The result?

Every call is relevant, no generic pitches.

Reps sound like experts because they know exactly where the restaurant stands.

Instead of selling, they’re educating and guiding prospects to the right solution.

Outbound Tech Stack

Here's the stack they use:

Data warehouse: Snowflake

Store their TAM 500k accounts.

Uses ML scoring to rank accounts based on:

Expected GMV (Gross Merchandise Volume)

E-Win Rate

Routing optimization (ensuring accounts go to the right BDRs based on capacity).

Sales Engagment Platform: Salesloft:

Manages outbound sequences, and tracking engagement

Specifically built for restaurant industry data.

Provides cell phone numbers of restaurant owners for better connect rates.

Records cold calls & discovery calls.

Extracts insights and automates CRM data entry (no more manual updates).

Flags coaching opportunities for BDRs.

Reduces Non-Revenue Generating Activities (Non-RGA).

Onboarding: Avarra (AI sim)

AI simulation trained on real conversations with prospects & customers.

New BDRs practice & train with AI before talking to real prospects.

Faster ramp time

CRM: Salesforce

Knowledge base: Guru

Comp Plan Tied to Customer Outcomes

Owner.com sales cycle? 7 days on average. Sometimes deals go from first call to full activation in under 3 weeks.

That means there’s zero time for slow hand-offs. The whole team is responsible for getting customers live and making sure they succeed.

At Owner.com, sales is a team game. Everyone has skin in the game, and their comp plans make sure of it:

XDRs get paid on Closed Wons → They don’t just pass leads off and disappear. They stay involved, helping drive deals to the finish line. Their comp is tied to predicted MRR, meaning payouts depend on what their internal algorithm says a customer is actually worth over time.

AEs get paid on Launches → Closing a deal isn’t enough. They work beyond the close to make sure customers actually go live.

Launch Specialists get paid on Quality → Their focus isn’t just speed, but long-term success.

At the end of the day, the goal is simple: customers win, the business wins. And the only way to make that happen? Everyone owns the outcome.

Performance management

They focus heavily on performance management, for an outbound you need this:

Be upfront from day one. Candidates know exactly what they’re walking into. No surprises. No excuses later.

Stack rank every month. Reps see exactly where they stand. No hiding.

Clear, binary expectations. Example: Hit below 75% attainment for two months in a row? That triggers a coaching plan.

Coaching is tracked. Managers don’t just “say” they’re coaching reps: it’s audited. Skill development is monitored. One skill at the time

Focus on effort, not just results. A rep can miss quota, but if the activity and progress are there, they get support. No effort? They’re out.

Move fast. If someone isn’t improving, don’t drag it out. Keeping underperformers too long kills team morale and slows growth.

Why this works

Most teams wait too long to manage performance. They keep reps who should’ve been let go months ago. The best teams? They set the standard, track progress, and cut fast when needed.

Challenges they are facing with a team of 100+ GTM reps

When too much information becomes a problem

Owner.com’s knowledge base got so big that reps couldn’t find anything. They’d waste time searching for answers.

The problem? Notion’s search sucked. It couldn’t keep up as the company scaled, and reps were drowning in information they couldn’t actually use.

So they moved everything to Guru. Now, instead of digging through endless docs, reps get the right answers fast.

How Owner.com Keeps Change from Becoming Chaos

Most companies roll out changes like a car crash, random Slack messages, confusing updates, and too much information at once.

The result? Reps stop paying attention.

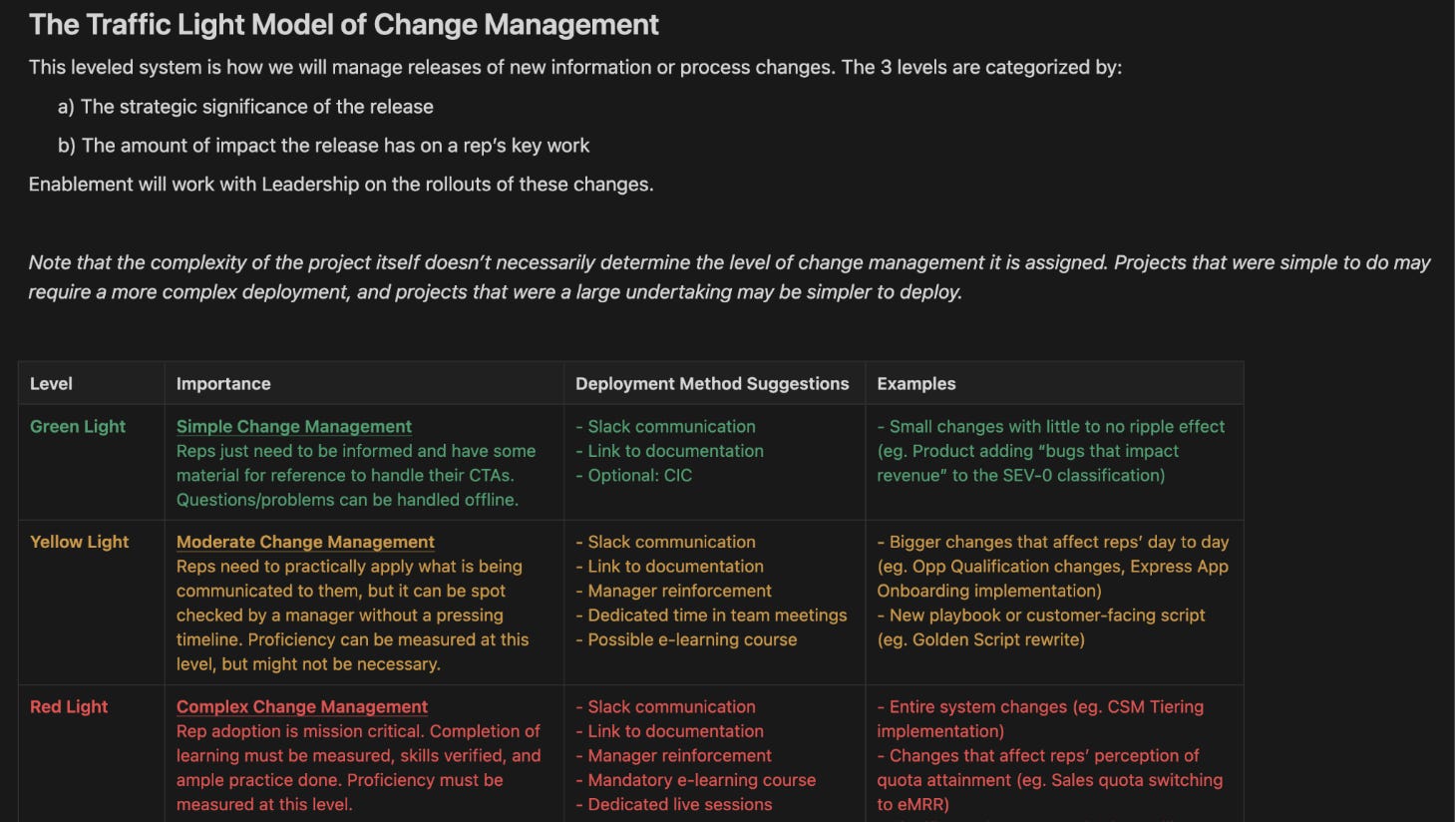

Owner.com learned this the hard way. Once the GTM team hit 100+ people, information overload became a real problem. Reps couldn’t keep up. Important updates got lost. So they built a simple system to manage change: The Traffic Light Model.

How It Works

🟢 Green (Small Changes) → No big deal. Minor updates like bug fixes. Sent via Slack or Notion.

🟡 Yellow (Moderate Changes) → Needs some discussion. Things like process tweaks or new playbooks. Shared in team meetings and documented properly.

🔴 Red (Major Changes) → Big impact. Changes to comp plans, sales strategy, or anything that affects the team’s paycheck. These require clear communication, training, and leadership involvement.

Why This Works

Most companies dump every update on reps and expect them to keep up. That doesn’t happen. Not every change needs an all-hands meeting. The Traffic Light Model keeps things clear:

Small updates? Quick and easy.

Medium updates? Clear documentation.

Big changes? Full rollout with training.

Now, instead of being overwhelmed with information, reps know exactly what to pay attention to.

Why they bringing XDRs back to the office.

Most people don’t expect this answer. Why change something that’s working? As a remote-first sales team, in 30 months, Owner.com has added $30M in ARR, productivity keeps improving, and enablement is solid. If remote works, why not keep it that way?

Because companies that stay comfortable stop growing.

Owner.com is about to scale the sales team fast. They hired 15-20 BDRs last year. Next year, it could be double that. More reps mean more risk, different training experiences, inconsistent ramp times, and unpredictable results. Keeping things remote would only add more variability.

So, they’re making a big bet:

All new BDRs and SDRs will be in-office, five days a week.

A Toronto sales hub opens on January 27th.

Inbound AEs, who are promoted from BDRs, will start in-office too.

Why? Because the data is clear.

Most companies bring reps back to the office with zero real data to support it. Kyle spent months pushing leaders for actual proof. Most had nothing, just gut feelings. The ones that actually tested remote vs. in-office? They saw:

20-50% faster ramp times.

30-60% higher productivity.

Stronger culture, lower turnover.

One company ran a real A/B test: 100 remote BDRs vs. 30-40 in-office reps. The in-office team crushed the remote team, 60% more activity. And this was a company that actually knew how to do remote sales well.

The biggest argument? Culture and energy.

New reps sitting alone in an apartment, trying to hype themselves up to make calls? Not great.

A packed sales floor with people pushing each other, managers nearby, and real momentum? That’s how teams win.

But what about reps who get more experience?

The plan isn’t to keep everyone in-office forever. After a certain point, reps will “graduate” to hybrid or remote. When? The data will decide. But experienced reps who know how to manage themselves will eventually earn that flexibility.

This isn’t a return-to-office.

The current remote team stays remote.

No one is being forced back.

But from now on, new hires start in the office.

Owner.com isn’t just playing defense. They’re making a bet on faster growth. The goal isn’t to keep pace, it’s to accelerate in 2025. Lower CAC. Faster pipeline. Higher output.

Most companies sandbag after a big year. Set “realistic” targets. Expect slower growth.

Owner.com? They’re doing the opposite. They’re raising the bar.

Since day one, the entire sales team has been remote. But in January, Kyle announced that Owner.com is opening a sales hub in Toronto on January 27th. And all new BDRs and SDRs? They’re expected to be in the office five days a week.

Why the shift?

For a while, everyone in sales had an opinion on remote vs. in-office, but when pressed for data, no one actually had any. They’d say, “Office is better.” But why? No real A/B testing. No side-by-side comparisons. Just gut feelings and assumptions.

And when companies did force their reps back into the office, their remote enablement was a disaster. Of course remote didn’t work for them, because they were horrible at it. Owner.com, on the other hand, has nailed remote onboarding. And yet, the data from companies that actually tested both models was impossible to ignore:

Ramping was faster: some companies saw reps onboard 20% quicker, others cut ramp time in half.

Productivity jumped: 30% to 60% better performance across the board.

In-office reps hit quota more often: the numbers backed it up.

And it makes sense. Remote reps sit alone in their apartment, trying to psych themselves up to make cold calls. In-office reps? They’re surrounded by energy: managers nearby, peers making calls, a real team vibe. It’s just easier to stay motivated when the whole room is working toward the same goal.

Retention matters too. Young reps move to big cities, don’t know many people, and struggle with isolation. An office provides built-in community. And every engagement study ever done shows that community is everything for long-term performance.

So, moving forward, all new sales hires will be in the office. This isn’t a “return to office” for the current team, remote employees can stay remote. But for new hires, the default is in-person.

What about AEs?

Inbound AEs will start in-office, but eventually, as reps gain experience, they’ll earn the option to go hybrid or remote. At a certain point, the flexibility of remote outweighs the need for an office. A tenured rep in their late 20s, with a serious relationship or thinking about moving out of the city, values work-life balance more than the energy of an office.

But fresh SDRs and BDRs? They need the fire of a buzzing sales floor. And that’s why Owner.com is making this move.

Common pitfalls to avoid

Hiring before fixing the growth math: Kyle mentioned he’s made this mistake before and won’t do it again. Don’t over-hire. Instead, make each rep as productive as possible before adding more headcount.

Not investing in outbound data early: BDRs waste hours calling bad phone numbers, this kills productivity. Fix your data first.

Waiting too long to invest in RevOps & Enablement: A messy system slows everything down. The earlier you invest in RevOps and Enablement, the faster your team gets results.

Relying on outdated scoring models: Old-school lead scoring = wasted effort. Use predictive ML scoring so your team focuses on the right accounts.

Hiring the wrong reps for early-stage: Early-stage requires a different type of rep. If you hire the wrong ones, you slow everything down.

Additional Resources

Article:

How to Build Go-to-Market Efficiency in SMB Sales with Owner.com CRO Kyle Norton

High school dropout starts company that offers free delivery for restaurants

Building a Revenue Operating System from SaaStr Annual 2024 (with Templates)

LinkedIn Post: Brian Marzo 🚨 Your comp plan is either building a team sport—or breaking it.

An inside look at our $120M Series C, co-led by Meritech and Headline.

Podcast:

OK10: How this CRO brings in $72K ARR per BDR, monthly, in SMB

OK17: Inside Owner.com's $21M ARR Outbound Strategy: AI, Office, & 83% Hiring Success (Part 2)

Architecting Systems for Hypergrowth with Nate Follen of Ramp

Scaling SMB to $30M, Investing in RevOps Early, and Stage-appropriate Sales Hiring with Kyle Norton

That’s it for today!

Curious, what's your biggest takeaway from Owner outbound secret sauce?

See you in the next newsletter.

Cheers,

Elric

Want my outbound swipe file with 100+ resources: sequences, scripts, AI prompts, and frameworks (worth $1,000+)?

Upgrade your Outbound Kitchen subscription today for just $22/month and get it all.

Don’t let another week slip by without turning outbound into your top growth engine!

👉 Start your free trial today.

As soon as you're ready, here’s how I can help:

Outbound Consulting Call: Need quick help? Book a 40-min session here.

Outbound Private Chef:

Part-time, I’ll build, optimize efficiency, and execute your outbound strategy.

Coaching/Advising: get tailored advice to fix your strategy, boost efficiency, and drive results.

Interested? Reply to this email or hit me up at bonjour@elriclegloire.com

👏🏻👏🏻👏🏻👏🏻