9 takeaways from the 2025 Sales Dev Benchmark

42 pages distilled into a 5-min read

👋 Hey, Elric here! Welcome to this week’s free edition of Outbound Kitchen. Every week, I break down real questions about scaling outbound so you can turn it into your #1 growth engine. Thinking about upgrading to the paid newsletter? Here’s what you’ll get:

Instant access to 25+ paid newsletters, including:

My Outbound Chef Kit: 120+ resources (email templates, cold call scripts, AI prompts, top outbound tools, and more, everything the best outbound teams use. Worth $1,000+)

The subscription costs $178/year (or $22/month). And the best part? You can try it free for 7 days. Cancel anytime.

But I think you'll love it!

👉 Start your free trial today.

P.S. The Outbound Kitchen Community is live (beta).

You get: All paid newsletter content (swipe files, AI prompts, templates)

PLUS:

Private Discussions → Ask questions you won't post on LinkedIn. Get insights Google can't provide. Solve outbound challenges with experienced practitioners.

Outbound Command Center → Tactical discussions on AI agents, data tools, pipeline drivers, and industry-specific messaging.

Expert Workshops & Hot Seats → GTM leaders sharing real tactics that work today.

Member Directory → Connect with the right people for your specific challenges.

Paid subscribers get early access, and the current price, before we open it up publicly and raise it.

The Bridge Group just released their 2025 Sales Development Report.

42 pages.

351 B2B and SaaS companies (from under $5M to over $500M ARR).

I went through the whole thing, so you don’t have to.

These are the 9 things that stood out the most to me:

P.S. I also went back and looked at the 2021 and 2023 reports to see what’s changed.

1. Territory > round-robin

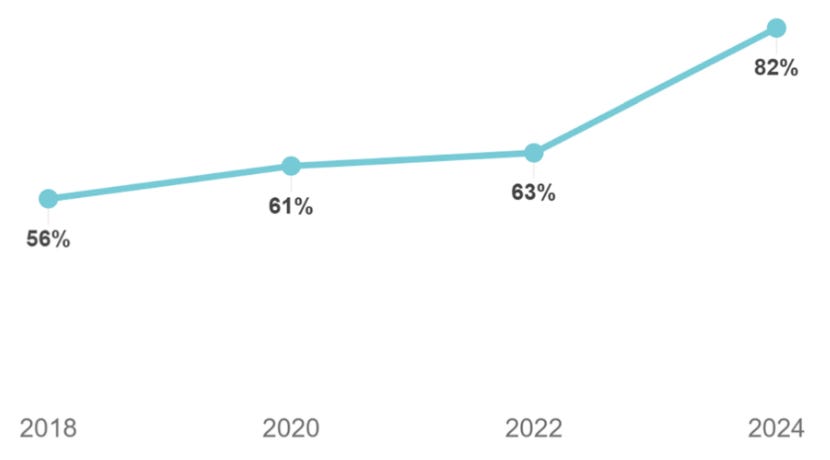

82 % of SDR orgs now align 1:1 with AE territories (up from 61 % in 2021).

Why the shift? 3 hypotheses:

ABM went mainstream: higher average deal sizes ($44 K ASP vs $27 K in 2022)

Buyer-experience backlash

2. Hitting goal is harder even after goals got easier

Quota-attainment slid to 60 % (-3% vs 2022), an all-time low, while opp quotas fell 33 %.

Why the shift? 3 hypotheses:

touches/day ↑ 8 % but connect quality lagged

orgs pivoted back to less-qualified intro meetings to fill top-funnel

CFO sign-off cycles lengthened post-rate hikes, pushing opps out of the quarter.

3. Fastest ramp ever: 3.0 months.

Ramp time fell to 3.0 mo (fastest ever)

Why the shift?

3 hypotheses:

AI coaching & call-recording: 68 %+ adoption slashes shadow-time.

territory focus gives new reps fewer segments to master

Back to the office policies for SDR teams

4. Tenure rebound

Avg SDR sticks 1.9 yrs (vs 1.4 in ’22).

Why the shift? 3 hypotheses:

2023-24 layoffs shrank promotion paths, so SDRs stay put

97 % of orgs now advertise at least one advancement track

visa slow-downs & WFH cost-of-living arbitrage cooled job-hopping.

Reps are staying longer, which sounds good, but only if you give them a reason to stay.

If you’re wondering how to handle longer SDR tenure, this guide might help. It walks through how to keep your reps motivated as they stay longer, with ideas around career pathing, skill development, and setting clear expectations:

5. Manager spans are shrinking: 6.4 reps per lead (was 8)

Why the shift? 3 hypotheses:

SDRs need heavier 1:1 cadence

leaders now own enablement, not just call-blocks

layoffs freed experienced managers, letting firms staff thicker.

6. Tech stack got “AI-ier”: touches/day up 8 %

Touches/rep/day ↑ 104 → 112 (AI-driven)

Why the shift? 3 hypotheses:

Content & research copilots automate pre-call prep.

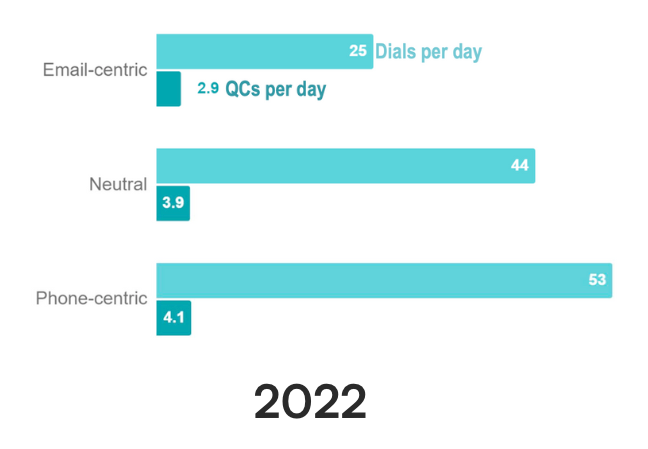

phone-centric teams now 41 % and post 1.4× QCs.

one-click multi-channel pushes volume up

Quality Conversations (QCs) per rep per day

Teams that lead with the phone don’t just dial more (which makes sense)…

They also get more results.

They’re seeing more qualified convos too, about 1.4x more than other teams.

Went from 4.1/day in 2022 to 4.6/day in 2024.

P.S. A “Quality Conversation” just means you learned something useful, either a reason to qualify or disqualify the lead.

Still not sure about cold calling?

Here’s the thing:

Cold-call-first teams get more convos. Period.

They also book more meetings.

If you tried cold calling and it didn’t work, you probably had some hidden issues.

Start by looking at your data:

Are you calling mobile numbers or office lines?

Do you actually validate your phone data?

Are you scoring accounts properly?

What's your enablement program? Coaching? Training? Practicing

And what about enablement?

Do reps get real coaching?

Track their progress?

If you want to go deeper into this, I put together a full cold calling playbook. You can check it out here:

7. Pay compression alert

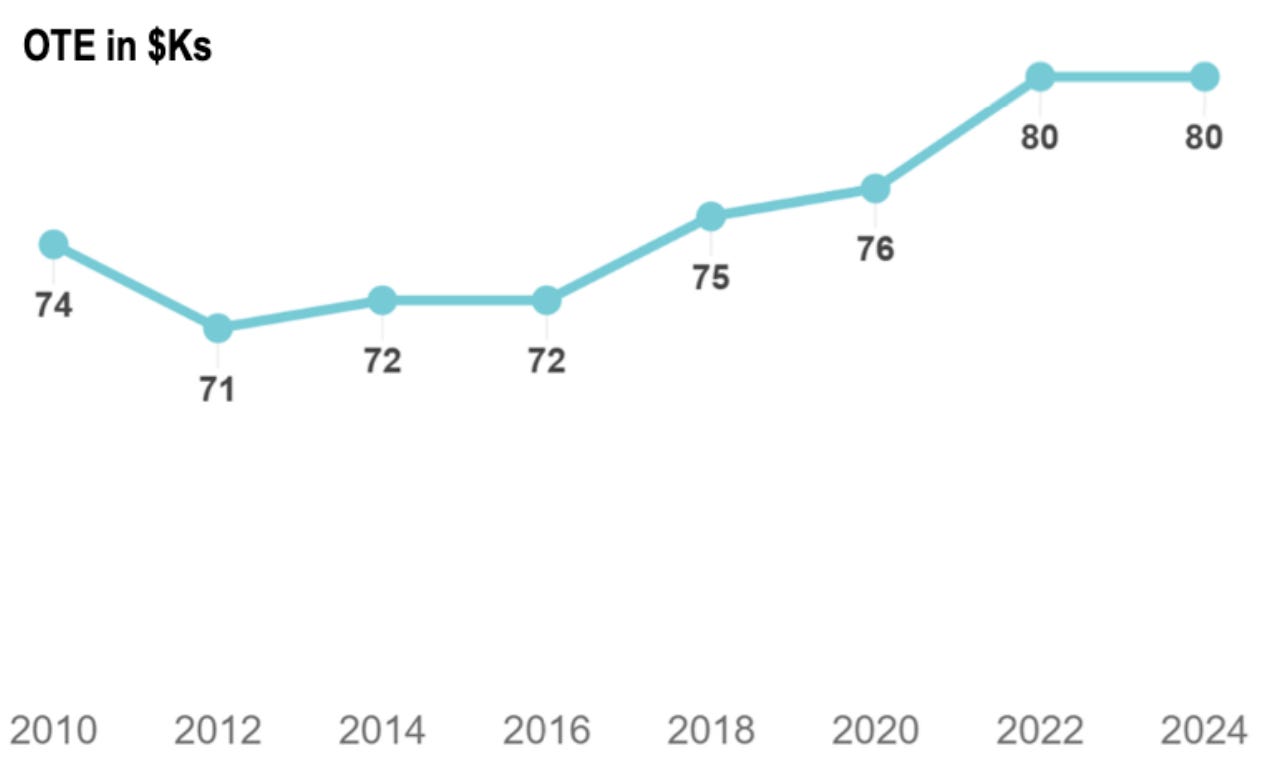

Median OTE flat at USD $80k while inflation soars.

Reps now judge employers by enablement, not just earnings.

Why the shift? 3 hypotheses:

Remote hiring lets firms source in lower-cost markets

orgs invest savings into tech, arguing it “earns” reps more variable pay

investors reward comp discipline after 2022 burn-rate scare.

Flat OTE = silent churn risk.

If you want to retain people and drive the right behaviors, you might need a new comp plan. Read my guide on this topic:

8. Pipeline sourced per SDR ↑ $3.0 M → $3.78 M

Pipeline per SDR hit $3.78 M (up 26 %).

Why the shift? 3 hypotheses:

Median ASP rose $17 K, inflating “raw” pipeline math

more Stage 0/1 opps count as “pipeline,” masking quality

Intent data & look-alike scoring let reps open 20 % more accounts, even if conversion lags.

9. Remote honeymoon is over.

Remote → partial Return To the Office (RTO) swing

Why the shift? 3 hypotheses:

Slower skill ramp for net-new grads when fully remote

“Trust-but-verify” management pressure

Faster tribal learning

If you’ve got junior reps, bringing them into the office helps.

I talked with Kyle Norton (Owner.com CRO) on my podcast, his company is remote-first, but he opened an office in Toronto just for this.

He told me BDR records are being broken… by new hires in the office.

If you want to read the full reports, go read them here:

That's it.

What's your main takeaway from this newsletter?

See you in the next newsletter.

Cheers,

Elric

Chef, Outbound Kitchen

Want my outbound swipe file with 120+ resources: sequences, scripts, AI prompts, and frameworks (worth $1,000+)?

Upgrade your Outbound Kitchen subscription today for just $22/month and get it all.

Don’t let another week slip by without turning outbound into your top growth engine!

👉 Start your free trial today.

As soon as you're ready, here’s how I can help:

Outbound Consulting Call: Need quick help? Book a 40-min session here.

Outbound Private Chef: Coaching/Advising: get tailored advice to fix your strategy, boost efficiency, and drive results.

Interested? Reply to this email or hit me up at bonjour@elriclegloire.com