ClickUp runs 2 outbound teams (not 1). Here's why.

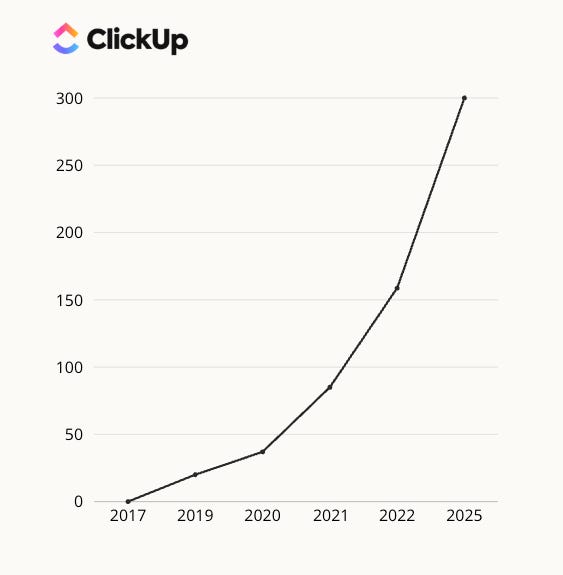

$300M ARR in a 522-product category. Different conversions. Both work.

The Outbound Kitchen is brought to you by: Wiza.

How ClickUp Builds Prospecting Lists Twice As Fast As Its Competitors

ClickUp’s outbound team builds highly targeted exec lists in engineering, product, and design using prospecting tools like Wiza to eliminate manual work. Quickly build ICP-matched lists and export with verified emails and phone numbers in minutes, ready for Outreach or Salesloft.

Today, I’m breaking down how ClickUp hit $300M ARR with outbound.

I spent over 20 hours listening to podcasts and reading articles to pull out 11 takeaways, what they’re doing differently, including their tech stack.

All from a company competing in one of the crowded markets out there:

the Project Management category, with 522 products on G2.

Company Overview

ARR: $300M+ (announced Sept 9, 2025)

20M+ users.

VC-backed (initially bootstrapped to ~$10–20M ARR, then raised VC from 2020 onward)

Total equity funding: ≈ $535M

Last round: Series C $400M (Oct 2021) – co-led by a16z & Tiger; $4B valuation.

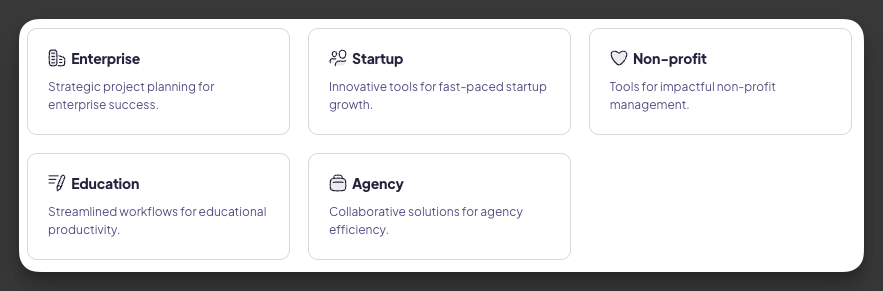

Horizontal SaaS and large TAM:

5 company types

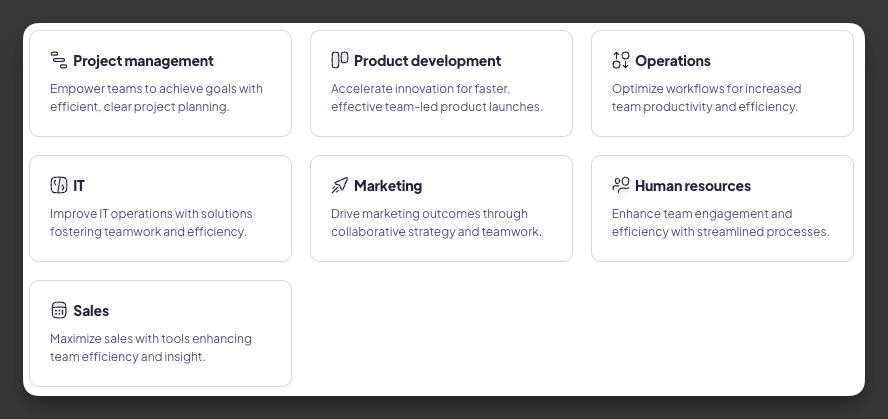

Sell to 7 teams:

GTM strategy:

Started with PLG from 2017 to 2020

Then, I added the Product sales led layer in 2020 (SLG + Outbound)

Team Size (October 2025):

~35-40 SDRs (15+ BDRs, 20+ SDRs)

~140 AEs

3.7:1 SDR:AE ratio

How ClickUp Scaled to $300M ARR (PLG → Outbound)

1. Dual Outbound Model: PLS + Cold Outbound

ClickUp runs two distinct outbound teams with completely different approaches:

A) Product-Led Sales (PLS) Outbound:

When someone signs up, “the domain is added to ClickUp’s system and any users are added to Salesforce”

Wait for Product Qualified Lead (PQL) signals before initiating outreach

SDRs handle this motion

Process: “Marketing Manager at Company A signs up for ClickUp → domain gets added to Salesforce → Marketing Manager becomes a PQL → ClickUp rep gets assigned”

B) Cold Outbound to Target Accounts:

Separate team

“Pull lists, target accounts, and contacts from those accounts. ClickUp targets stronger verticals and looks for contacts in their ICP (ex: executives at midmarket/enterprise companies in engineering, product, or design)”

“Use intent information from ZoomInfo and Clearbit (ex: you can identify domains that have visited your pricing page, then pull lists of top executives there)”

Why It Matters:

The conversion rate is different:

PLS motion: 10% lead-to-close conversion

Cold outbound: 2-4% lead-to-close conversion (where a “lead” is anyone who responds to an email)

As Kenny Vincent (former Sales Leader at ClickUp) notes:

“It takes a longer time for these teams to see traction, generally 6-9 months, and so it’s best to start small and then scale. These cold outbound teams are especially challenging to introduce in the current macroeconomic environment.”

How to Implement:

Start PLS first if you have product usage

Keep cold team small initially during 6-9 month proof period

Different metrics: PLS = conversion/revenue goals; Cold = activity metrics

Layer intent signals (pricing page visits) for cold targeting

Accept lower conversion on cold but recognize it accesses different buyers

2. Work the entire account, not just the lead

Their reps need to work the entire account, not just the lead/user. That means engaging with existing users, encouraging those users to invite their teams, but also engaging in pure cold outbound to high value users AND going top-down to complement the bottom-up traction.

The exact playbook:

The rep prioritizes building a rapport with the Marketing Manager and encourages her to invite the entire team → ‘I’ll train your team on how to use ClickUp for free’”

“The rep identifies other executives in the company that align to the ideal customer profile (ICP) → ‘Your team is already using ClickUp, would you be curious to see how?’”

“The outbound rep works the entire account, not just the Marketing Manager, in order to get a larger deal → Use case development, top-down targeting“

Why It Matters:

Gaurav Agarwal (their COO) reveals the economics:

“When a customer moves from self-serve or product led growth to sales assist we see a 11x lift in LTV.”

Product-led growth (PLG) allows you to cast that wide net, catch a lot of fish, and then sales-led growth allows you to go hunt for whales within the fish that you have captured.

ClickUp takes a different view: A lot of other companies would say, ‘Do one, not the other.’ I know so many that kill one motion to focus on the other, when in reality, both feed into each other.”

How to Implement:

Immediate account research upon PQL trigger: Don’t just email the user, map the org chart

Multi-threaded outreach strategy:

Thread 1: Nurture the existing user with training/support

Thread 2: Cold outreach to executives with social proof (”your team is already using us”)

Thread 3: Identify other power users in adjacent departments

Use case expansion questions: Train reps to ask “Who else in the company struggles with [problem]?” or “Which other teams would benefit from this?”

Build account plans, not contact plans: Measure success by account penetration, not just individual conversions

Top-down messaging: Frame executive outreach as “Your team found us, let me show you the strategic value”

3. Build a Tier Signal Scoring System

What ClickUp does:

The PLS team prioritizes product-signal outreach using signal stacking, combining multiple signals to decide which accounts are most urgent.

Examples:

20+ free users → interest in rolling ClickUp out at a higher level.

Multiple invites from a new sign-up → Active evaluation

Free plan limitations hit → “Have you run into any limitations on the free plan?”

Email engagement → “I sent you an email recently about...”

Single user on free plan → “I noticed you signed up for ClickUp.”

Past or dormant user → “Not sure if you remember signing up a while back.”

Multiple workspaces on same domain → Indicates organic growth

Product-Qualified Lead (PQL) Triggers

Usage Metrics

Sudden spike in seat count

New admin created

SSO/API enabled

Each of these = a PQL.

Paywall Intelligence: The paywall a user hits shows:

Their potential value as a customer

Which package fits best

How advanced their workflows are

Advanced Feature Engagement

Use of features like automations or integrations shows the move from individual productivity to business-critical workflows.

Why It Matters:

Signal stacking = prioritization.

One strong signal (e.g., a new sign-up) = medium priority.

Four signals combined (20+ users + VP title + Jira usage + email open) = same-day outreach.

4. Orchestrate Outbound with Signals → Playbooks → SLAs

What ClickUp Does:

They built Project Constellation, a systems-first GTM approach. It uses product and account signals to guide actions across sales, success, and marketing, one connected “brain” for the whole org.

Their process:

Signals → Playbooks → SLAs

Turn each signal into a clear next step with time limits and ownership rules.

Example:

Seat spike → SDR or AE follows up in 48h

Why It Matters:

Without orchestration, teams overlap, the “eight-layer cake.”

An SDR, AE, and CSM all reach out separately, making the customer experience confusing instead of seamless.

How to Implement

1. Start with 4–6 key product or outbound signals.

Examples (Expansion Signals):

+5 users in 7 days → SDR/AE outreach in 48h

SSO activation → AE enterprise convo in 48h

Large import/migration → Expansion play in 24h

20+ users → Immediate assignment

2. Map everything: Signal → Owner → Playbook → SLA

Example:

Signal: +10 users in 7 days

Owner: AE (expansion, not SDR)

Playbook: “Expansion conversation”

SLA: 48h

Template: “I noticed your team has grown to X users...”

3. Build an orchestration dashboard.

All signals visible to all teams

Clear ownership (no overlap)

SLA countdown (red/yellow/green)

Prevents the “eight-layer cake”

4. Automate routing.

When a signal fires:

Auto-assign rep → Suggest playbook → Start countdown

Rep gets a notification: “New high-priority lead: 22 users, VP title, Jira user”

One click loads the call script, email, and research

5. Cap touches

If SDR is working it → suppress AE outreach

If AE has an open opp → suppress SDR sequences

6. Run holdouts to measure impact.

Don’t act on 20–30% of signals (control group).

Compare:

Actioned seat spikes → 15% conversion

Not actioned → 5%

→ 10% lift proves signal value.

7. Optimize weekly.

Review which signals drive results

Kill low-impact ones (<5% lift)

Double down on top performers (>15% lift)

What If You Knew When Every Prospect Was Ready to Buy?

ClickUp leans on intent signals to strike at the perfect moment. With Wiza Monitor, you can track key accounts and get instant email and Slack alerts when decision-makers change jobs or companies (70%+ more likely to buy in first 90 days). Be the first solution to land in their new inbox, not the tenth.

5. Build an AI-Powered Infrastructure

They use AI to personalize messaging across 60-70 use cases and 5 ICPs. I mentioned that earlier, they are a horizontal SaaS and have different use cases so they use AI to accelerate what to say for each ICP and persona. So if you would do that manually it will take some time. But with AI you can craft this quicker for all your ICPs + teams you go after.

They built an AI-SDR with Retool:

“Automate manual analysis, qualification, and routing of inbound inquiries. The agent categorizes inquiries, conducts discovery, answers questions, and routes leads.”

Broader AI Usage:

Sellers use AI for generating first draft emails

Account research is all AI driven

Use Gong + AI to surface which deals need attention

Why It Matters:

Instead of buying an expensive SDR agent solution, they used Retool’s adaptable platform to build out this complex use case.

Human leverage: “Human-in-the-loop oversight ensures quality and customer satisfaction.”

Kyle Coleman (Global VP of Marketing) on AI limits:

“AI is not good at strategic thinking... AI can’t invent a different future for your customers. That has to come from you.”

The right use: “Marketers that use AI to open up more time for strategic thinking are the ones winning.”

6. Develop a Field-Tested Messaging

What ClickUp Does:

Kyle Coleman: “We need to be really crisp about the problem that we solve... A lot of it is around productivity, efficiency, time savings... but it’s not visceral. There’s no emotion.”

The test: “If I go to you and I say, your team could be 20% more efficient, is that going to get you to leap out of bed? Probably not.”

Research process:

“Field survey where we asked our 800 customer-facing people... what are the problems we solve for practitioners? For executives?”

“I was on with one of our best customers asking: What were the problems before ClickUp? How did you communicate those problems to your executives?“

Field testing: “Sales reps using language, SDRs on cold calls using language... you want to see what is the reaction? Does that prospect start using that language back to you at the end of the call?”

Adoption signal: “By the end of the call, the prospect would be saying to us, I think we can stop our revenue leak here, here, and here. And we’re like, okay, this is working because they’re using our language back to us.”

Why It Matters:

Outbound with generic productivity language gets ignored. Emotional problem statements get responses.

7. Productize the Platform

They’ve been productizing the platform because ClickUp is an horizontal product. They can sell to “everybody”.

What are the top 10 use cases? Campaign execution, creative production, field events, OKRs, corporate initiatives, project management, product launches.

The problem: “Everything to everybody is often nothing to nobody.”

Persona-to-Use Case Mapping:

Engineering leaders → Project management, sprint planning

Marketing directors → Campaign execution, creative production

Operations VPs → Workflow management, team coordination

IT teams → Tool consolidation, digital transformation

Why It Matters:

The average deal size should see significant growth. Many sales-led opportunities were anchored to PPU pricing from PLG. Now with packaged use cases incorporating AI, we can use AI as a pricing lever.

The Data Engine Behind $300M Outbound

ClickUp scaled its outbound to enterprise precision. With Wiza’s live LinkedIn data network of 850M+ B2B professionals, your team can find ICP-fit contacts, verify emails instantly, and launch sequences that reliably reach real decision-makers.

8. Separate Demand Creation from Demand Harvesting

What ClickUp Does:

Clickup COO’s framework: “I looked at it as demand creation and demand harvesting... Creating demand is about four to five times harder than harvesting demand.”

Applied to outbound:

Creating demand: Cold outbound to accounts who don’t know you

Harvesting demand: PLS outbound to accounts already using product

“The group that is closing demand needs to be significantly more effective and efficient than the group that is creating demand.”

In Practice:

Demand Harvesting Reps (PLS team):

Work product usage signals

Talk to users who already experience value

Conversion-focused metrics

Expected CAC payback: <12 months

Demand Creation Reps (Cold team):

Reach accounts with zero awareness

Educate on problem + solution

Activity-focused metrics

Allowed CAC payback: <24 months (4-5x more)

Why It Matters:

Outbound leaders who treat creation and harvesting equally waste money. Creation should be allowed 4-5x higher CAC because it’s 4-5x harder.

9. ClickUp Sales Tech Stack

Here’s ClickUp stack use by the Sales Development team:

Pocus (PLS signals & orchestration)

Nooks (power dialer)

Outreach (email sequencing)

Salesforce (CRM)

ZoomInfo (data & intent)

Clari (forecasting & deal inspection)

LinkedIn Sales Navigator (prospecting)

Gong (call intelligence)

Retool (AI-SDR custom build)

10. Track Pipeline Leading Indicators, Not Just Revenue

What ClickUp Does:

Matt Bauman: “Since revenue is a lagging indicator, there’s one leading indicator of revenue that we really hone in on: pipeline.”

But they go deeper with activity leading indicators:

“Number of qualified meetings over the course of a week”

“Number of customized demos per quarter”

“Average deal sizes in the pipeline”

“Number of deals in the pipeline“

The formula: “If reps are hitting their goals across each of these indicators, we typically find that they’re also hitting their pipeline targets. And if they’re hitting their pipeline targets, typically they’re also hitting their revenue targets.”

Why It Matters:

Revenue is too late. Pipeline is better but still lags. Qualified meetings this week predict pipeline next month.

11. Prove Outbound ROI with Incrementality Testing (Not attribution)

What ClickUp Does:

The smarter way of doing attribution is to run a test. They call it incrementality test where I’ll show Sophie banner ads, but then Gaurav will not see any banner ads. And then let’s see, did Sophie buy more compared to a control?

Applied to outbound: “Understanding I have a complex portfolio that spans across marketing channels, self-serve marketing, B2B marketing... you need to understand what’s the incrementality of each intervention.”

Results: Out of the 3x reduction they did in CAC... 1.5x we got it through a ton of incrementality testing.

Why It Matters for Outbound:

Attribution credits outbound for deals that would’ve closed anyway (e.g., someone was already in free trial, would’ve self-served). Incrementality proves what actually creates new pipeline.

Example:

Attribution says: Outbound drove 100 opps

Incrementality reveals: 60 would’ve self-served anyway, outbound only created 40 incremental opps

Bottom Line for Outbound Teams:

ClickUp’s success comes from running parallel motions (PLS + cold outreach), working entire accounts, testing for incrementality, separating creation from harvesting, and productizing into 10 use cases.

Key quote from their COO:

“I don’t care if it’s digital, if it’s sales. I care about building the best revenue mechanics. That’s all that matters.”

The Results:

11x LTV lift when customers move from self-serve to sales-assisted

3x CAC reduction (50% from culture/team alignment, 50% from incrementality testing)

$1M pipeline/month from AI-SDR in first month of piloting

10% PLS conversion vs 2-4% cold conversion (5x difference)

$300M ARR with 20M+ users

The Meta-Lesson:

Most outbound teams optimize for attribution (who gets credit). ClickUp optimizes for incrementality (what actually creates new pipeline). This mindset shift, plus ruthless testing with holdouts, is how they cut CAC by 3x while scaling ARR from $85M to $250M+.

The question isn’t “did outbound touch this deal?” It’s “would this deal have happened without outbound?” Test with control groups. Kill what doesn’t add lift. Double down on what does.

More resources for a deeper dive

The marketing framework ClickUp used to scale to be a $4 billion company

Deconstructing ClickUp’s GTM: A Journey Through Three Eras of Growth

That’s it for today!

Curious, what’s your biggest takeaway?

What’s your biggest challenge with scaling outbound?

See you in the next newsletter.

Cheers,

Elric

Thinking about upgrading to the paid newsletter? Here’s what you’ll get:

Instant access to 40+ paid newsletters, including:

My Outbound Chef Kit: 130+ resources: 20+ email templates, cold call scripts, AI prompts, top outbound tools, and more, everything the best outbound teams use. Worth $1,000+

And the best part? You can try it free for 7 days. Cancel anytime.

But I think you’ll love it!

👉 Start your free trial today.

As soon as you’re ready, here’s how I can help:

Outbound Consulting Call: Need quick help? Book a 40-min session here.

Outbound Private Chef:

Part-time, I’ll build, optimize efficiency, and execute your outbound strategy.

Coaching/Advising: get tailored advice to fix your strategy, boost efficiency, and drive results.

Interested? Reply to this email or hit me up at bonjour@elriclegloire.com